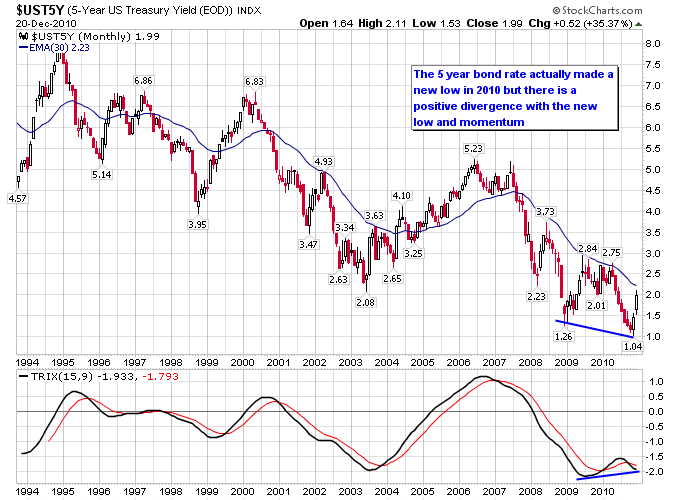

The 5-year treasury rate made a new low in 2010 but a positive divergence has setup between the new low and the momentum to the downside. What this means is even though a new low was made there is less downside momentum than there was when the previous low was made. This produces the divergence between the new low and the momentum. Divergences in momentum can sometimes lead to trend changes, and since there is a lot of talk of the bond bull market being over this could be an important technical indicator to watch. Another interesting thing to note is this appears to be the first major occurrence of a divergence between momentum and price that has occurred on this chart in 16 years.

Related Posts

About Author: Justin