Corn looks interesting to me here for a few different reasons. First the basics: corn has been in a multi-year bear market, and has fallen over 50% from its 2012 highs. 2012 was kind of weird though because it was a giant fake rally off of drought worries. In reality the corn bear kind of started in 2011, like the bear markets in most other commodities.

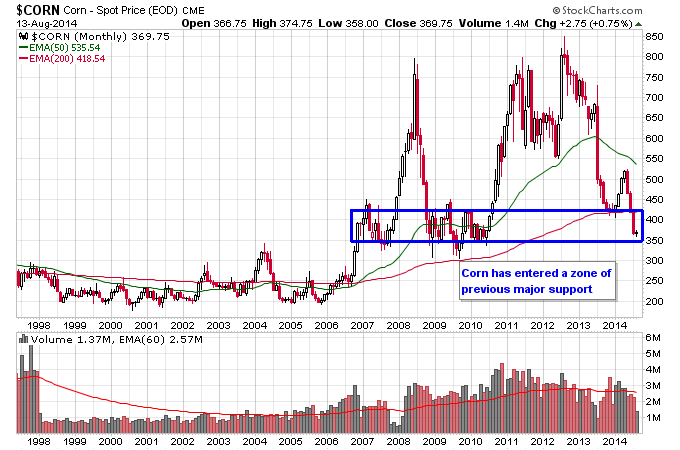

Most bear markets fall about 50% or so, and severe bear markets like the one in gold stocks go down 60-70%. So corn has the option of ending the bear at a normal bear here, or going into a severe bear and falling another 20% or so. Here’s a long term chart of corn and you can see that corn is now at support that held after the 2008 bear market.

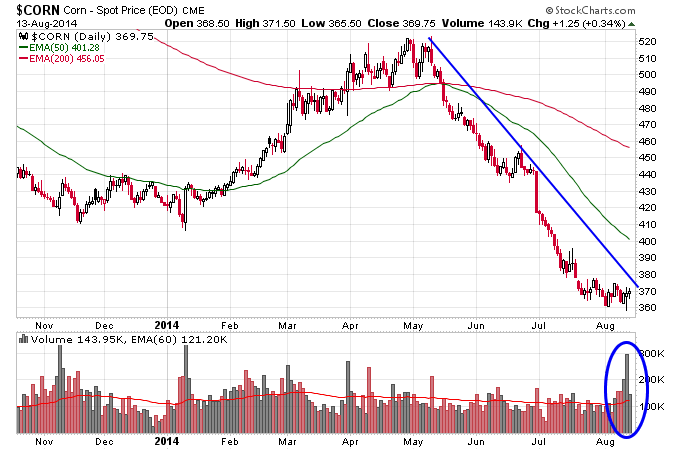

Here’s the daily chart of corn. You can see that since May corn has been annihilated in a severe 30% move lower in 3 months. That’s quite a beating. Most longs have now probably been flushed out of this market. So basically the risk/reward down here is good, if corn breaks strong support at 350 it’s time to get out of the trade. But if support holds you can take a long trade against that level with good risk/reward potential. I think starting out with selling puts might be a better strategy here because if corn just bases for a while then you can take in the premium even if corn goes nowhere.

I think corn will have to base a while before going into a bull market though so big trades seeking a new bull market in corn are probably premature. Corn is still technically in a Stage 4 downtrend but it’s probably getting close to the end of its bear market.