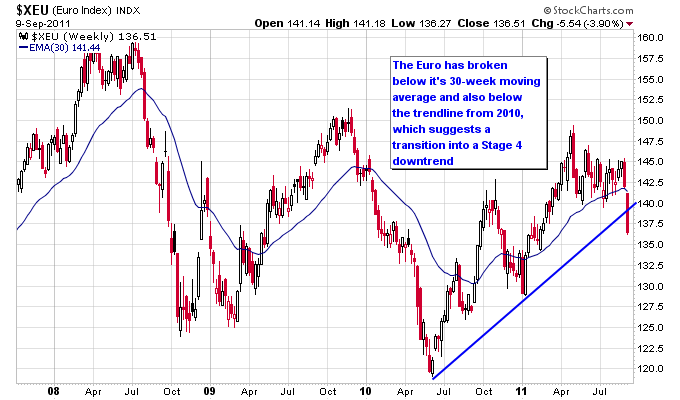

Back in July I wrote an article discussing the fact that the Euro had failed so far to come under pressure during this wave of the European debt crisis. In fact it was still in a technical uptrend since bottoming in 2010 after the first wave of the Euro crisis. Last week the picture for the Euro changed significantly as it fell -3.90% for the week and fell out of a trading range between 140 and 145. The breakdown out of this trading range could be the beginning of a new Stage 4 downtrend for the Euro, as it is now trading below its 30-week moving average which has also turned lower.

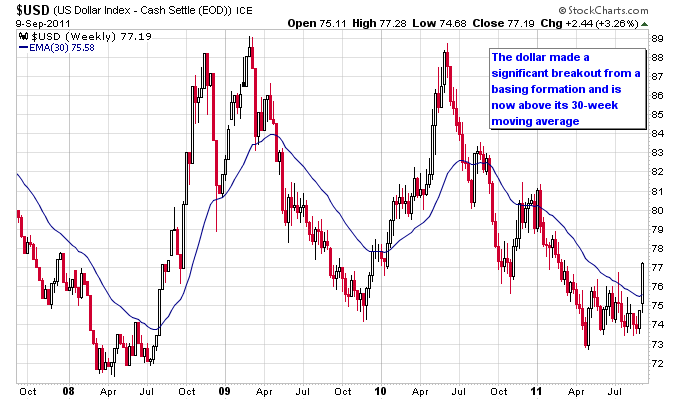

The U.S. dollar conversely has broken out of its trading range and could be on the verge of a new Stage 2 uptrend. This will undoubtedly have an impact on other sectors of the market, as the dollar has shown to be negatively correlated to most asset classes since the 2008 financial crisis. Chris Puplava from Financial Sense just wrote a good article showing some of the correlations of the dollar to other asset classes. Most sectors of the stock market appear to have a negative correlation in the -0.40 to -0.50 range to the U.S. dollar, which could be characterized as a moderate negative correlation. What this basically means is that they don’t always move in the opposite direction of each other, but have shown a tendency to move in opposite directions. Since most sectors of the stock market have transitioned into a Stage 4 downtrend it is not very helpful to the stock market to now have a rising dollar.

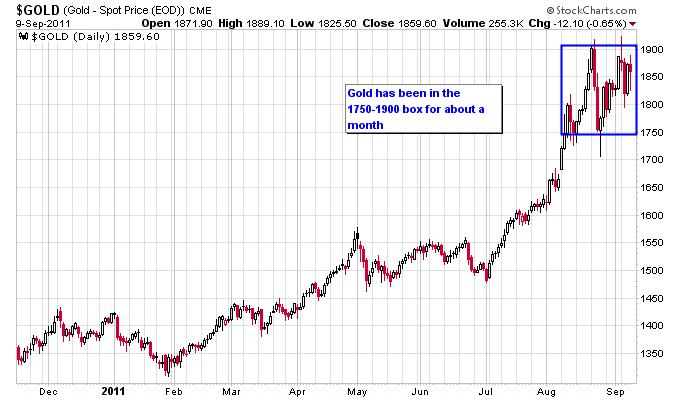

Gold actually has a negative correlation of less than -0.20 to the dollar, which means that gold has shown a weaker tendency to move in the opposite direction of the dollar than the stock market. This runs contrary to a lot of common thinking that gold always runs counter to the action in the U.S. dollar. Relatively speaking, this weaker negative correlation is good news for gold since gold has been the leading sector of the market over the last few months. Gold is currently consolidating under the 1900 level which it needs to take out for its uptrend to remain intact.

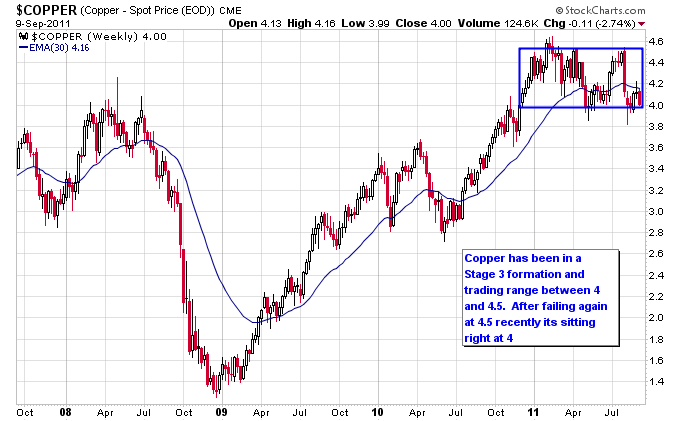

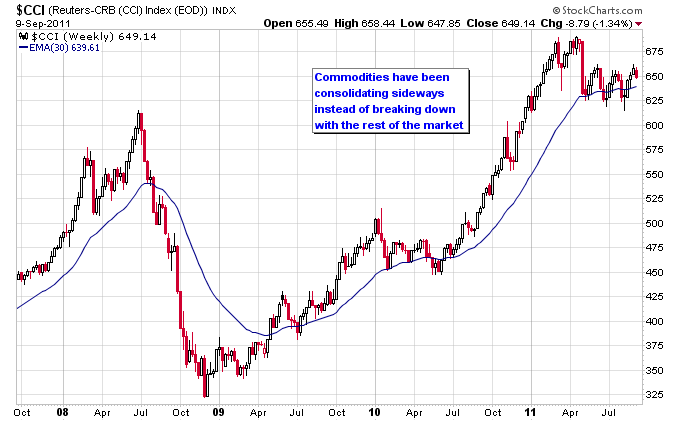

Two other charts worth paying attention to now that the dollar is attempting to rally is copper and the commodities index. Both have been consolidating in a Stage 3 instead of breaking down with the rest of the market. But a rallying dollar could potentially be the push needed to transition them into a Stage 4.

This potential structural shift in the movement of the U.S. dollar is bearish for the stock market. The stock market didn’t really need this bad news, since it has already broadly transitioned into a Stage 4 downtrend across most sectors of the market. Stan Weinstein, who outlined the Stage Analysis method in the book Secrets For Profiting In Bull And Bear Markets, says in the book that above all else, do not buy or hold anything in a Stage 4. I definitely agree with that statement, as the only way to lose significant money in the market is to stay on the wrong side of the market and build up losses. As a trend follower the number one job is to listen to the message of the market, which includes the bearish potential outcome of a trend change in the dollar.