October 19th was the 24th anniversary of the 1987 stock market crash, and interestingly enough the Nightly Business Report interviewed Stan Weinstein that day to get his thoughts on the crash. This interview piqued my interest due to the fact that Stage Analysis is one of the methods I like to use to analyze the market. The interview with Weinstein starts at about 4 minutes into the clip. Below, I’d like to discuss some of the important statements he made in the interview:

“What I learned long ago, when you’re in a crash sequence, you don’t try and guess a bottom.”

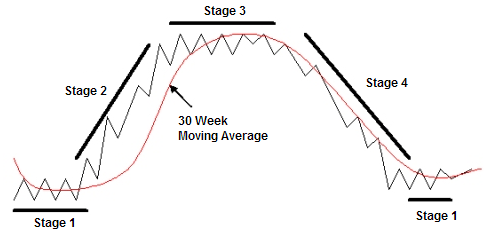

If you read the book Secrets For Profiting In Bull And Bear Markets, the number one rule Weinstein says in the book is don’t buy and hold anything in a Stage 4 chart pattern. This means don’t buy and hold anything declining below a declining 30-week moving average (see the graphic above). The basic reason is you have no idea when the bottom will come. A small loss could turn into a huge loss if you stick with something in a Stage 4. When the majority of the stock market transitions into a Stage 4 pattern, it’s called a bear market.

“This didn’t come out of the blue.”

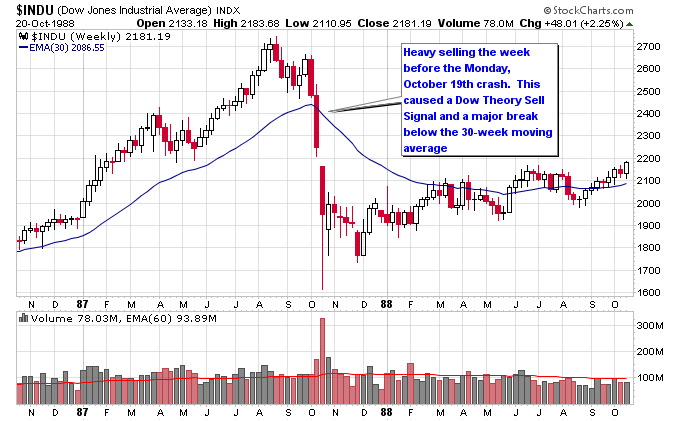

Weinstein states in the interview that internal indicators he was monitoring were breaking down before the crash. There was also a Dow Theory sell signal, and the week before the crash the Dow Jones Industrial Average crossed below the 30-week moving average in a big way, with heavy volume. The chart below is a weekly chart of the ’87 crash:

One thing to note here. One week isn’t usually the amount of time it takes for the market to transition into a Stage 4, usually there is some type of topping period or Stage 3 in between, and that topping pattern can take weeks to months to form. But nevertheless there was enough technical damage during the week before the ’87 crash to recognize that something was seriously wrong with the market going into the following week.

“When the market broke below 2450 you turn negative, and this is a negative phase that we’re in, and the market is now panicking.”

Here, by saying “negative” twice and “panicking”, he’s emphasizing that the market was in a negative mood. Robert Prechter likes to talk a lot about the “social mood” of society and how it affects the market, and how shifts towards negativity in the world lead to the biggest market collapses. A Stage 4 is essentially a shift towards pervasive negativity for the market, which in many ways reflects what is going on in the economy and the world, and that’s what Weinstein was trying to get across in that statement. Think about all the negativity in the world today with the Eurozone crisis, Occupy Wall Street, signs of a new worldwide recession, etc. Combine that with the fact that most of the market is transitioning into another Stage 4 trend and you can start to see how the pieces are falling together.

“There’s going to be a lot of base building since there was a lot of technical damage done. I’ve learned to never guess the bottom.”

Again, don’t try and guess the end of a Stage 4 trend. Instead, wait for the base building, or Stage 1 phase to begin. You don’t even want to buy the Stage 1 either, if you read his book the goal is to buy only after a Stage 1 breaks out into a Stage 2. The reason is if you buy something in a Stage 1, it can sit there for an unknown period of time going nowhere and essentially wasting your time. The two most important assets an investor has is time and money, so wasting your precious time and buying in a Stage 1 is not what you want to do. The bottom line is you want to see all of this in the rear view mirror, the end of the Stage 4 trend and the end of the Stage 1 base building afterwards. Once you can clearly see all of that is over with, then it’s a much more constructive time to be participating in the market.

“I have to wait and see the action, I don’t want to look ahead of the action.”

The interviewer asks Weinstein what he’s going to buy when all this is over, is he going to buy back into the blue chip stocks? Weinstein responds by saying he doesn’t know, and wants to see the action in the market first. If you understand his trading method then you know that what he’s really saying is he’s going to wait to see what sets up in a Stage 1 base, and then breaks out on high volume into a Stage 2 uptrend. He has no idea what is going to do that ahead of time, so there’s no point in trying to guess. This is an essential point of trend following, or being reactive to the market versus being proactive and trying to outsmart the market. Trend followers let the market tell them what to do, and the Stage Analysis trading method is essentially a trend following method.