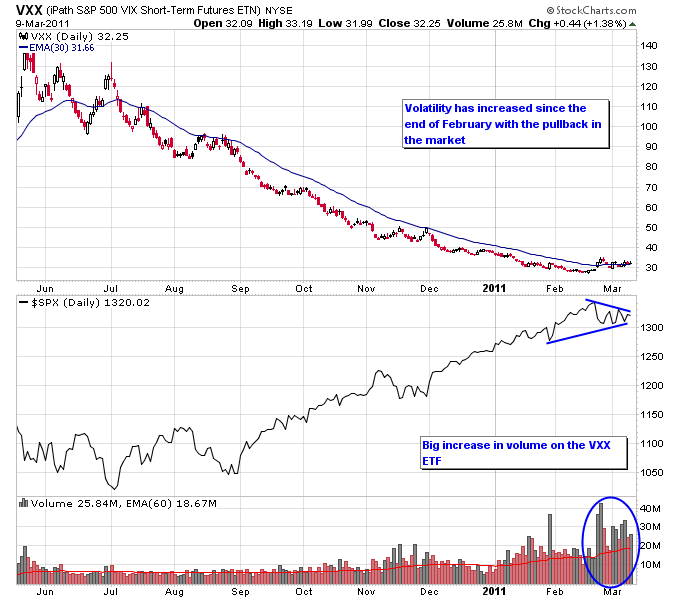

Volatility has returned to the market since the end of February. The volume on the VXX ETF has surged and the trend to the downside for VXX has temporarily been halted. On the chart below this is the first time VXX has traded above the 30 day ema since the rally begain last summer. The S&P 500 has started forming a triangle formation and depending on which way it breaks should determine whether volatility increases or settles down.

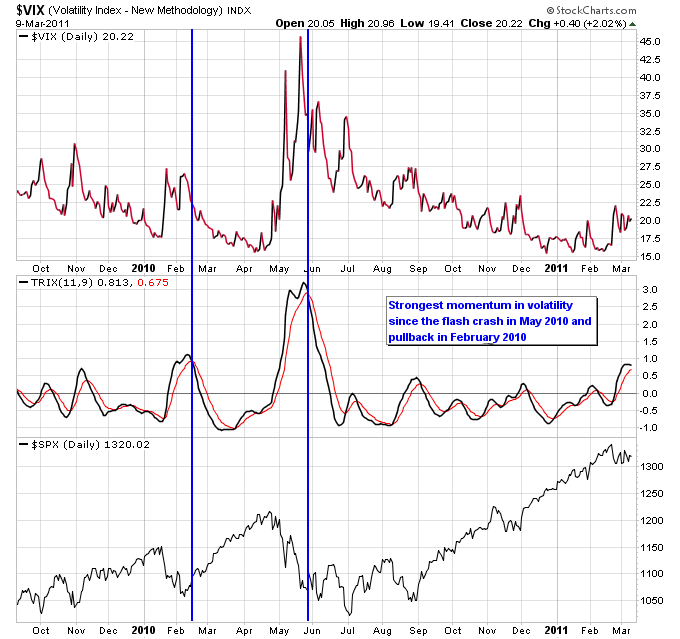

On a longer term chart the momentum in volatility has increased at its fastest rate since the flash crash in May 2010 and the correction in February 2010. On the previous two market corrections once the TRIX crossed back to the downside indicating momentum on volatility was waning, the bulk of the correction was over (the market took longer to digest the May 2010 correction though). Currently momentum on volatility is still to the upside on the chart. Notice how the S&P trended higher as the TRIX was below zero on the volatility index.