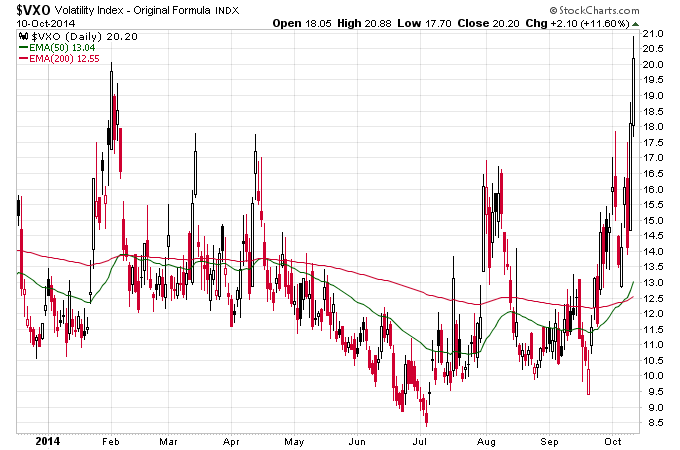

The VIX spiked to its highest level all year on Friday as fear is ramping up in the financial markets. The day time moves in stocks are now what I call carnival type action, where one minute you look at a stock could be up 3% and then in 30 minutes it’s down 6% or more as the stock market craters. This is the type of action we saw in 2008 as stock market volatility went crazy and intraday moves in stocks were out of control.

I would definitely look for a big bounce in the markets at some point here because fear spikes like this always flame out eventually. But the structure of the stock market is now decisively bearish. Most developed foreign markets are in Stage 3 or Stage 4, most Emerging Markets are in Stage 3 or Stage 4, and many U.S. sectors transitioned into Stage 3 this week. That’s a brutal configuration if you’re a bull and if the U.S. finishes transitioning into a Stage 4 we could be in for a global bear market.

The stock market bulls this year ignored a couple of different things all year which I think is now coming back to bite them. They ignored the fact that a ton of stocks made a top in March of this year and then got leveled. Some of them recovered to make marginal new highs but many stocks have barely even recovered the damage they took in the beginning of the year.

The second thing they ignored is continued weakness and volatility in the small caps. This is the same type of action I saw in gold stocks in 2011 that led to their eventual top and bear market. I wrote about that in a recent article. The bottom line is there have been bear warning signs for months now but overly bullish sentiment by the media and many analysts seemed to drown out these warning signs.

The fact that everyone is still bearish on gold here I think is a positive sign for the metals too. I do not expect a huge dollar rally if we get a new bear market because the dollar has been going up ever since 2011, and is actually due for a top and not a bottom. The opposite is due for gold a long term bottom that should coincide with another big round of money printing once the Fed panics and reverses course.