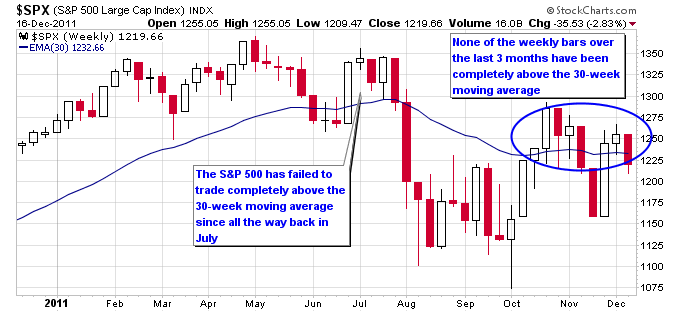

With a couple weeks left to go for the year, many stock market analysts are still hoping for a Santa Claus rally. They were emboldened by the huge October rally in the stock market, and then a big bounce out of the worst Thanksgiving week since the Great Depression. But after selling off again last week, the S&P 500 has still failed to trade above the 30-week moving average for an entire week since July! If you look at the chart below you can see that for the last 9 weeks the S&P 500 has failed to retake the 30-week moving average.

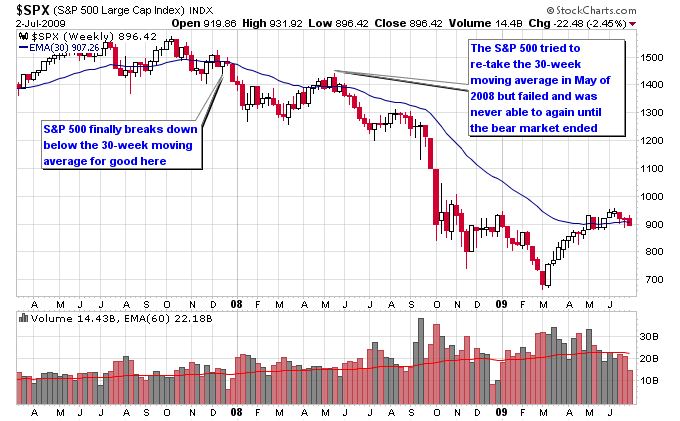

This type of bearish action occurred during the last two bear markets. During the 2008 bear market, once the S&P 500 dipped below the 30-week moving average during the last week of 2007, it never again traded completely above the 30-week moving average until the bear market was over. It tried to re-take the 30-week moving average in May of 2008, but failed.

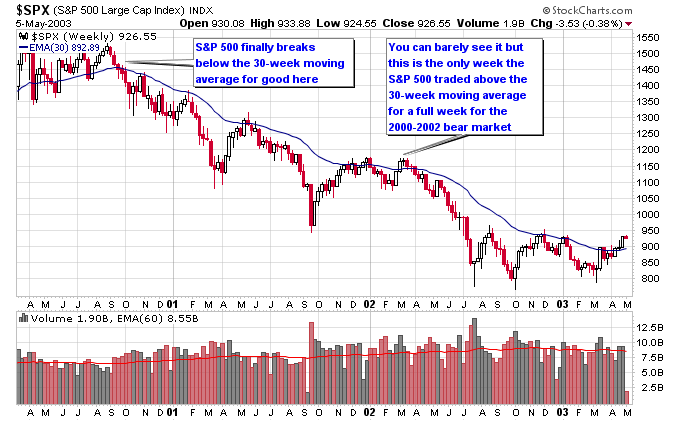

During the 2000-2002 bear market, which was much more drawn out than the 2008 bear market, the S&P 500 made more attempts to re-take the 30-week moving average. But it failed every time except for a single week in March 2002. Only when the end of the bear market was reached in April 2003 was the S&P 500 able to trade above the 30-week moving average for more than a week.

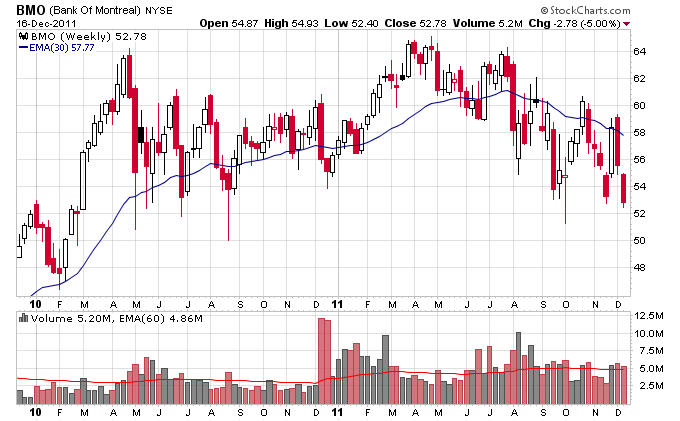

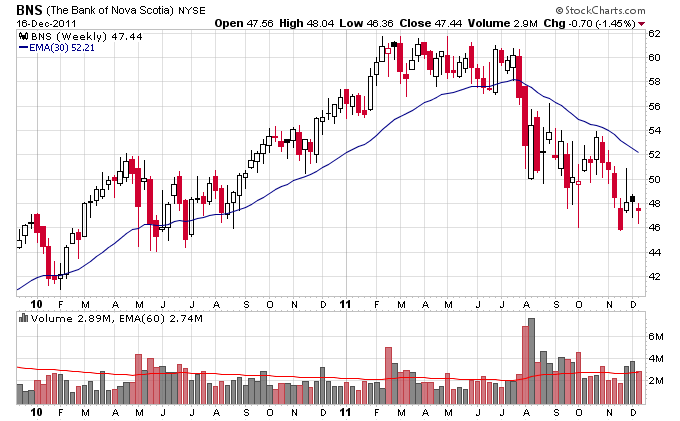

Besides the bearish implications above, there’s more bear tracks showing up in other markets. Some markets are looking like they could breakdown below their October lows. Canadian banks are one, which is interesting because they were supposed to be relatively healthy, due to the fact they didn’t use as much crazy leverage as U.S. or European banks. Bank of Montreal made a new closing low for the year last week, and is clearly in a Stage 4 downtrend.

Bank of Nova Scotia is also threatening it’s October lows, and like Bank of Montreal is in a Stage 4 downtrend. I’m not showing them below, but Stage 4 downtrends are also occurring in the Royal Bank of Canada and Toronto Dominion Bank.

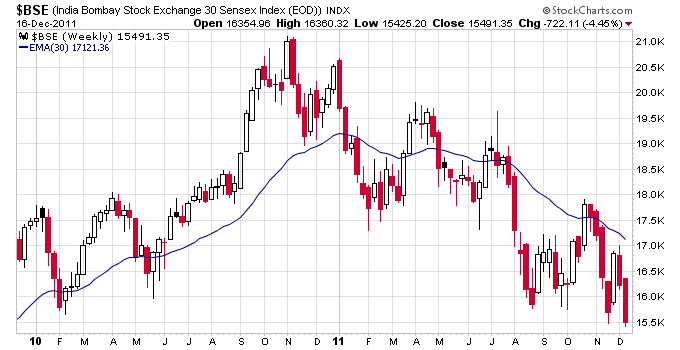

India made a new closing low for the year last week and looks set to continue moving lower. This is obviously bearish since India is supposed to be a source of global growth.

Now you might say why should I care about Canadian banks or India, if I’m only concerned with U.S. markets? If these markets weren’t heavily intertwined with the rest of the world I would agree. But since they are important parts of the world economy, the signals they are giving can’t be ignored.

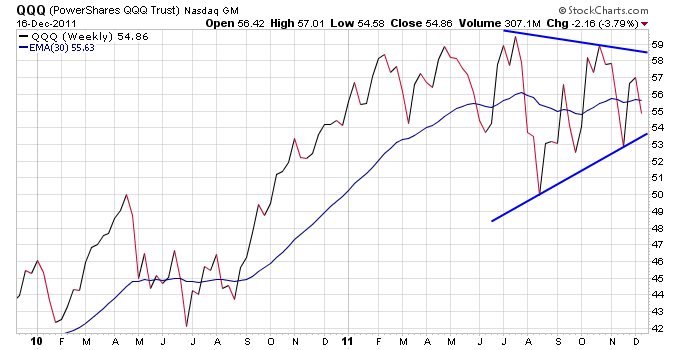

Finally, for the October rally to be something other than a simple mean reversion rally, the tech sector needs to re-establish its leadership position. If the Nasdaq 100 was to break below the November lows it would start a pattern of lower highs and lower lows, which would add to the bear case.

The market will continue to remain unhealthy if these bearish trends proceed. Watch those October lows and whether other markets are able to hold those lows or fall below them.