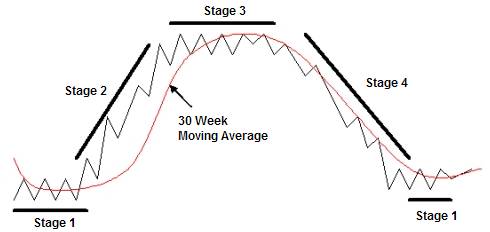

Tech stocks have had a brilliant run since the March 2009 bottom in the stock market, even beating some of the best performing commodities over the same time period. But some tech stocks that have had great runs are starting to show early signs of a potential Stage 3 top, according to Stage Analysis. To review, a Stage 3 top forms after a Stage 2 advance. In the Stage 2 advance, prices advance above an advancing 30-week moving average. During a Stage 3 top, prices start to flatten out and move above and below a flattened 30-week moving average that is not longer trending higher. Essentialy a Stage 3 top is the transitional period between the uptrend and downtrend where prices grind sideways before they finally change directions.

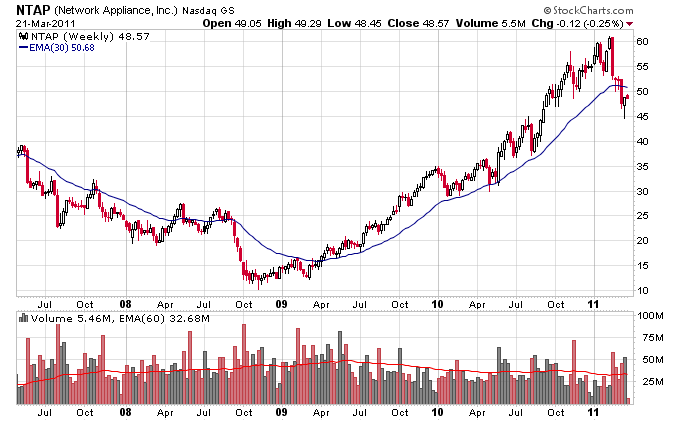

NTAP has gone up over 4 times since its March 2009 bottom. During the recent market correction NTAP finally broke below the 30-week moving average, after trending strongly above it for almost 2 years.

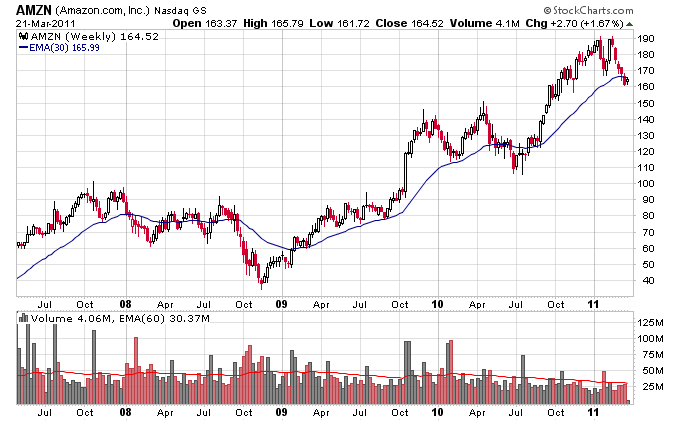

AMZN is also trading below its 30-week moving average for the first time since the middle of 2010.

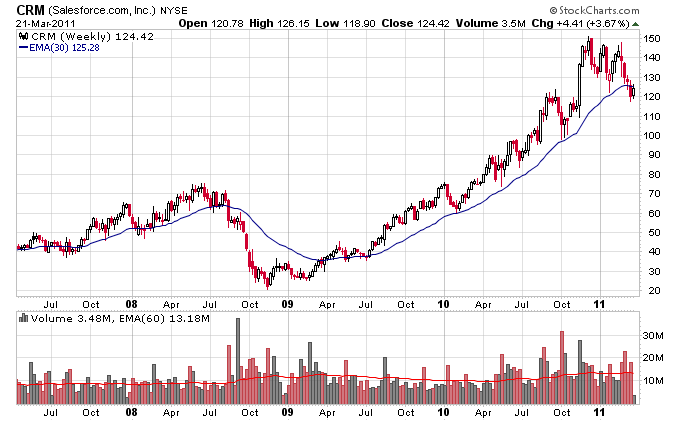

CRM had a huge run from the March 2009 bottom but finally pierced its 30-week moving average over the last couple of weeks.

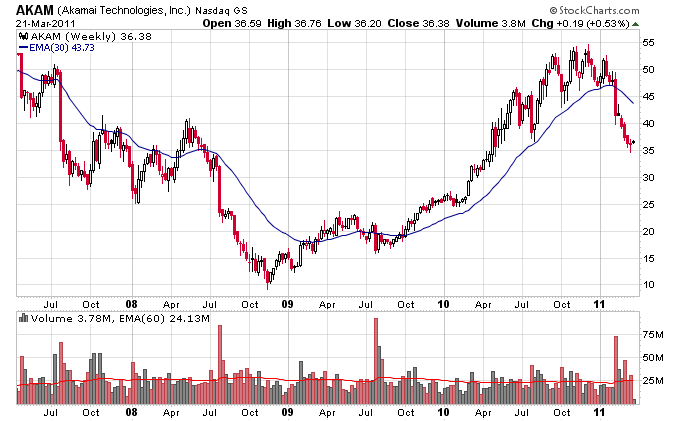

AKAM has broken further below the 30-week moving average than other stocks listed above, and its 30-week moving average has started to trend lower, which is an ominous sign.

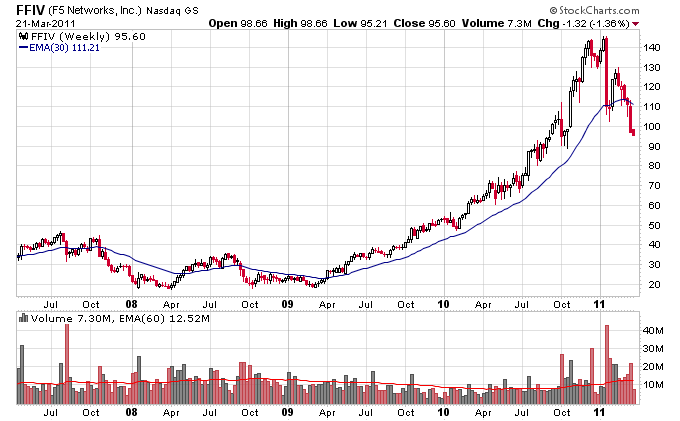

FFIV had a large selloff after an earnings release earlier in the year, and not only hasn’t recovered but is starting to move below its 30-week moving average.

If tech stocks continue to form Stage 3 tops then it will be much more difficult for the market to maintain its long term trend higher.