Portions of the market bounced back strongly last week, led by technology. Bonds also had a strong week. Commodities continued to struggle, with gold and silver continuing to trend sideways to lower. I did a short article on corn earlier in the week and thought it looked like an interesting trade to the long side. The grains are still technically in a Stage 4 downtrend though.

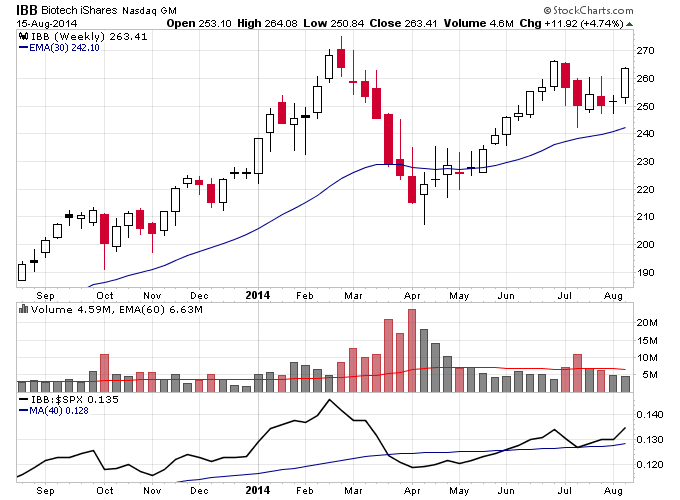

Commodities are definitely in a do or die situation now as if they continue much lower from here the entire complex will be back in a Stage 4. If that transition occurs maybe the broad markets will continue to head higher. Semiconductors still look strong so they might be a good sector to look at for market leadership. Biotech is also looking like it wants to resume a Stage 2 uptrend. Many biotech stocks transitioned back into Stage 1 or 2 last week. Checkout the chart of IBB below and notice it has formed a potential cup and handle continuation pattern higher. It is also once again outperforming the S&P 500.