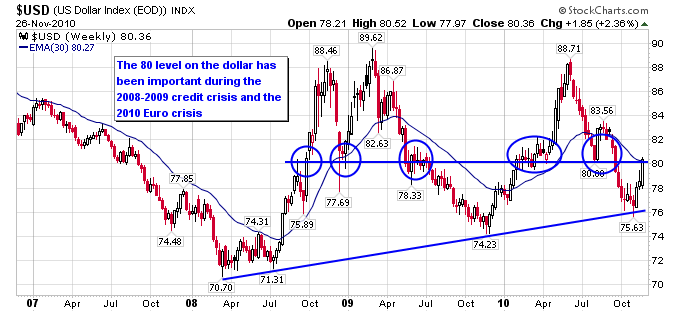

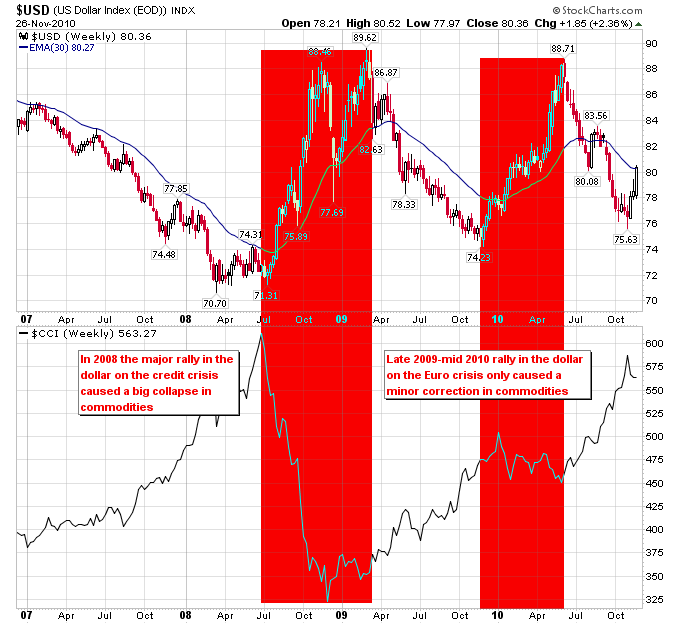

The U.S. Dollar Index is once again right at a significant price level at 80. This level was important during the 2008-2009 credit crisis and the 2010 Euro crisis, as it proved to be both resistance and support on rallies and declines. As both crises abated, the dollar broke down below the 80 level, but it has still consolidated in a slight uptrend ever since the start of the credit crisis in 2008.

In 2008 the dollar rally caused a huge correction in commodities, after they had rallied for 6 years from 2002-2008. The correction brought the CCI Index down 47% from peak to trough in 2008. In the first half of 2010, the dollar rally during the Euro crisis caused a more minor correction in commodities of roughly 13%.