Today one of the stocks I own provided a glaring opportunity of how sentiment and excessive pessimism can mis-price an asset and provide huge opportunities to those that are paying attention. The stock is Starcore International Mines (SAM.TO) on the Canadian TSX exchange. Now this is a small cap mining stock with only one property in production, so it carries it’s own company specific risk that some people might not want to take on. But in a gold bull market a stock like this can also do exceptionally well especially when it is priced for failure but turns out to be a success.

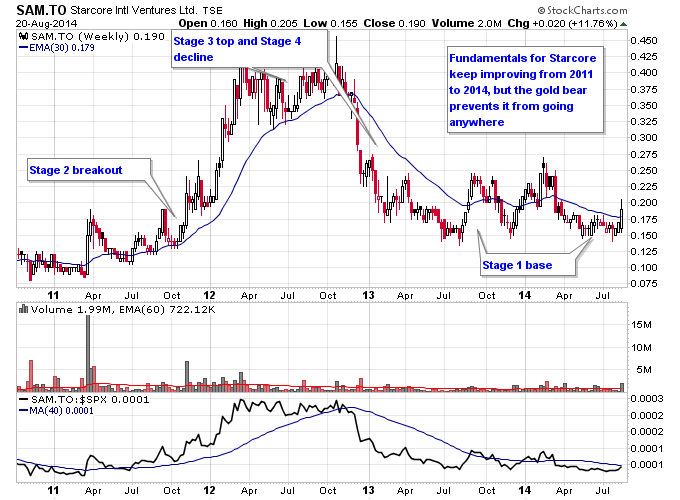

Here’s the basic rundown of what has been happening with this company. Leading up into the year 2012, this company had their gold production hedged and didn’t own their mine due to a loan and a hedge they took out to acquire the mine. So these facts put kind of a damper on the stock to begin with. Why would you want to own a hedged miner when most gold miners are unhedged in this gold bull? But in 2011 even as gold was topping, the market started recognizing the fact that Starcore was going to pay off its hedge soon and would be an unhedged gold producer with free cash flow. And it had a low P/E ratio because the stock wasn’t being assigned a high valuation by the market. So what did the market do in response to these facts? It bid up the shares from under 10 cents to over 40 cents in a matter of months. And this was all while gold topped in 2011 and started a bear market. You can see the Stage 2 breakout below in the chart.

In 2012 Starcore outperformed just about every other mining stock out there due to its changing fundamentals. But the gold bear market eventually got to this stock and in 2013 the gold bear started hammering its shares. Starcore fell all the way back to the mid-teens and has been oscillating up and down since then as the gold bear market has prevented big money from taking interest in a small cap miner like this.

But the fundamentals just kept improving for Starcore during 2013 and into 2014, as it paid off its debt and went debt free with 100% ownership of its mine. Then Starcore just kept adding cash to its balance sheet, and put out a press release stating that it intended to be a dividend paying gold miner once it built up enough cash reserves. This alone made it a very unique stock because there are not that many small cap gold miners that are cash flow focused and shareholder friendly enough to pay dividends. But Starcore decided to be unique in this aspect. All of these facts and improving fundamentals is what gave me the resolve to add shares in Starcore during this gold bear with the goal that once the bear market was lifted the improving fundamentals would help the stock take off.

The gold bear of 2011-2014 basically negated the improving fundamentals of Starcore that were occurring under the surface. This isn’t just unique to this stock but other gold miners as well as companies in other industries that have endured bear markets. Especially cyclical markets that don’t go away, downturns always create buying opportunities for the next upturn. The market has basically ignored Starcore’s improving fundamentals and even with today’s dividend announcement won’t give the stock full credit for its improved fundamentals until gold transitions back into a bull market.

But until then and especially since gold is late in its bear market it’s a great time to acquire undervalued assets that are mis-priced due to excessively bearish sentiment. This is when those that are paying attention and know that bull and bear markets don’t last forever can make big long term trades.

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.