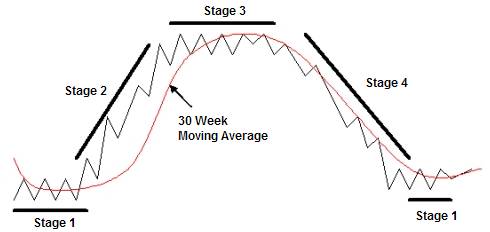

Stage Analysis is one of my favorite methods for understanding the current trend and identifying trend changes. The methodology was created by Stan Weinstein and discussed in the excellent book Secrets for Profiting in Bull and Bear Markets. The simplicity of the system is one of its strengths: all that is needed is a weekly chart with the volume showing and a 30-week moving average. Depending on price and its relation to the 30-week moving average, the market is in one of four stages: Stage 1 the bottoming or basing stage, Stage 2 the advancing stage, Stage 3 the consolidating or topping stage, and Stage 4 the declining stage. The following diagram shows each of the stages and how they transition from one to another:

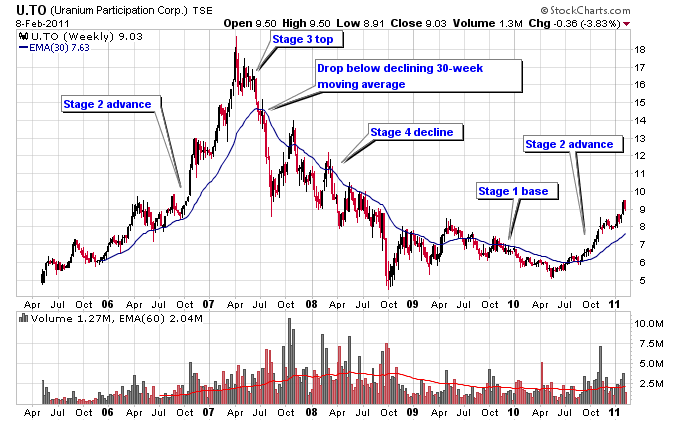

The next chart analyzes the uranium market from a Stage Analysis perspective. The chart shows U.TO, which is a Canadian equity that tracks the price of uranium. The chart shows the end of the last massive run in uranium, where the spot price went from $7 per lb. to $136 per lb. from 2003-2007 for nearly a 2000% gain. The parabolic top in 2007 ended the Stage 2 advance for uranium, and the Stage 3 top was fairly small due to the parabolic rise. Once uranium broke down below the 30-week moving average in 2007 the 30-week moving average turned down and the price of uranium trended lower into a Stage 4 decline. The Stage 4 decline went all the way into early 2009 with the price of uranium trending lower below its 30-week moving average.

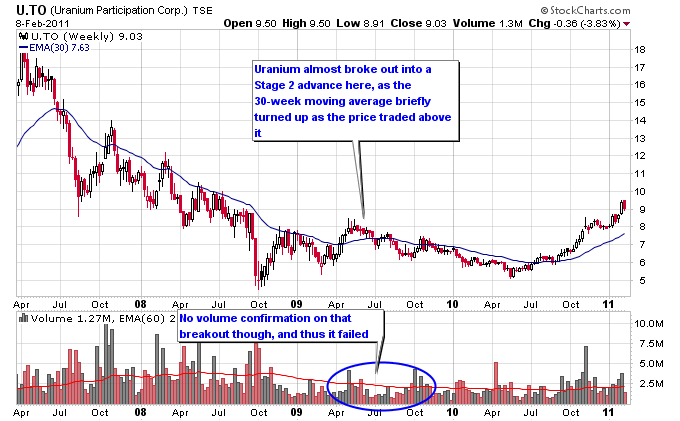

In the middle of 2009 uranium made an attempt to breakout into a Stage 2 advance, but failed and continued to trade in a Stage 1 base. As can be seen on the chart volume never increased during that Stage 2 breakout attempt. Increased volume is a key ingredient to a successful Stage 2 breakout.

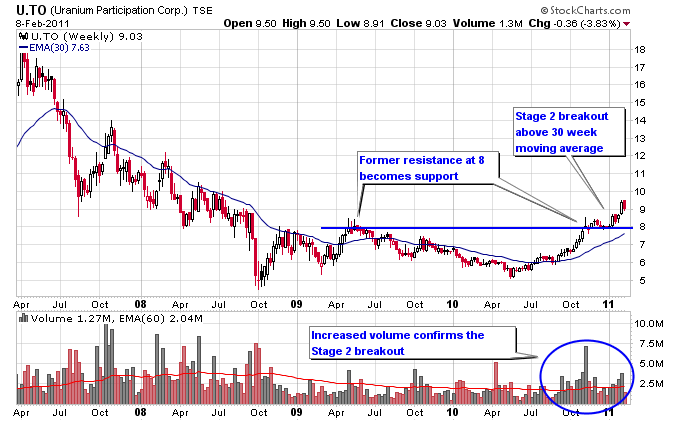

In October 2010 uranium moved back above the 30-week moving average again but this time the volume increased significantly as can be seen on the next chart. Multiple weekly volume bars exceeded the average volume during the breakout. With the 30-week moving average turned up and uranium trading above the 30-week moving average uranium transitioned into a Stage 2 advance. Notice how the former resistance level at 8 held as support recently as well.

One important thing to note about this Stage 2 breakout is it occurred off of a 2-year Stage 1 base. Typically the “bigger the base, the stronger the case” as is noted in Weinstein’s book, which is bullish for uranium going forward.