I’m personally rooting for an epic buying opportunity to just keep getting better. Now that gold and gold stocks are back in a Stage 4 it’s pointless to try and predict a bottom, especially since we are in a massive liquidation phase where funds are exiting this sector. Instead it’s best to step aside and just watch them annihilate each other, and look for the next logical basing phase to possibly generate a new uptrend.

Imagine being a gold fund manager in this environment or a hedge fund manager with large position in gold or gold stocks. Not only are they trying to protect their own asset bases but they have clients who are probably trying to pull money out or are upset about the losses in the sector. All of this feeds on itself and is what causes mass liquidation of positions at the bottom. This happens over and over again in markets, just like buying panics cause manias, selling panics cause market meltdowns as the frenzy feeds on itself.

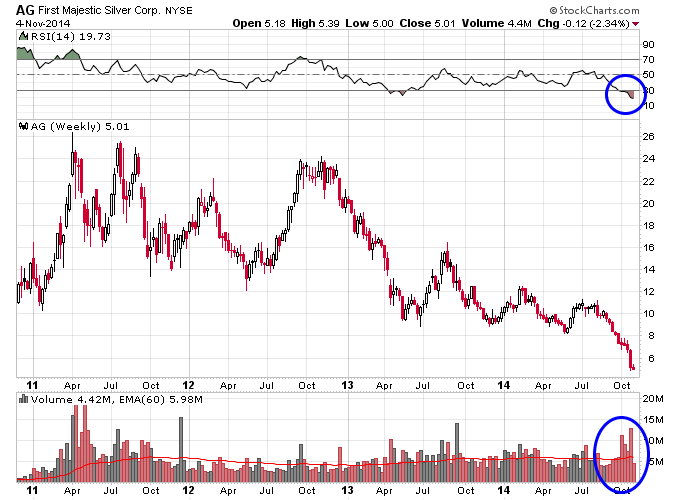

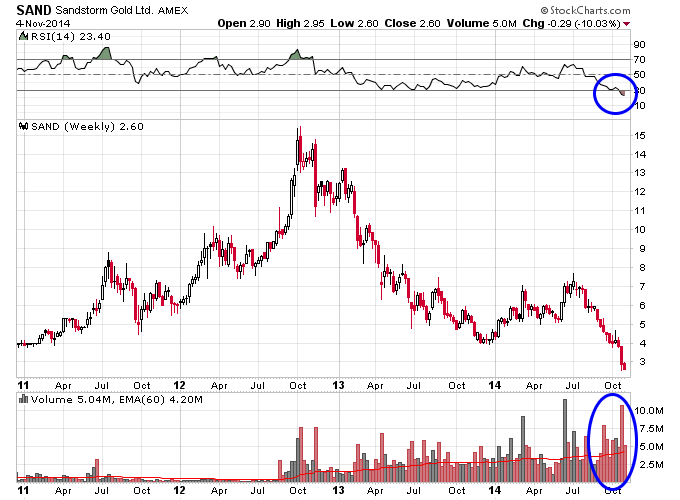

Take a look at the volume on some mining stocks recently at a record oversold position on the RSI. Both AG and SAND shown below have had a big increase in volume as they reach a record oversold level.

You would think that selling down here would not be what the professionals would want to do but towards the end of a bear market in a capitulation phase this is what they end up having to do without a choice.

Originally my thought was that since gold and silver had already undergone an extended bear market, capitulation volume wasn’t needed at the bottom for the precious metals. But now that the mining shares have displayed such a panic sell-off I’m more inclined to believe a panic sell-off could be coming to the metals themselves.

The lower and more on sale they go though the better positioned they will be for monster gains during the next Stage 2 rally. If anything we should say thanks to the hedge funds and leveraged speculators for the bargains they are generating by selling everything they have at the bottom.