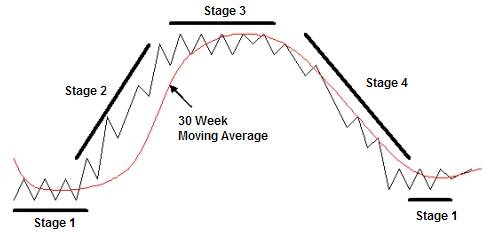

Thanksgiving week has been an ugly week for the markets, which isn’t anything new since the entire year of 2011 has been a choppy mess. The rally out of the October 4th low got many bulls’ hopes up and calls for a “4th quarter rally” ran rampant on the financial blogosphere and on CNBC. But despite a powerful countertrend rally that may have completed with a top on October 27th, stock markets across the world remain in structural bear markets. From a Stage Analysis perspective, a bear market is a Stage 4 market that is declining below a declining 30-week moving average.

The bear market contagion that has spread across world stock markets can be seen on the next table. The world picture looks ugly as 96% of the stock markets listed below are in a Stage 4 trend. Only Mexico and South Africa aren’t currently in a Stage 4 trend, but they are barely hanging on to their Stage 3 status. The table also shows the quarter and year each market put in a long term top. It’s noteworthy from the table that the PIIGS countries, that have formed the basis for the European financial crisis, topped all the way back in late 2009 and early 2010. Their poor price action compared to other world stock markets was a good indicator that there were fundamental problems underlying their markets.

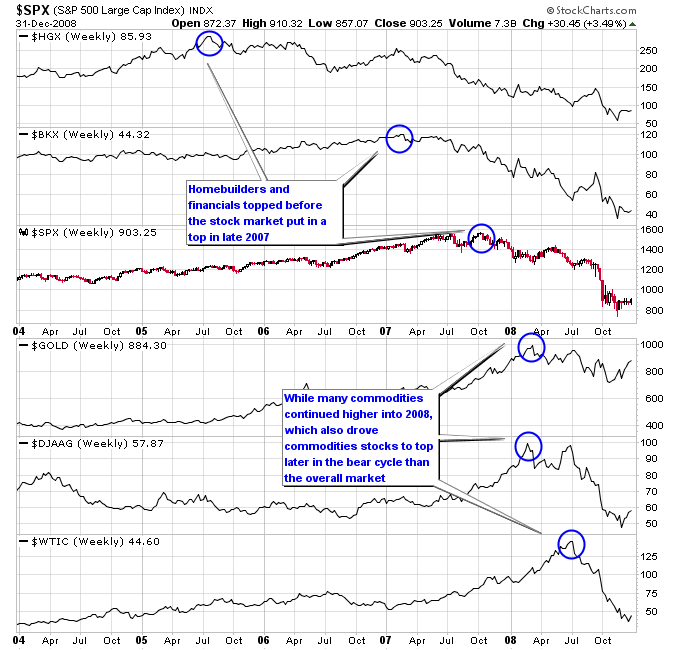

A phenomenon that tends to occur in bear markets is the following three steps: 1) the weaker parts of the market put in a long term top, then 2) the overall market tops, and then 3) the strongest parts of the market finally put in a top. A great example of this was in the late 2007 stock market top where financials and homebuilders had already completed long term market tops before the overall market. Other sectors of the market, most notably those tied to commodities made further moves higher in the early part of 2008. This culminated with the oil market in the summer of 2008 going parabolic as market participants piled into oil, as it was quite literally the only thing left going up as everything else had topped.

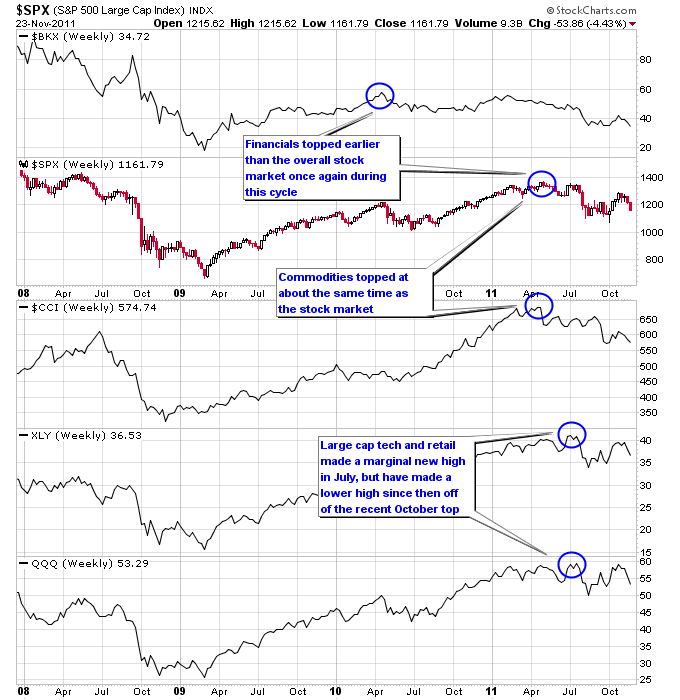

In the current topping situation in the market the actors have changed somewhat but things have played out in a similar fashion. The financials once again topped early, but this time around commodities topped at about the same time as the stock market. Some sectors within the stock market went on to make marginal new highs after the stock market topped, including large cap tech stocks and retail stocks. But large cap tech and retail as a group failed to make a higher high during the October rally.

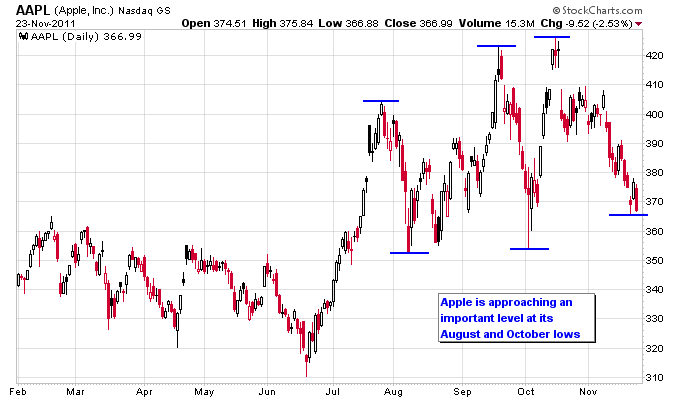

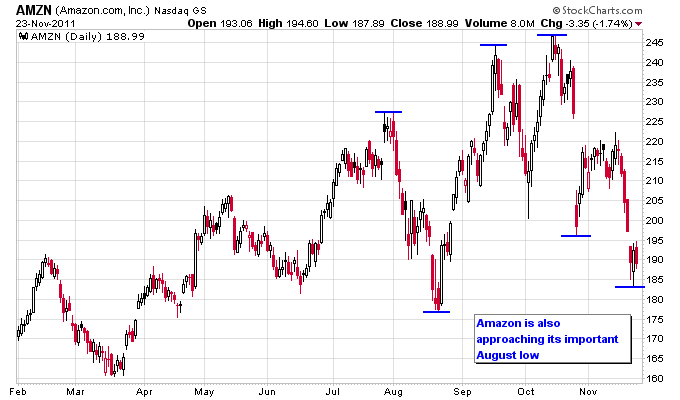

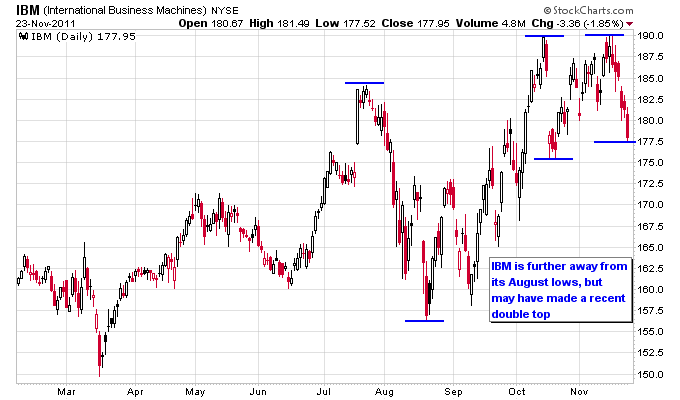

Drilling down into individual stocks, three stocks that I’ve focused on during the last few months have been AAPL, IBM, and AMZN due to their strong Stage 2 trends that they launched into coming out of the 2009 market bottom. These stocks were “market leaders” and important stocks to watch to gauge the overall health of the market. Each of these stocks actually made a marginal new high in October, but with the recent pullback in the market since October 27th, all are now already back below their July highs. AAPL and AMZN are both also back near their August lows, and a break below those lows would start a pattern of lower highs and lower lows for each of those stocks.

An intriguing development I saw recently was the online currency trading platform Oanda telling its clients to stay out of the currency markets. Their basic conclusion was they would rather see their clients survive and stay with them over the long term, then suffer huge losses during the volatile markets we are dealing with and no longer use their service. The president of Oanda in an interview said that “We are encouraging our clients not to trade right now, but to watch the market carefully”.

In my opinion that’s a great place to be during a Stage 4 bear market, on the sidelines and watching the markets. This keeps your physical and emotional capital intact, which is the only thing that lets you survive as an investor or trader. The market will eventually find a long term bottom out of the current Stage 4 downtrend, but until you can see the bottom in the rear view mirror it’s just a guessing game.