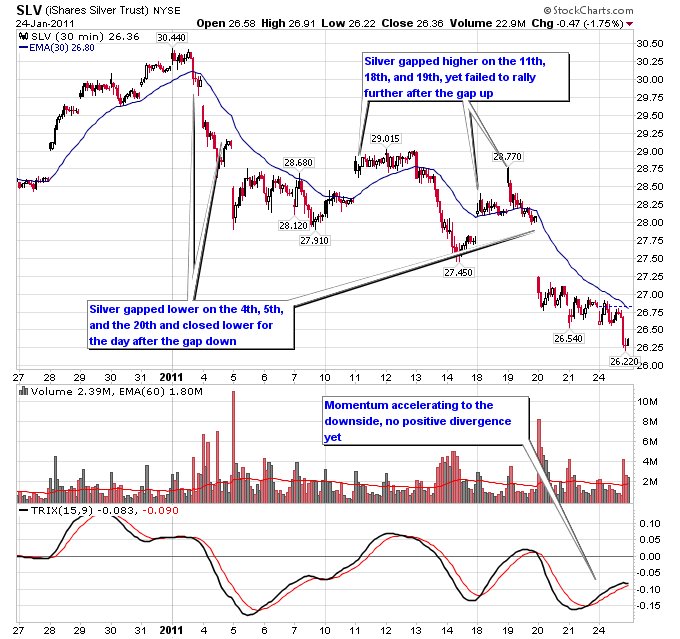

Silver continued to trade to the downside today and if it closes down for the week it will be four straight down weeks to start 2011. The selling appears to be orderly to the downside so far too which leads one to believe the trend lower is still in force. Drilling down into a 30-minute chart you can see clearly that silver has exhibited very little strength to the upside since 2011 started. On the gaps higher that occurred on the 11th, 18th, and 19th of this month, there was no follow through after the gap. At best all silver could do was meander sideways after the gap higher and then eventually head into another selloff. On the gaps lower which occurred on the 4th, 5th, and 20th, silver has only managed to fill the gap on the 5th but it turned lower after filling the gap. Momentum has also accelerated to the downside on silver and there hasn’t been any positive divergence suggesting at least an oversold bounce.

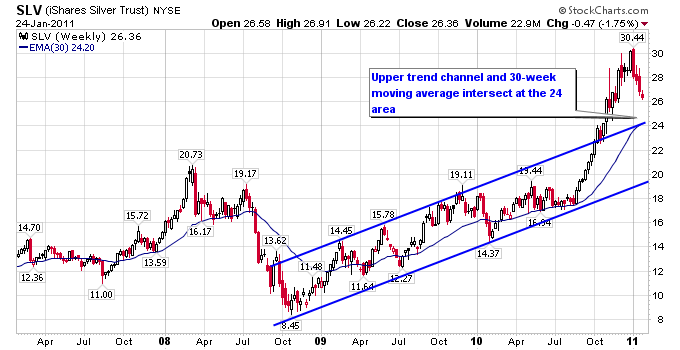

Since silver broke out and spiked higher to multi-year highs last year there isn’t much support for it to fall back to. There is a convergence of the upper trend channel line from the 2008 low and the 30-week moving average, which could be a logical support area on the downside.