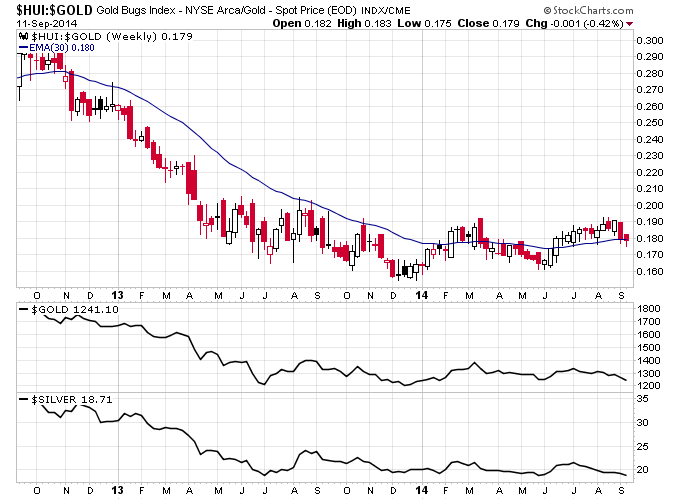

As gold and silver keep crashing into oblivion, you have to wonder what had gotten into the gold stocks for 9 months so far this year. See the HUI to Gold ratio bottomed in December 2013, which was a signal that the gold bear market was finally coming to an end.

But the metals themselves aren’t cooperating. Silver looks like it’s about to make a lower low, probably into the 17s and maybe down lower than that. Gold could retest $1180 but has room to fall down there, it’s possible that gold would find support at that level again.

If you look at the HUI/Gold ratio though you can clearly see an uptrend that formed at the end of 2013 until now. Gold stocks made a higher high in mid-2014 when gold and silver retested their lows, and are still making a higher high now with silver making new lows and gold potentially retesting new lows.

So gold stocks are either crazy, or they are onto something. I still believe that they are correctly forecasting the end to the gold bear market, but that doesn’t mean the metals won’t make new lows here. Gold and silver are very leveraged markets, and once these metals break support you should see the sharks come out and try to punish the bulls for quick gains. But it’s very possible that this upcoming breakdown could be of the fake variety given how the gold stocks have acted. Even if some of gold stocks start crashing, they will be above earlier levels indicating that the gold bear is late in the tooth.