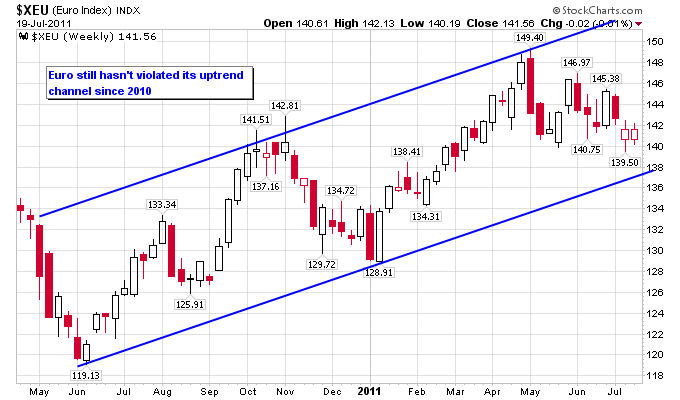

If you simply looked at a chart of the Euro over the last year or so, and didn’t know about all of the problems facing the European Union, you could conclude that the Euro was just experiencing a pullback in an ongoing uptrend. That’s how good the technical action in the Euro has been given the considerable problems it has been facing. From the recent May high in the Euro at 149.40 to the July low of 139.50, the Euro is down a mere 6.6%. This pullback so far isn’t even as big as the pullback in the Euro at the end of 2010.

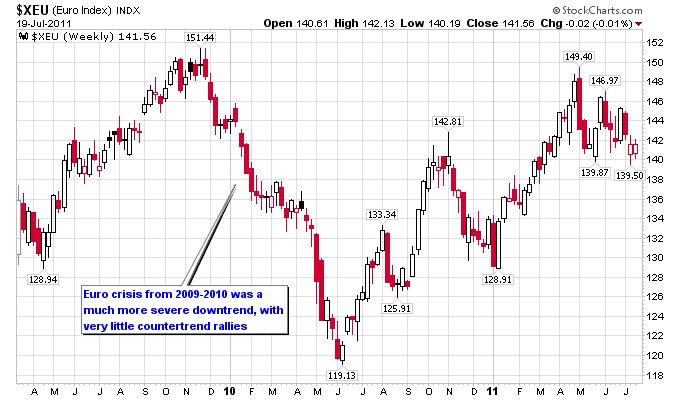

The Euro has been rising ever since the end of the first wave of the Euro crisis that began in October 2009 and ran until May 2010. The first Euro crisis was a much more severe downtrend. It took the Euro down about 20% from over 150 to under 120. The Euro was not able to have many positive weeks during that multi-month move to the downside.

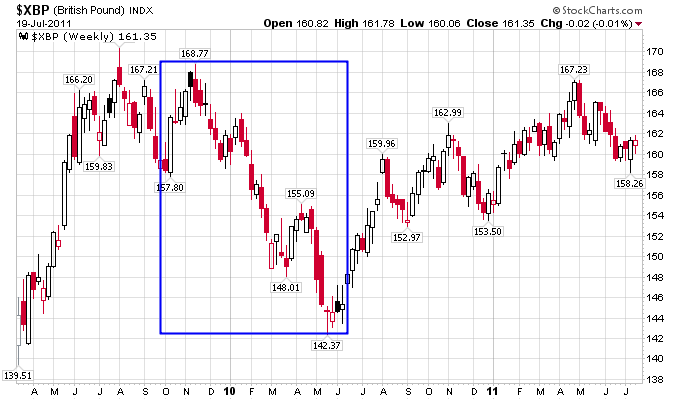

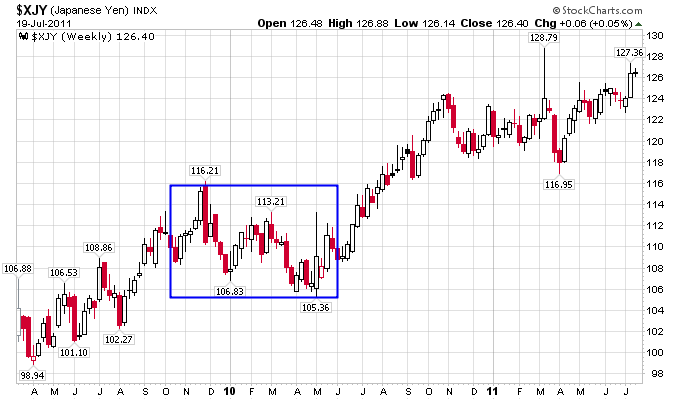

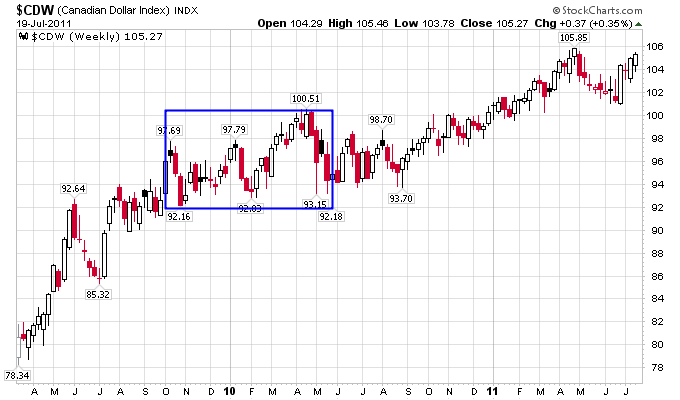

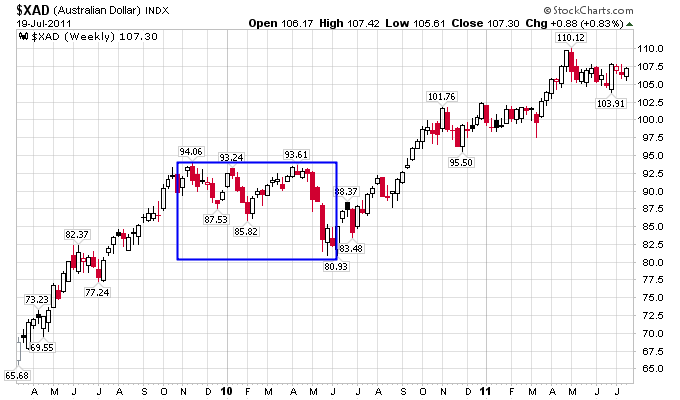

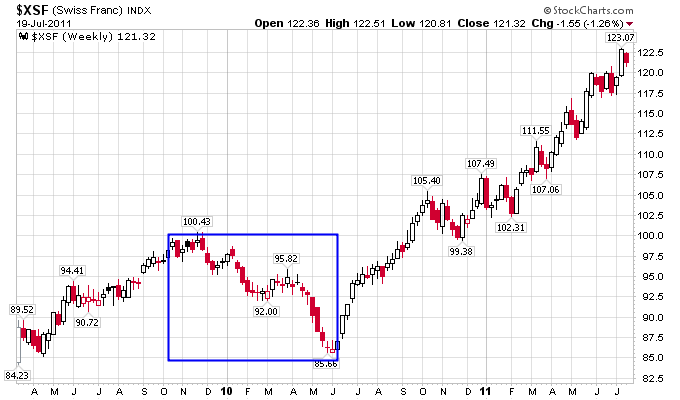

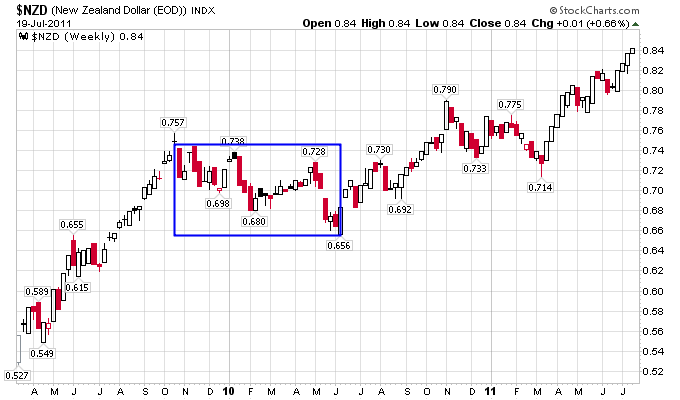

The massive downtrend in the Euro helped drive a big upleg in the dollar over the same period. But just like the Euro hasn’t been as aggressively sold off this time around, neither has other major foreign currencies. The next series of charts highlights the period of the first Euro crisis on charts of the Pound, Yen, Canadian Dollar, Australian Dollar, Swiss Franc, and New Zealand Dollar. Note that all of those currencies experienced sideways to downward trends during the same period as the Euro crisis, which helped drive the dollar higher.

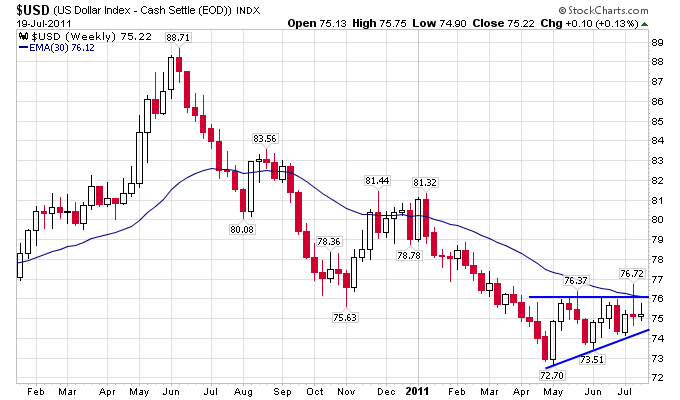

Currently the Swiss Franc and New Zealand Dollar are making new highs against the U.S. Dollar. The Yen, Australian Dollar, and Canadian Dollar are getting close to making new highs. If those three currencies breakout once again against the dollar then trend followers need to take heed that this current situation is much different than the previous Euro crisis. The currency markets could possibly be signalling that the U.S. Dollar downtrend would resume. Taking a look at the current chart of the dollar shows an ascending triangle pattern on the weekly chart, with a breakout level of 76. The dollar has failed twice so far to hold above 76 during the rally from May so that clearly is an important technical level.

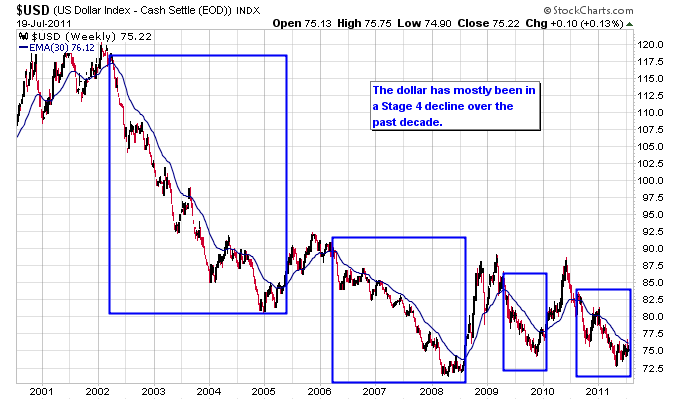

The 76 level also coincides with the 30-week moving average that the Stage Analysis trend following method uses. Currently the dollar is still technically in a Stage 4 downtrend, which it has been for most of the past decade besides a few major countertrend rallies.

So to summarize the Euro still has yet to come under the same magnitude of pressure it did during the last crisis. If the shorts in the Euro fail to get aggressive and foreign currencies continue to be resilient against the U.S. Dollar then a continued U.S. Dollar downtrend could be on the horizon.