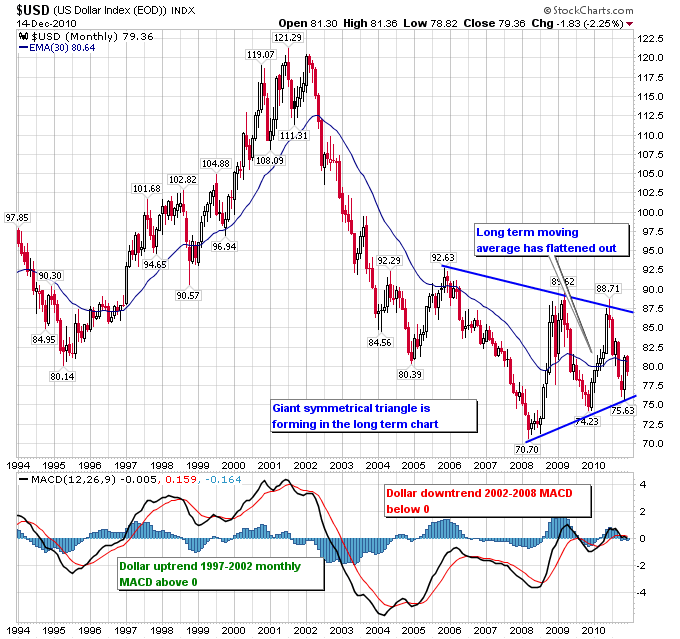

The U.S. Dollar continues to consolidate right at the 80 level, which is roughly the midpoint of the trading range the dollar has established since bottoming in 2008. The trading range has narrowed with each successive rally and correction in the dollar, and appears to be forming into a symmetrical triangle pattern. The monthly MACD is at zero, which seems to be a good dividing line between bull and bear markets in the dollar.

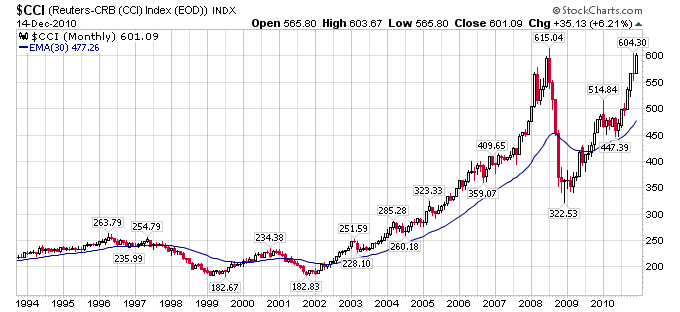

Commodities and recently the bond market seem to be suggesting the dollar is more likely to breakdown into a renewed downtrend when this consolidation ends. Commodities as represented by the CCI Index are almost back to their former highs:

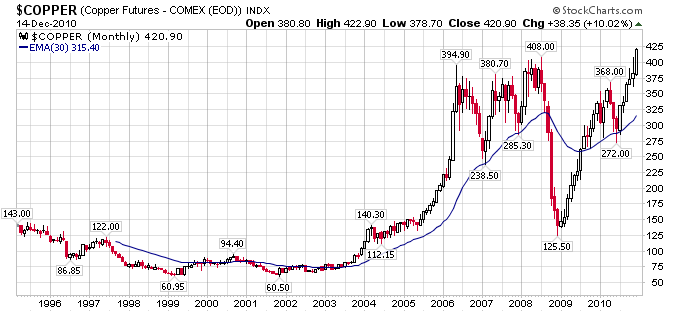

Copper is hitting new highs:

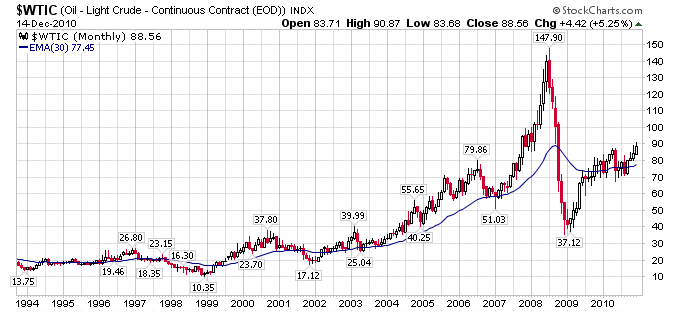

Oil is continuing to make new highs:

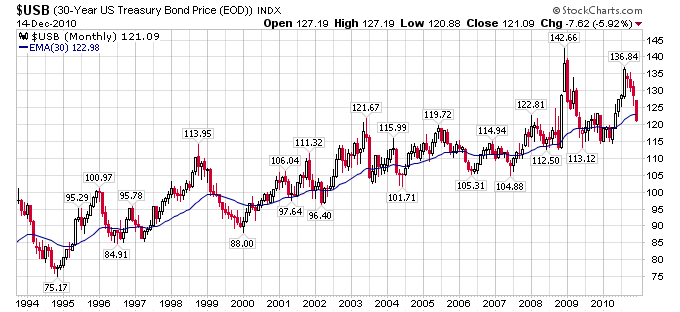

And the long bond has made a lower high that will have to be reclaimed in order for the uptrend in bonds to continue: