When markets don’t go our way, our emotions get tested. Our thought processes and decision-making ability gets polluted by fear. And when overcome by fear we often make bad decisions. Sometimes these bad decisions can be actions taken as a direct result of fear. But fear can also lead to an inability to take action, as a result of emotional scars from the experience.

Back in April and May of this year, there was a lot of negativity and fear in the gold space. I actually started keeping a list of pessimistic gold article titles, which served as a home-made negativity gauge in the gold sector. Some of these articles were written by analysts that I read and respect, but clearly they were experiencing the same frustration that was affecting the average investor. Here’s a list of some of the pessimistic gold headlines from earlier this year:

Gold Stocks Suck

Can Gold Fall Forever?

Are Gold Stock Fundamentals Still Bullish?

Precious Metals: Don’t Want To Play Anymore?

Traders Eye Gold Stocks, Warily

Is Gold’s Party Over?

Where’s the Beef For Gold Equities?

Why Gold Is No Longer a Safe Haven For Investors

Gold Slides to New 2012 Low: Buying Opportunity or Bull Market Breakdown?

What’s Wrong With Gold Mining Stocks?

I wondered what some of the big financial institutions were doing during this negative period for gold. Were they adding to their positions, or were they feeling the fear and liquidating their positions? Unfortunately we don’t get to see 13F filings for financial institutions until 45 days after a quarter has ended, but nevertheless they can reveal some interesting information. A few weeks ago it was reported that John Paulson added to his gold holdings in the second quarter, and it was the first time he had done that since the 1st quarter of 2009. From Bloomberg:

“Billionaire John Paulson raised his stake in an exchange-traded fund tracking the price of gold while selling other stocks during the second quarter, leaving his $21 billion hedge fund with more than 44 percent of its U.S. traded equities tied to bullion.”

So Paulson added to his gold holdings during this latest cyclical downturn in gold, and increased the overall percentage of his holdings tied to the gold sector. I thought the next quote from the Bloomberg article was particularly good:

“Paulson, who became a billionaire in 2007 by wagering against the subprime mortgage market, told clients in February that gold is his best long-term bet, serving as protection against currency debasement, rising inflation and a possible breakup of the euro. Gold miners are historically inexpensive, he said at a meeting with investors in April.”

Paulson was reassuring his clients on his conviction in the gold bull market back in February. He was reassuring them again in April, right towards the end of this latest downturn in gold, as fear was on the rise. And he backed up that conviction by adding to his positions during the second quarter.

Paulson strikes me as someone who understands bull markets. He was able to tell that the housing bull market had morphed into a mania. He saw past the emotional attachment that most of the investment community had towards the housing mania, and took the other side of the trade which was hugely profitable. My guess is he sees nothing like what was going on in the housing mania in the current gold market. Thus he was confident that gold was just completing another major pullback earlier this year.

Clearly Paulson’s view of the gold bull market allowed him to take action during this latest pullback, and not remain paralyzed by fear. And that is one of the main reasons I’m an advocate of using simple trend following methods, such as Stage Analysis, for understanding trends in the market. They help you take a detached, unemotional view of the market, which is key at major turning points in markets. Instead of being paralyzed by fear and uncertainty after an emotional downturn, you can simply take an “it is what it is” look at the market and be prepared when market conditions become favorable again.

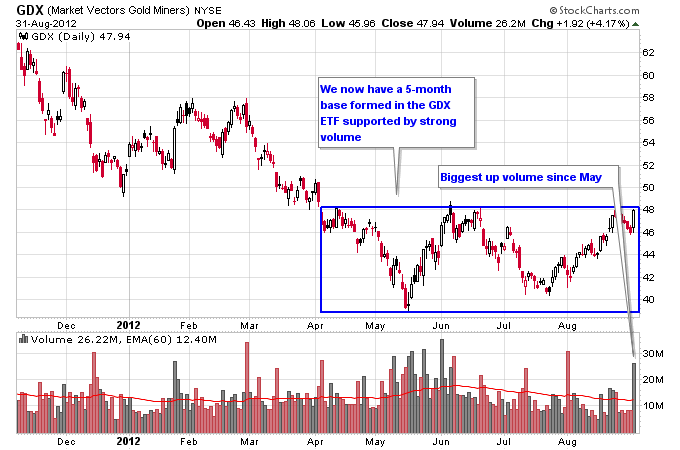

Now for the current analysis of the gold market. Last week Friday was a big day for the precious metals sector as both gold and silver moved higher on above average volume. The GDX gold stock ETF is now threatening to breakout from a 5-month base that is supported by strong volume.

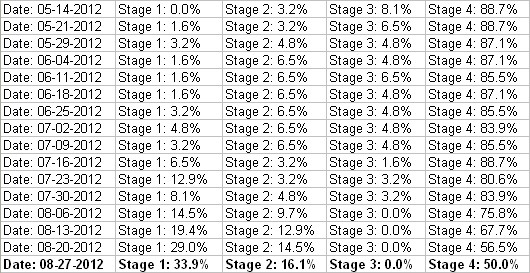

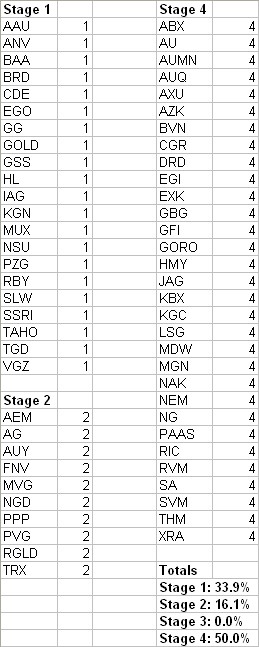

The Stage Analysis mechanical system that I revealed last week showed continued improved strength in the gold sector. More gold stocks moved into Stage 1 and Stage 2 from the previous week.

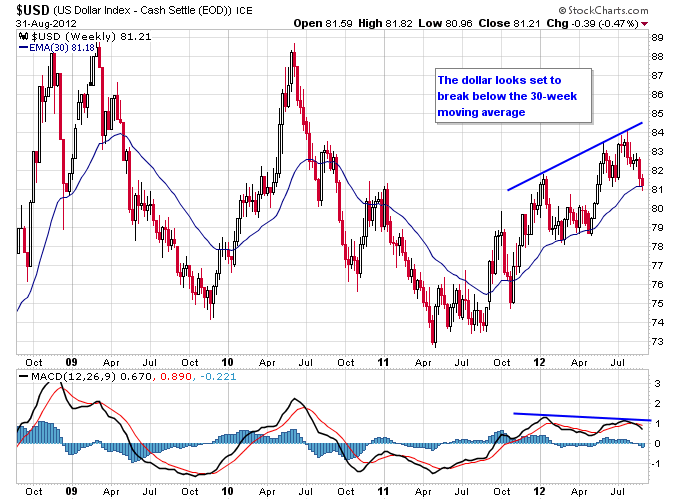

Finally the dollar looks ready to break below its 30-week moving average for the first time since 2011. Often times major changes in trend are accompanied by a divergence in momentum (shown in the MACD indicator) and price. This can clearly be seen on the chart of the dollar and would go right along with a major rally in the gold sector.

Connect with me on Twitter: @nextbigtrade

The original article and much more can be found at: https://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.