I still remember December 2012 and how petrified CNBC was trying to make people of the fiscal cliff. They had a fiscal cliff countdown for an entire month as if when it expired the stock market would explode. Everyone on there was scared and telling you to sell stocks because of the uncertainty surrounding the fiscal cliff. I remember one of their analysts got on and proclaimed for the first time since he was on TV, he didn’t own any stocks. I thought this was pretty ironic considering he always had a stock to tout and tell you how awesome it was. But even he succumbed to the fear of the fiscal cliff emanating from CNBC. Funny thing is, it was the exact wrong thing to do to be scared of the market coming into 2013.

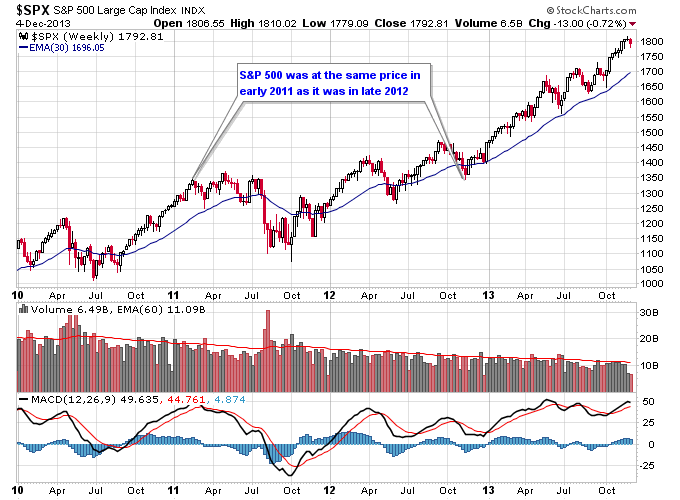

See the S&P 500 didn’t really do much from early 2011 to the end of 2012. It did a sideways grind for all of 2011 basically. By the middle of 2012 it still hadn’t gone anywhere. Then it had a rally into about October of 2012, followed by a pullback to the end of the year. That made the entire two year span just mostly a big consolidation, which really is what setup the potential for what we’ve seen in 2013.

Now recently we get a headline from CNBC titled “Embrace the Selloff”. Remembering what they were saying back in December 2012, I thought this was pretty funny.

This all boils down to psychology and how people react given what has happened in the recent past in the markets. Back in December 2012, they were scared of the fiscal cliff, not only for the fiscal cliff’s sake, but REALLY because the market had barely gone anywhere in 2 years. So the fiscal cliff represented another reason for the markets to go down and make everyone miserable, and they hopped on that bandwagon and made sure everyone felt the fear.

Now that the S&P 500 has gone up 400 points, people are much more comfortable with it. Which is why we get headlines talking about embracing pullbacks or talk of the Fed tapering. Instead of fear, they are saying “bring it on” because we’ve got profits, and this market is still going higher. This is all nonsense though because in reality the higher an asset class goes in price the more risk is built into it.

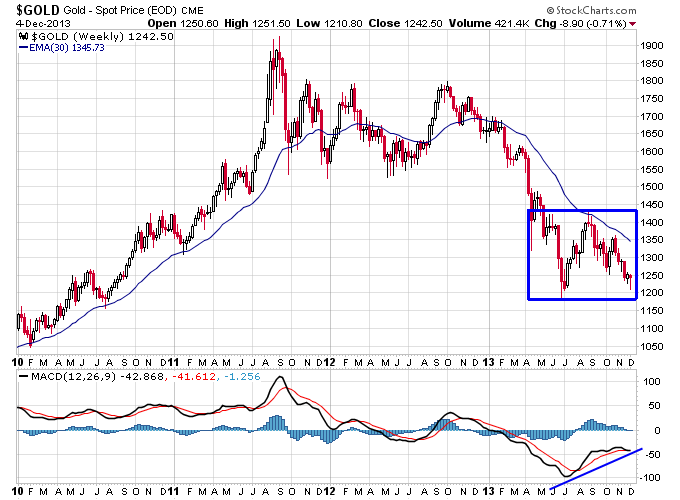

Which brings me to everyone’s favorite asset class to hate: gold. What’s ironic about gold is most of the risk in gold has probably now been removed from its price after a 2-year+ cyclical bear market. Yet hardly anyone will believe that, because all they remember right now is pain. But bear markets remove risk, which is why you need to embrace the panic.

Of course you can’t take advantage of a bear market until its over, that’s the key problem with the gold market. It looked for a second like the gold bear market was over in 2012, but that didn’t turn out to to be the case. Now that we’re ending 2013, it’s MORE LIKELY the gold bear market is over, but maybe it still isn’t.

The best thing we can say about gold is it isn’t going down as fast as it was earlier in the year. Ironically, people are about as or even more bearish on it now than they were then. Gold is starting to set up a base which is what you want to see for a market to bottom and transition back into a bull market. We could even make a new low on gold here and have a positive divergence in momentum, and still have the type of basing pattern necessary for a real bottom.

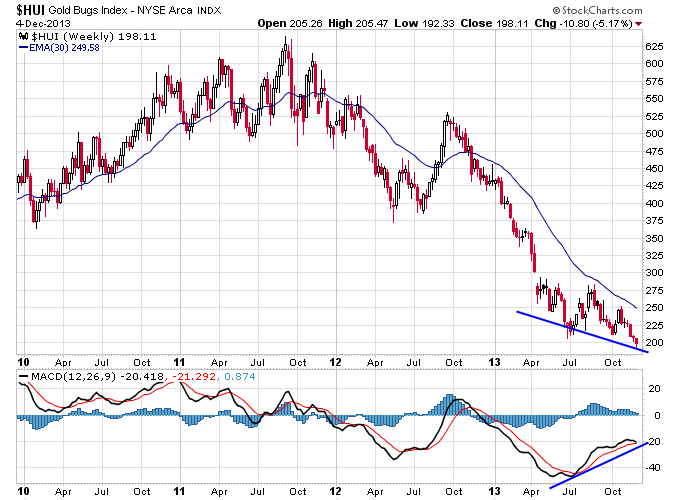

Gold stocks on the other hand are still trading horribly. The only positive thing you can say is even though they’ve made another new low, there is a positive divergence setting up. If they do get a rally from here it will also re-establish the base that would eventually then usher in the next bull market in gold stocks.

More than likely CNBC and the media will go into 2014 looking for more reasons the stock market will go up and shake off bad news. But their optimism was only gained because stocks had a great year in 2013. Eventually the pessimism in the gold market will be just as ill-founded as the pessimism in stocks was to start 2013.

Connect with me on Twitter: @nextbigtrade

The original article and much more can be found at: https://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.