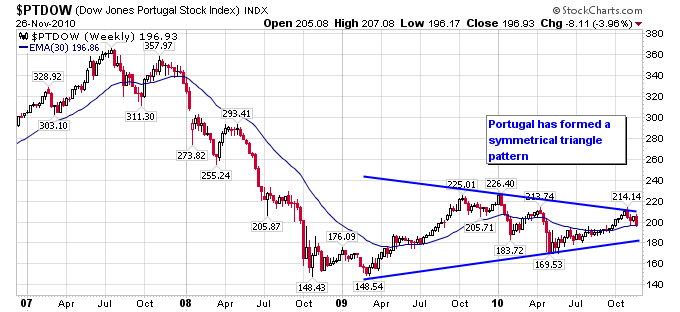

With the debt troubles in Ireland making headlines over the past few weeks it’s instructive to look at the indexes of the PIIGS countries. First up is a chart of the Dow Jones Portugal Stock Index. Portugal has traced a symmetric triangle on the chart and is still trading slightly above its 30-week moving average.

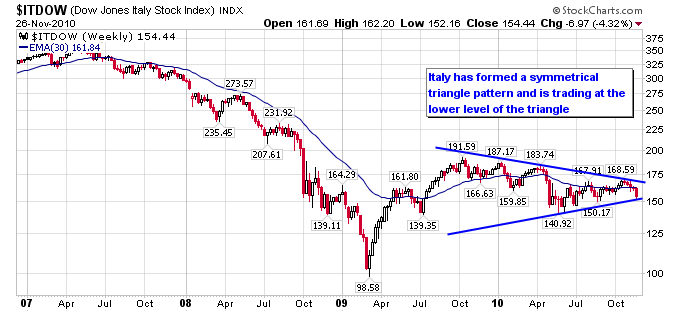

Italy has also formed a symmetric triangle, but is trading at the lower end of the triangle and has broken below the 30-week moving average.

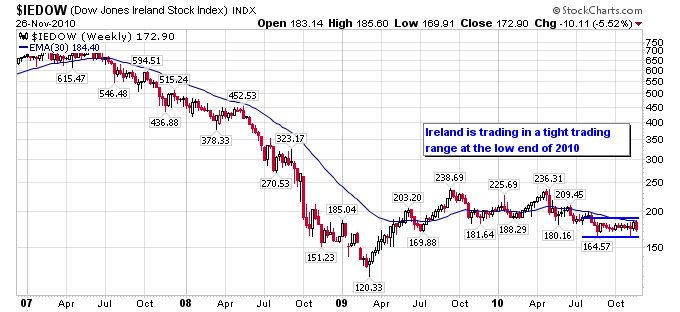

Ireland has been trading in a tight range since July but within the trading range the index has made new lows for 2010, and a breakdown would make another lower low.

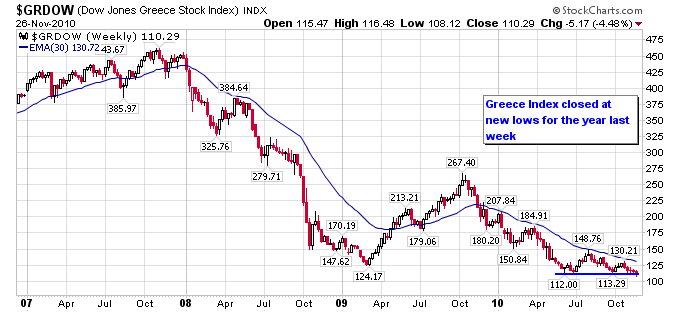

Greece has been the weakest of the PIIGS for the last few years, as it gave up all its gains from a rally in 2009. Greece also made new lows for 2010 this past week and for the bear market from 2008.

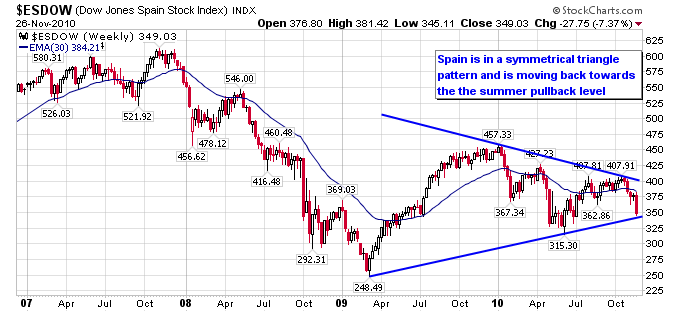

Spain has also formed a symmetrical triangle and like Italy is right at the lower end of the triangle.

Overall the technical action of the PIIGS is taking a bearish tone as 4 of the 5 are now trading below a long term moving average, and two of them are potentially setup to break a symmetrical triangle to the downside.