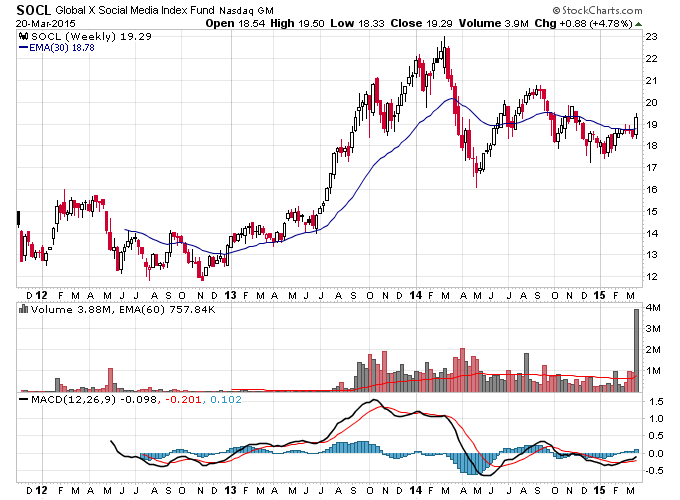

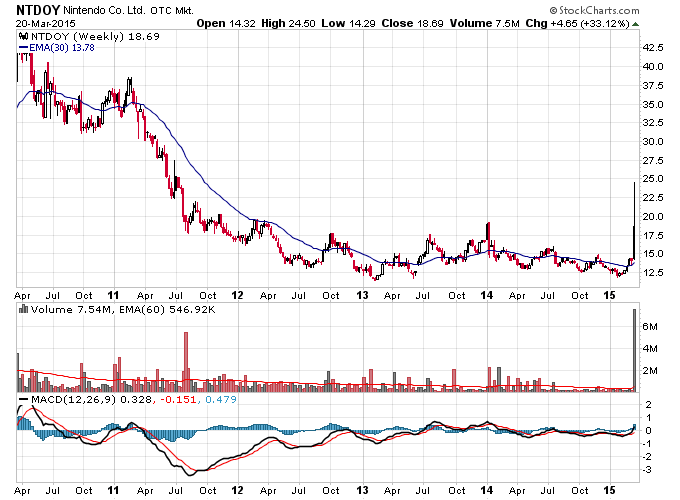

The biggest stand outs from the past week were the monster move in Nintendo (NTDOY) on overwhelming volume and a big move in the SOCL ETF on huge volume. Facebook also started breaking out of a consolidation last week which is bullish for social media stocks. I wouldn’t be too bearish on stocks with stocks like FB making new highs, at least for now.

Gold also made an interesting move to end the week and the Commitment of Traders report looks very bullish for gold from this past week. I did see an abnormal amount of bearish articles from gold analysts last week as well which I also view as bullish. Finally the U.S. dollar looks like it is getting heavy and I think it is headed for a broad topping formation next or an outright crash back down.

Stage Analysis: Watchlist Report

| Ticker | Stage | Weeks | Links |

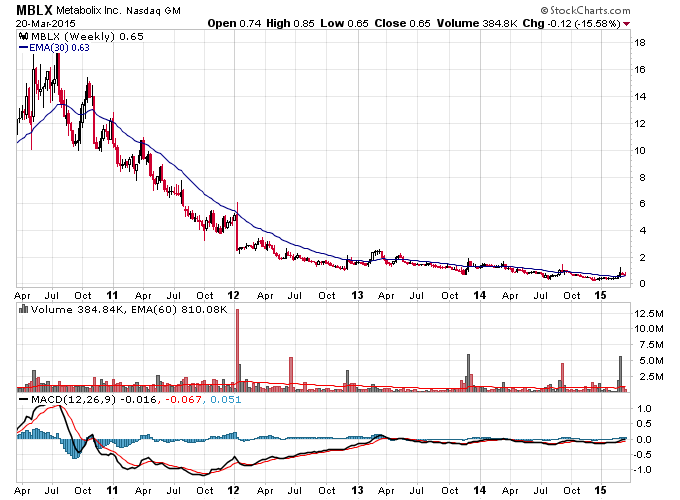

| MBLX | 1 | 1 | D W F Y G |

| SOCL | 1 | 1 | D W F Y G |

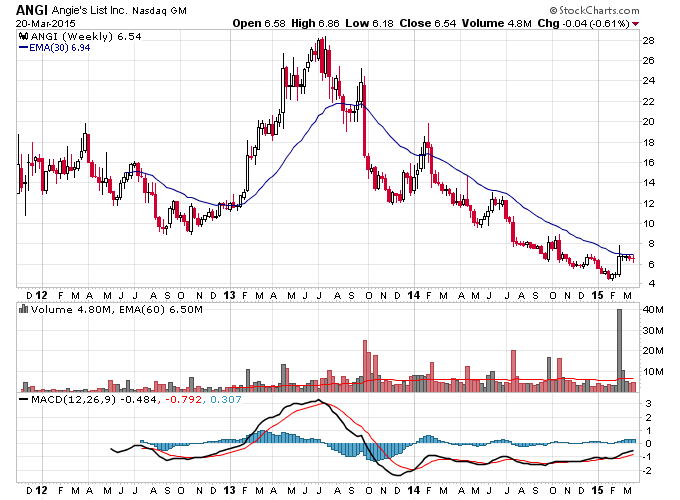

| ANGI | 1 | 2 | D W F Y G |

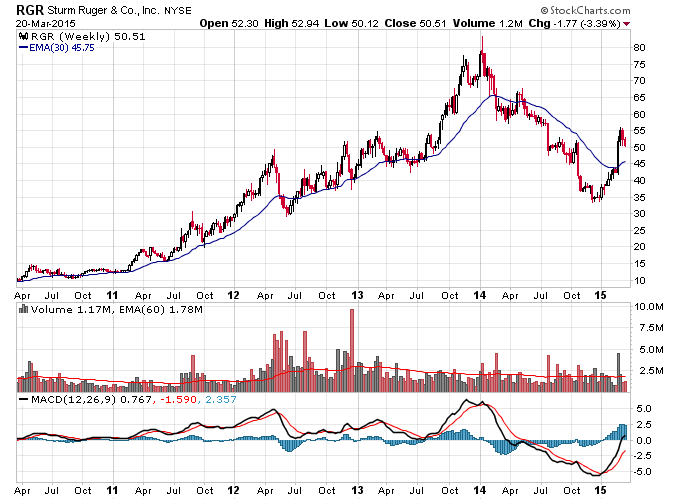

| RGR | 1 | 2 | D W F Y G |

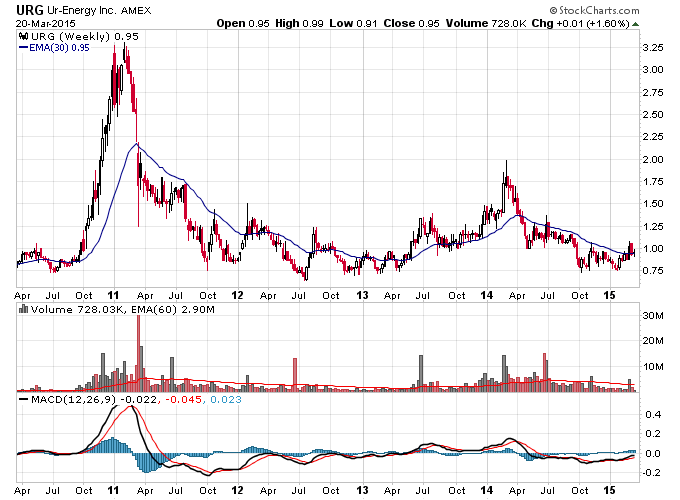

| URG | 1 | 3 | D W F Y G |

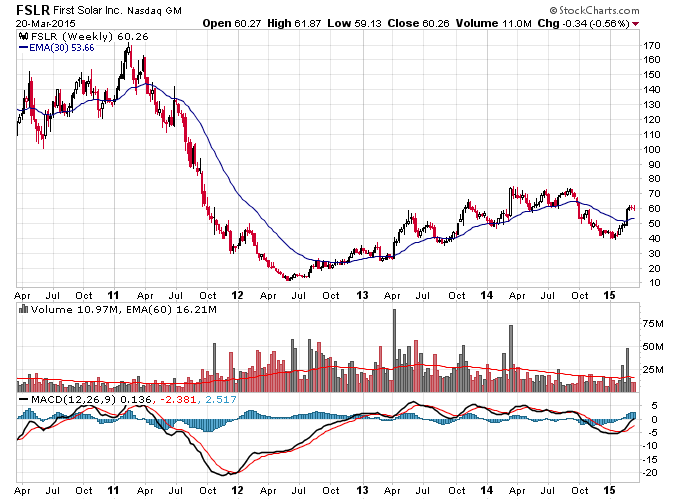

| FSLR | 1 | 4 | D W F Y G |

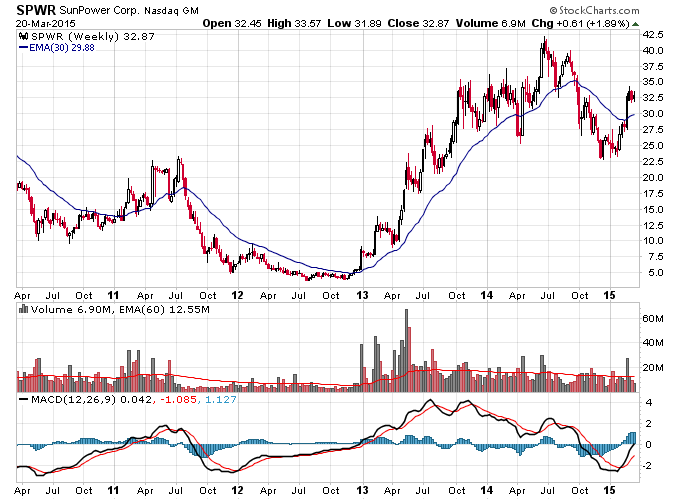

| SPWR | 1 | 4 | D W F Y G |

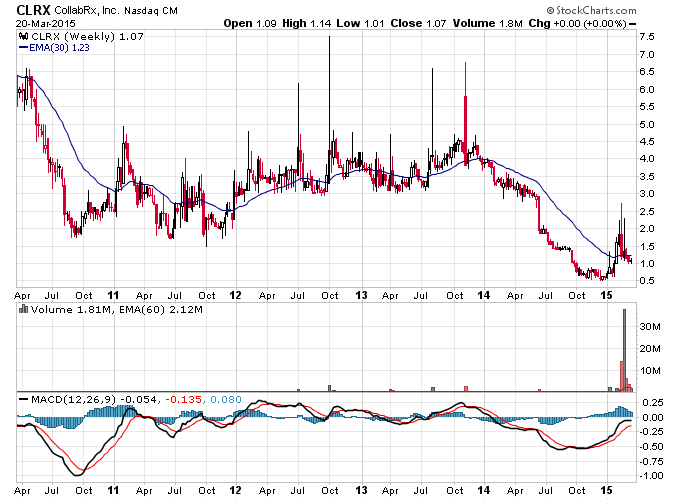

| CLRX | 1 | 5 | D W F Y G |

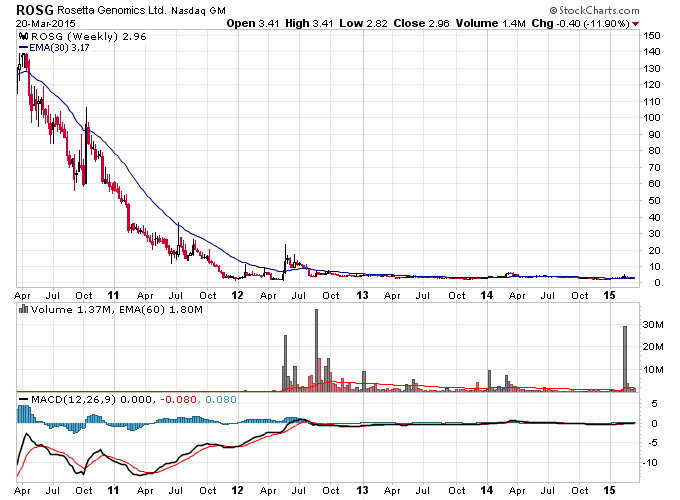

| ROSG | 1 | 7 | D W F Y G |

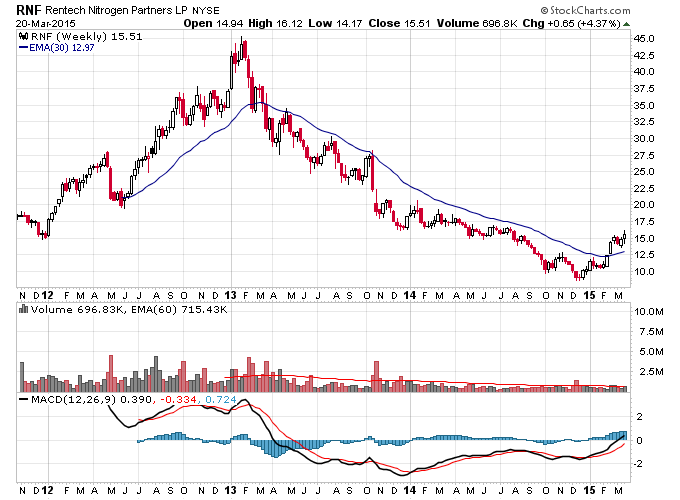

| RNF | 2 | 1 | D W F Y G |

| NTDOY | 2 | 1 | D W F Y G |

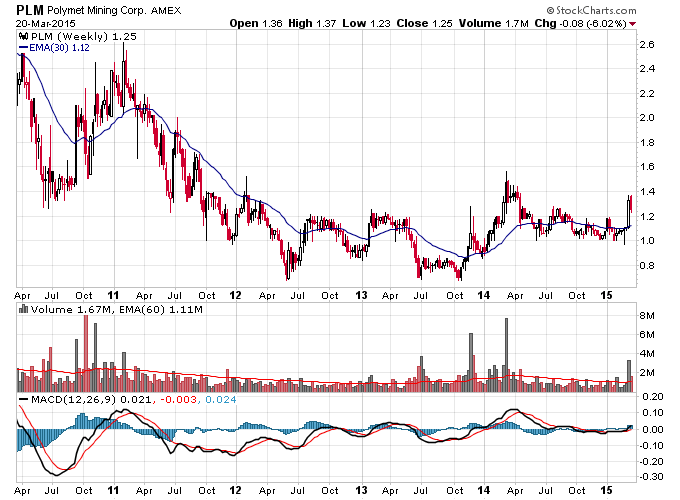

| PLM | 2 | 2 | D W F Y G |

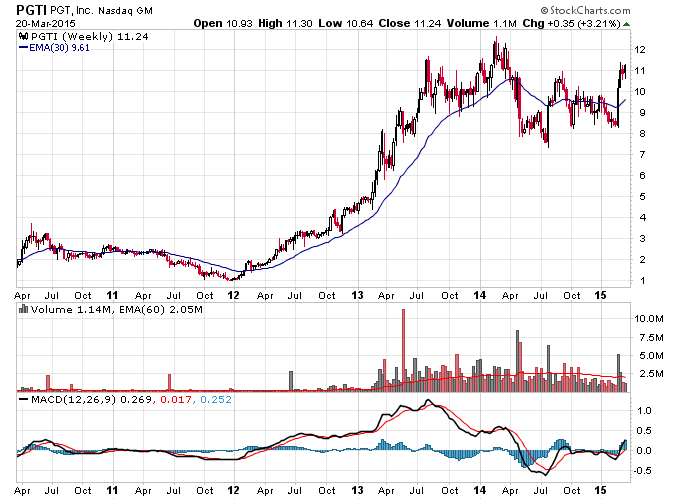

| PGTI | 2 | 2 | D W F Y G |

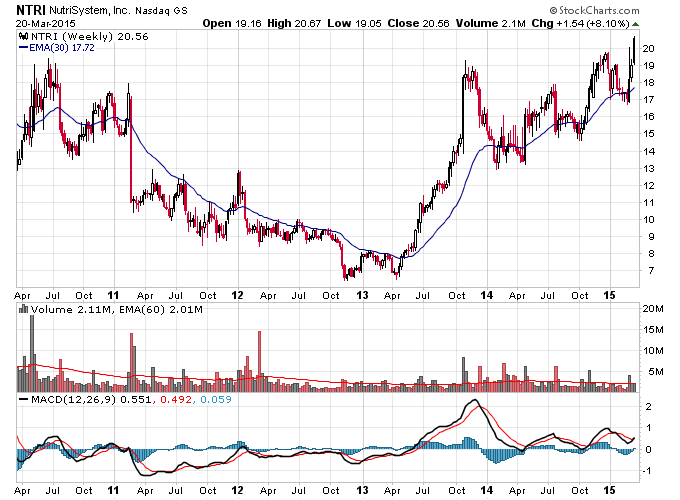

| NTRI | 2 | 2 | D W F Y G |

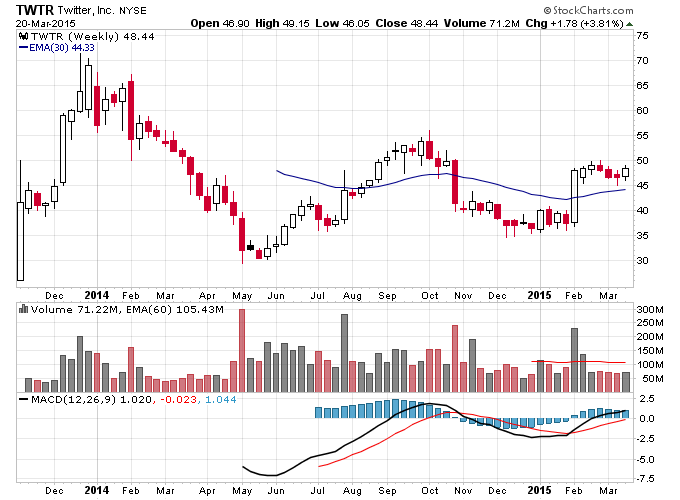

| TWTR | 2 | 3 | D W F Y G |

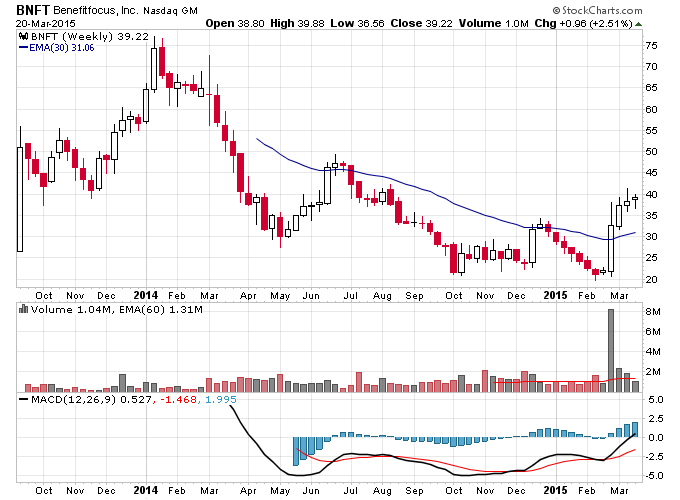

| BNFT | 2 | 3 | D W F Y G |

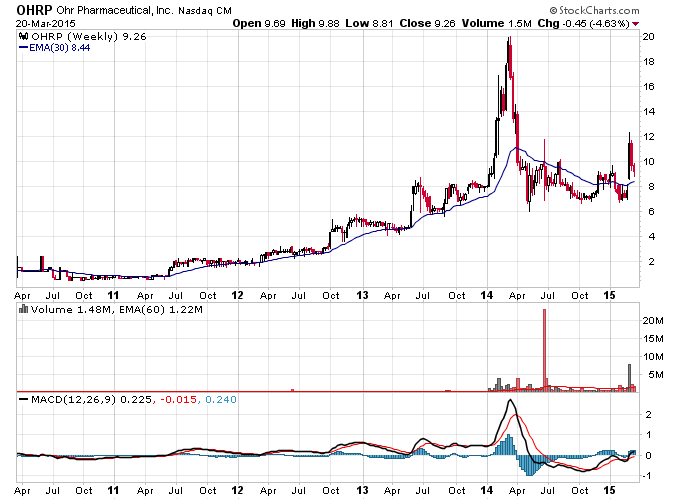

| OHRP | 2 | 3 | D W F Y G |

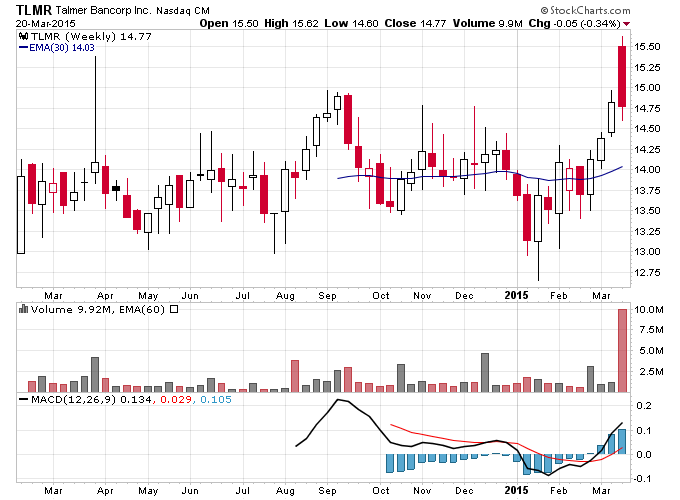

| TLMR | 2 | 3 | D W F Y G |

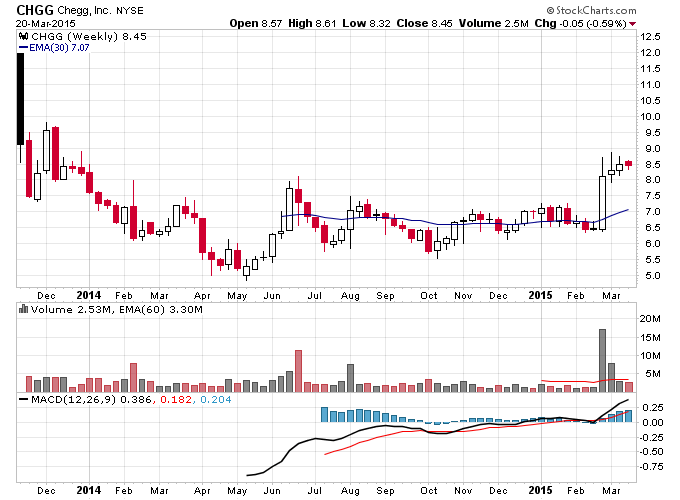

| CHGG | 2 | 4 | D W F Y G |

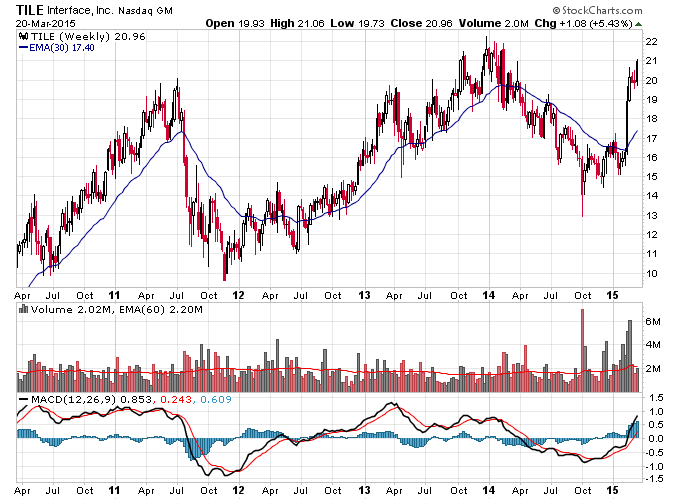

| TILE | 2 | 4 | D W F Y G |

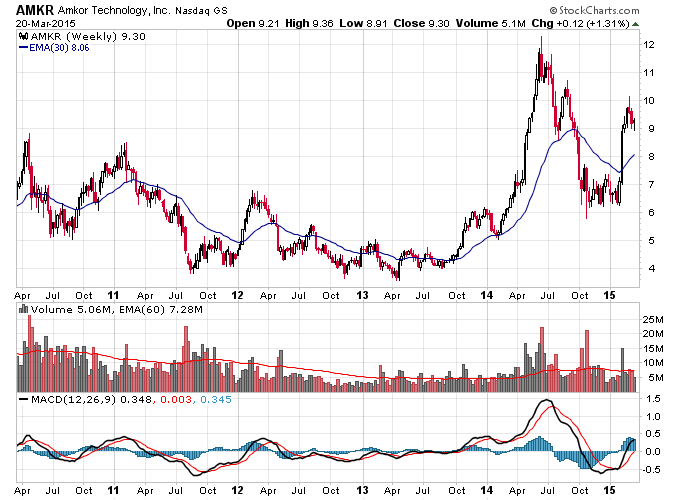

| AMKR | 2 | 4 | D W F Y G |

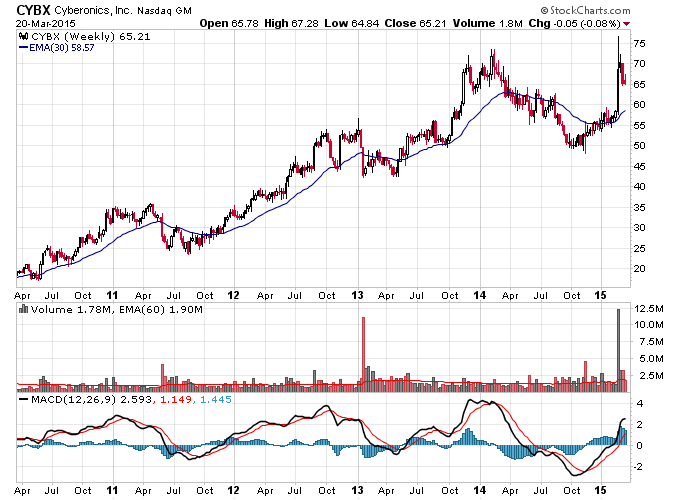

| CYBX | 2 | 4 | D W F Y G |

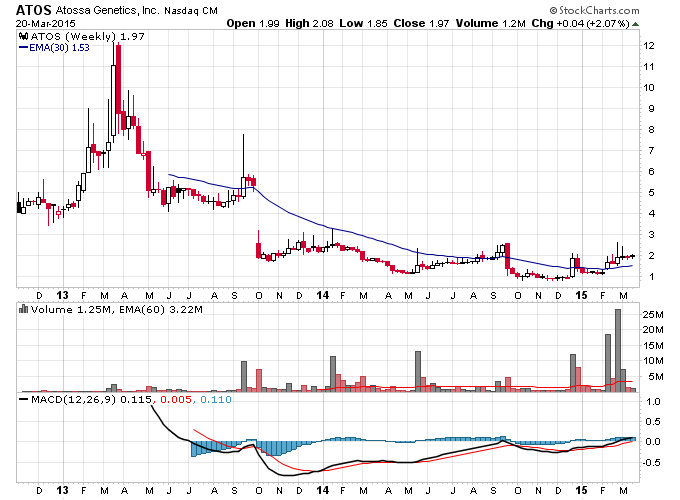

| ATOS | 2 | 4 | D W F Y G |

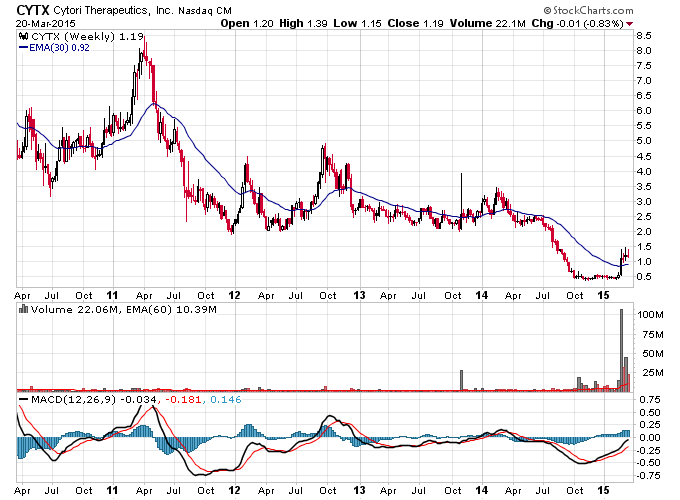

| CYTX | 2 | 4 | D W F Y G |

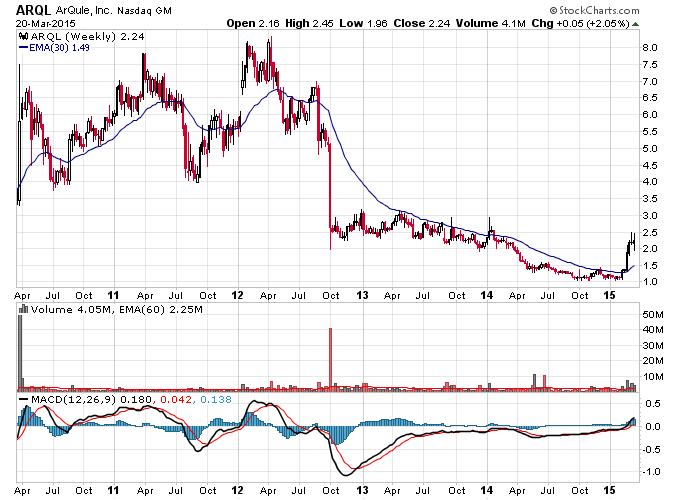

| ARQL | 2 | 4 | D W F Y G |

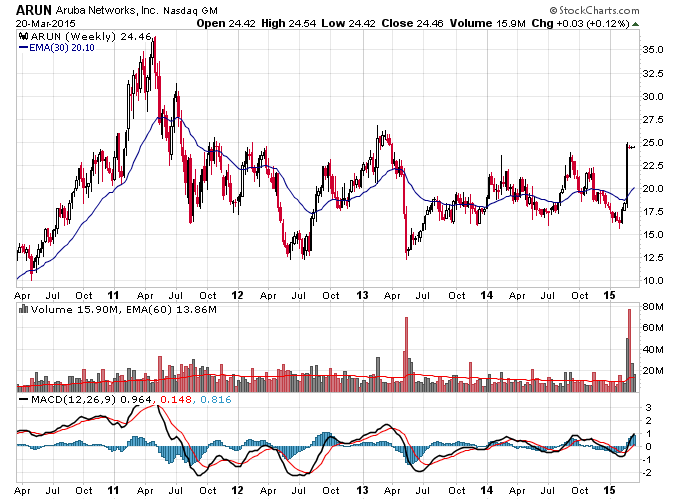

| ARUN | 2 | 4 | D W F Y G |

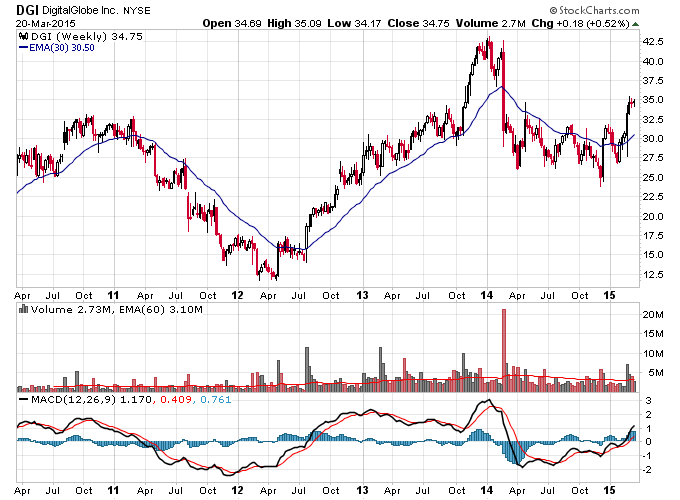

| DGI | 2 | 4 | D W F Y G |

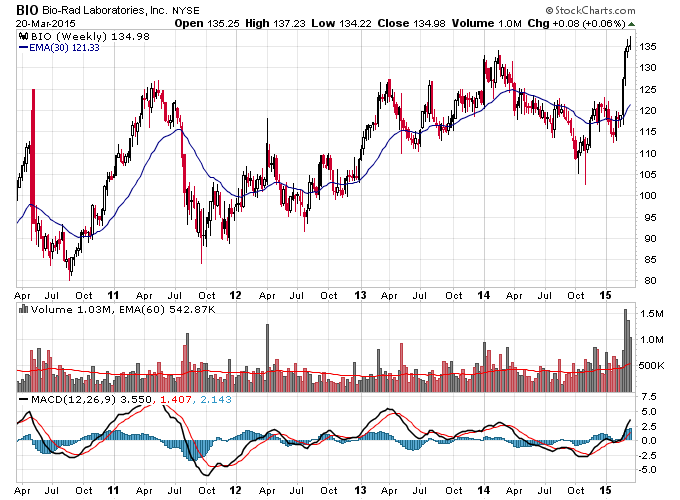

| BIO | 2 | 4 | D W F Y G |

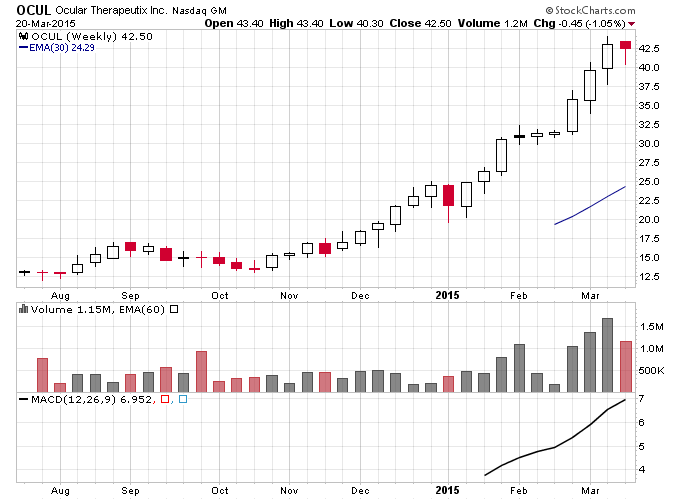

| OCUL | 2 | 4 | D W F Y G |

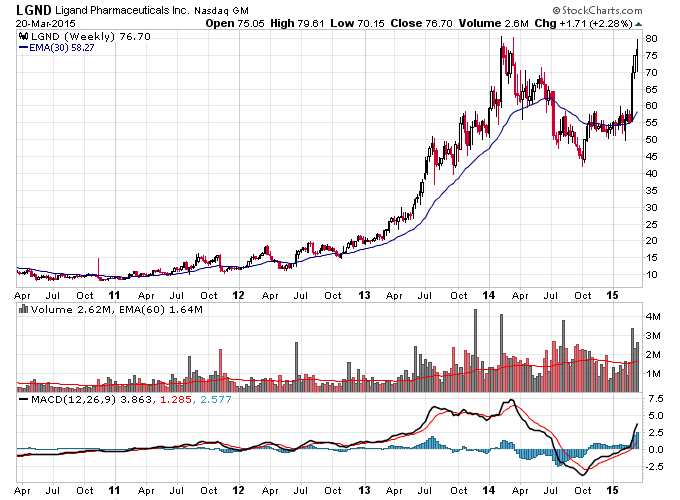

| LGND | 2 | 5 | D W F Y G |

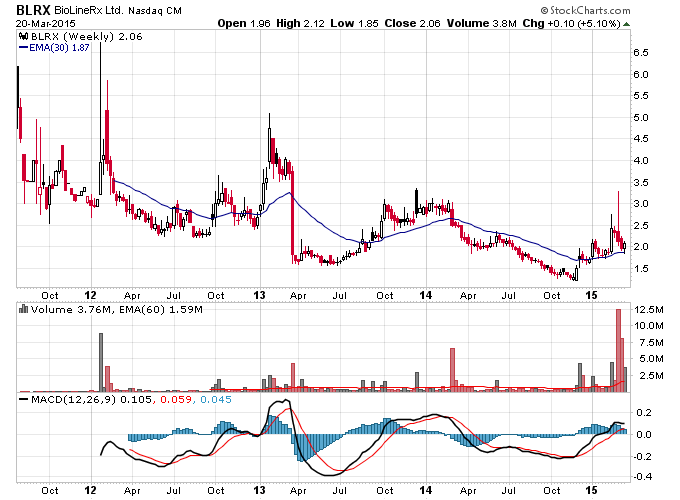

| BLRX | 2 | 5 | D W F Y G |

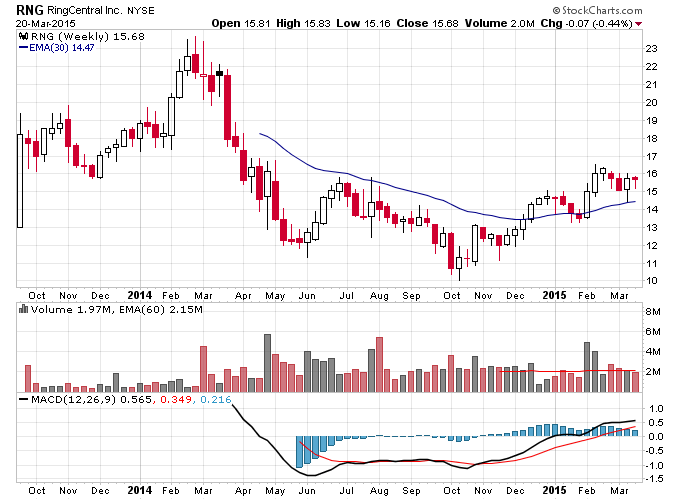

| RNG | 2 | 6 | D W F Y G |

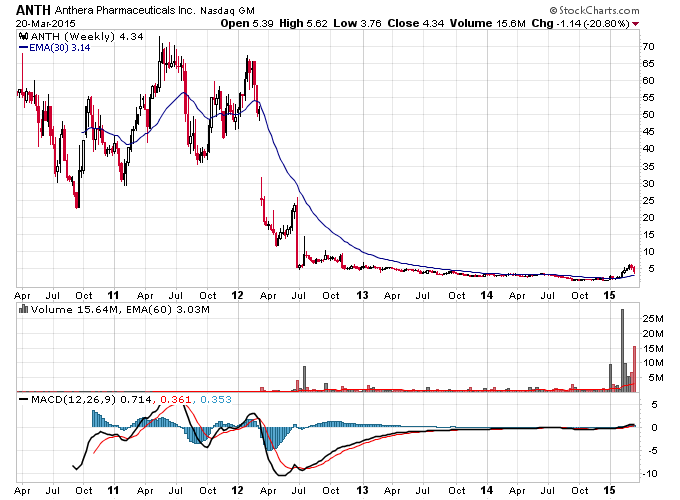

| ANTH | 2 | 6 | D W F Y G |

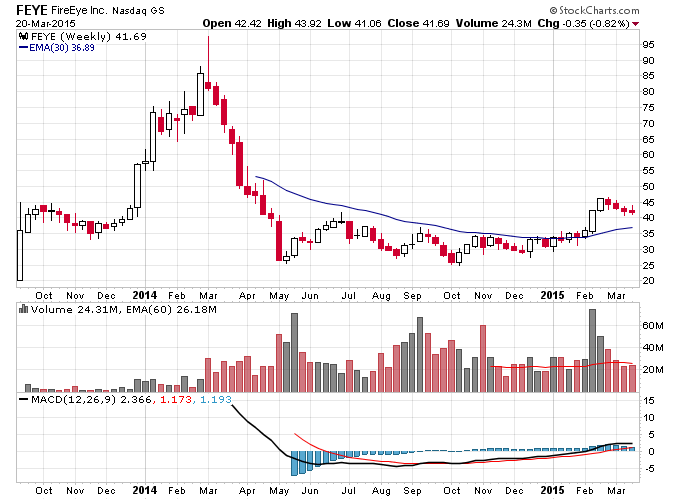

| FEYE | 2 | 6 | D W F Y G |

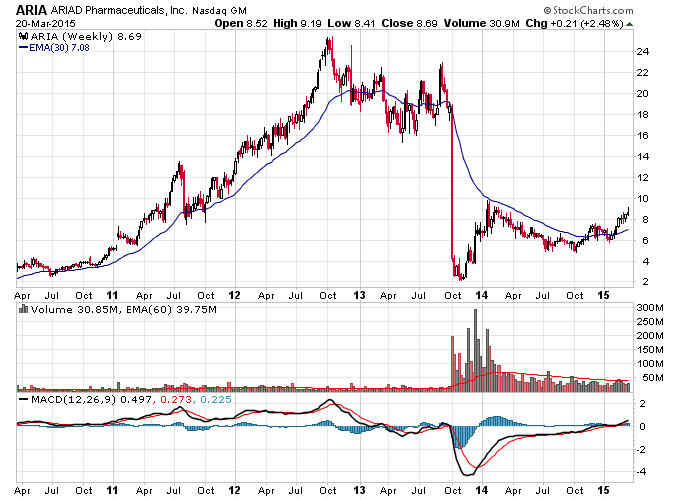

| ARIA | 2 | 6 | D W F Y G |

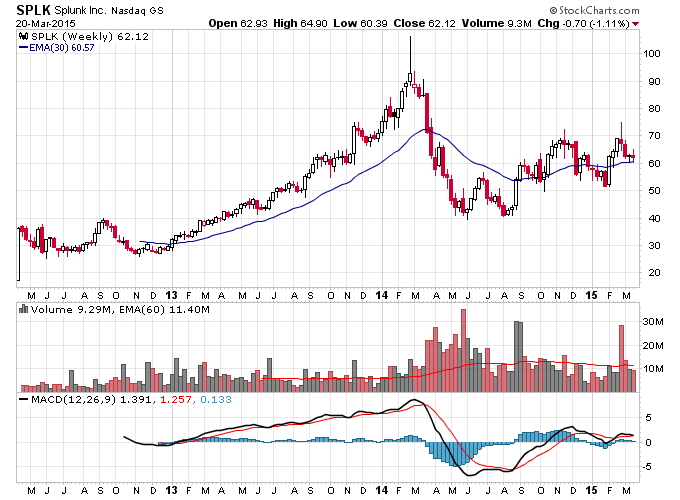

| SPLK | 2 | 6 | D W F Y G |

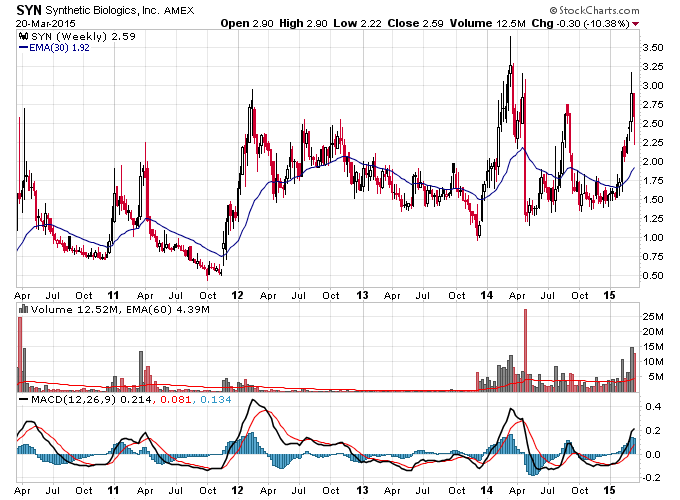

| SYN | 2 | 6 | D W F Y G |

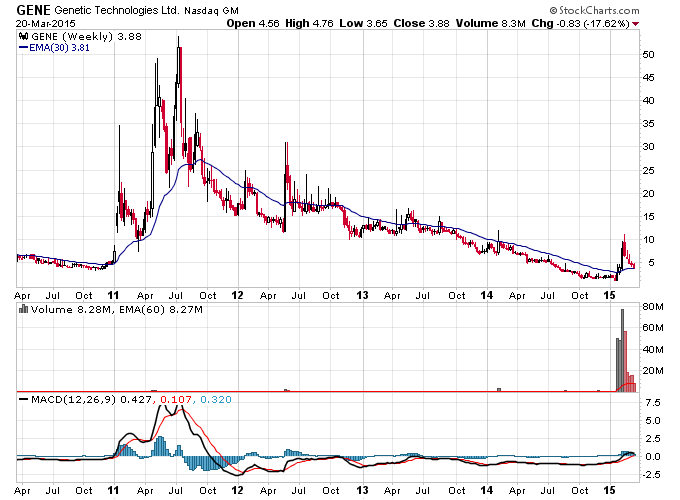

| GENE | 2 | 7 | D W F Y G |

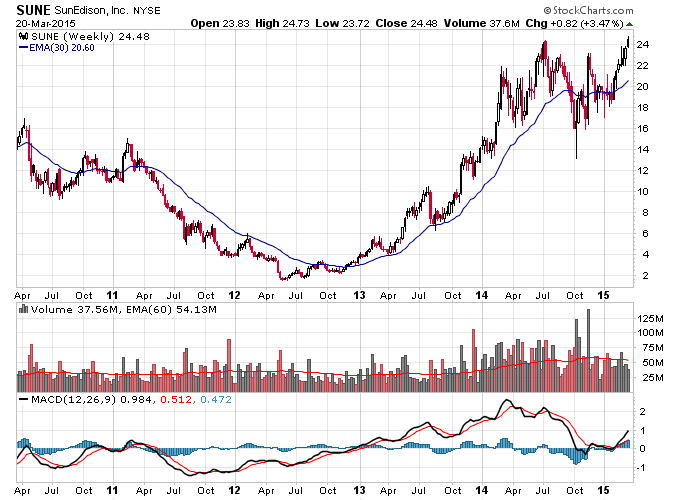

| SUNE | 2 | 7 | D W F Y G |

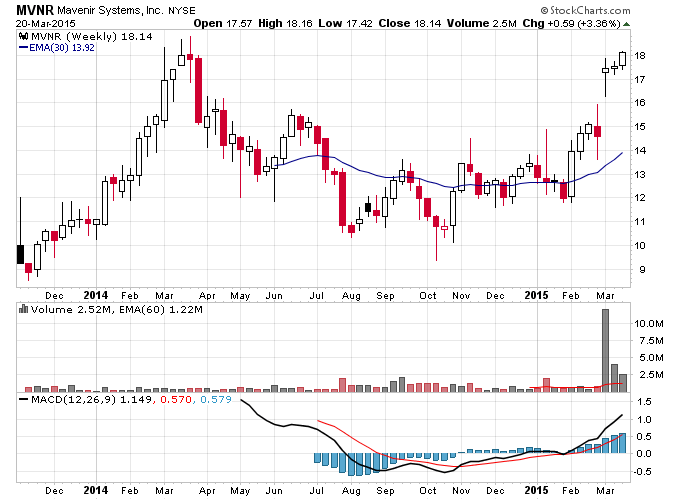

| MVNR | 2 | 7 | D W F Y G |

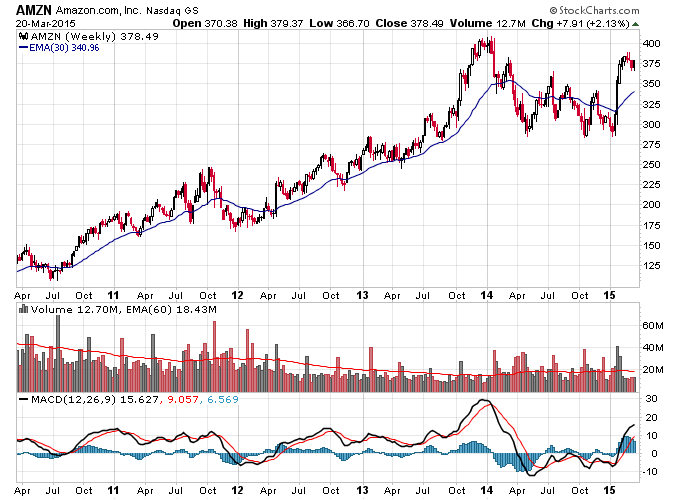

| AMZN | 2 | 7 | D W F Y G |

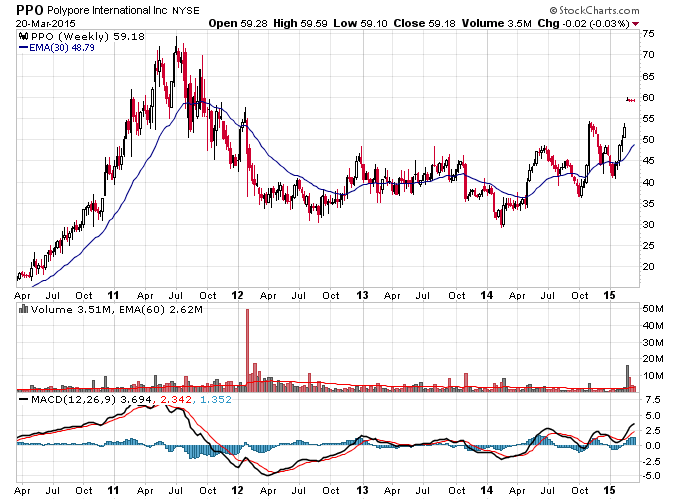

| PPO | 2 | 7 | D W F Y G |

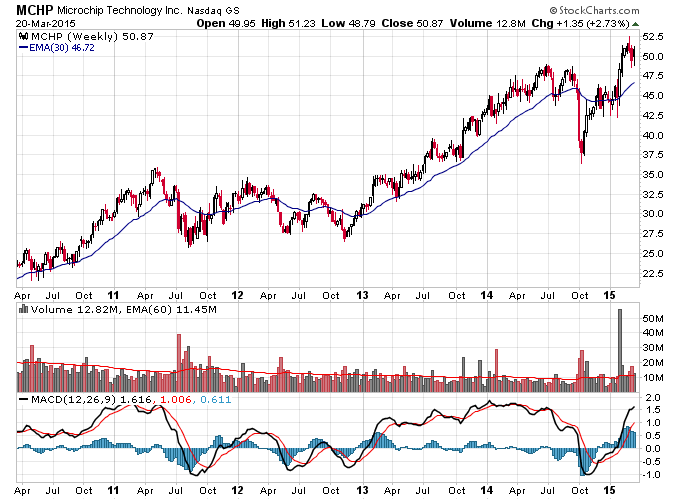

| MCHP | 2 | 8 | D W F Y G |

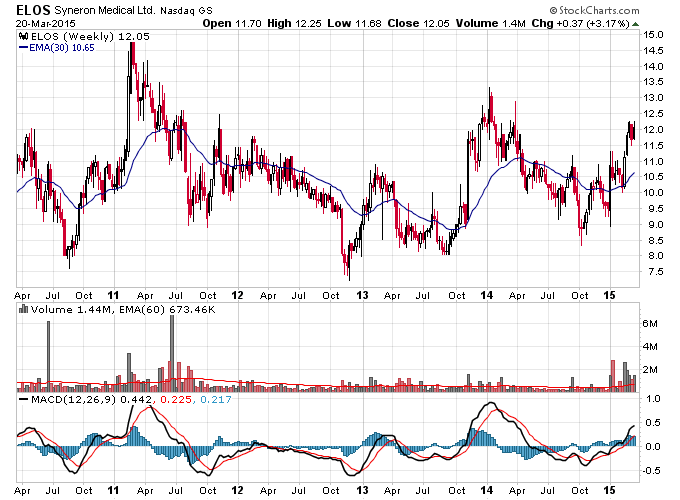

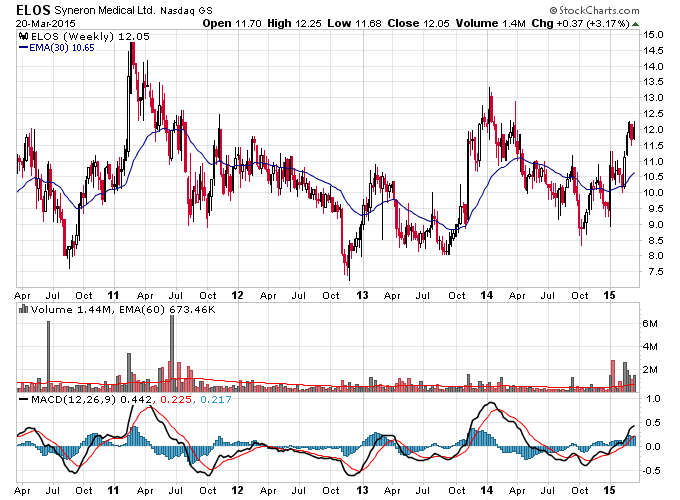

| ELOS | 2 | 8 | D W F Y G |

| ELOS | 2 | 8 | D W F Y G |

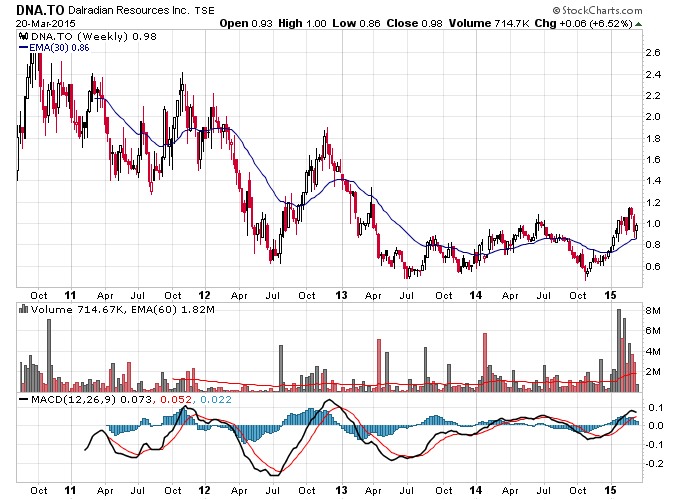

| DNA.TO | 2 | 9 | D W F Y G |

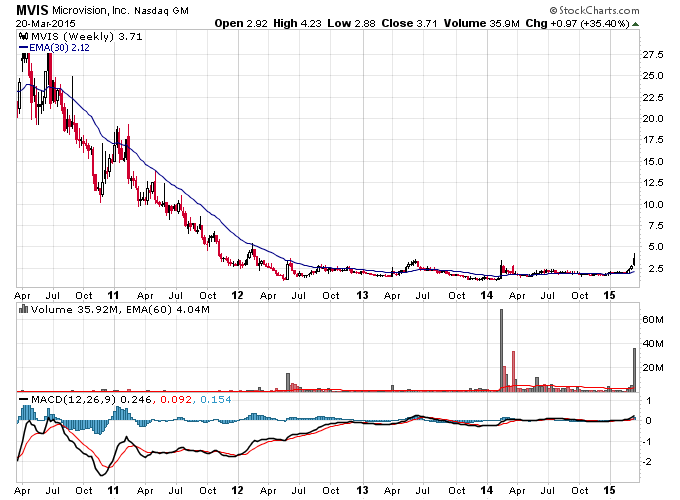

| MVIS | 2 | 9 | D W F Y G |

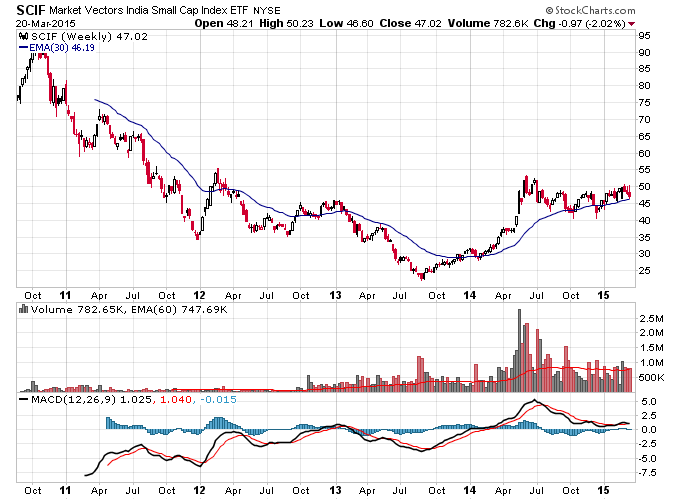

| SCIF | 2 | 10 | D W F Y G |

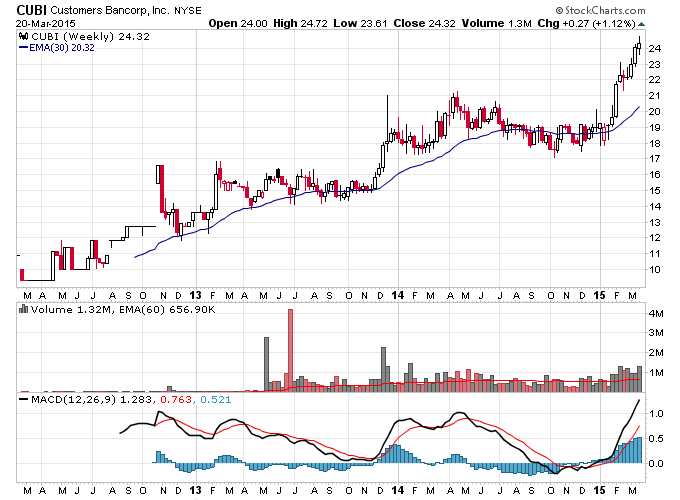

| CUBI | 2 | 10 | D W F Y G |

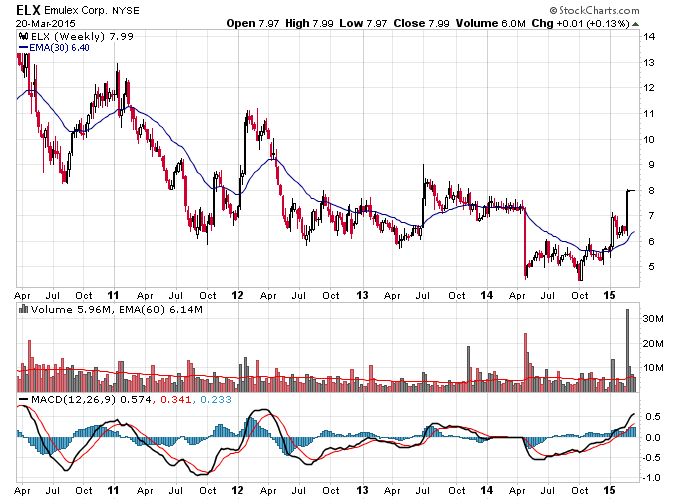

| ELX | 2 | 10 | D W F Y G |

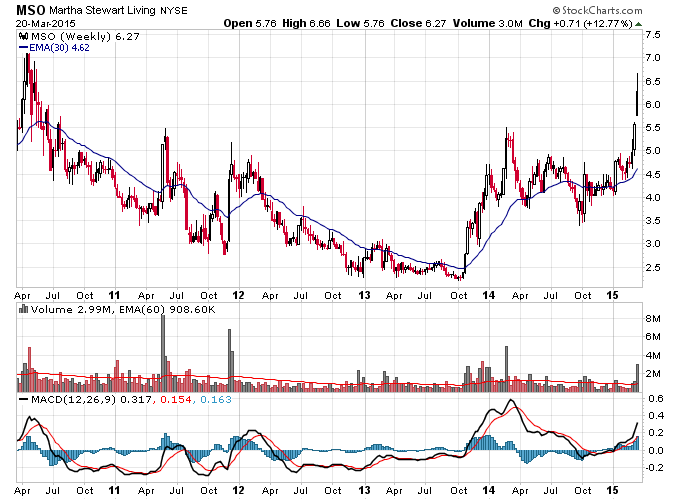

| MSO | 2 | 10 | D W F Y G |

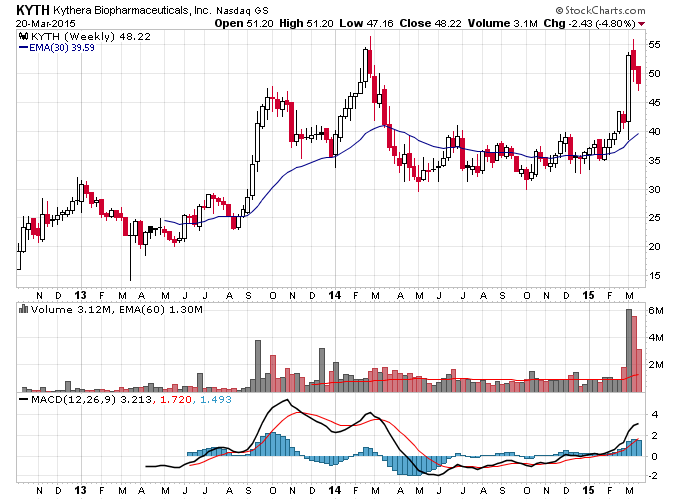

| KYTH | 2 | 11 | D W F Y G |

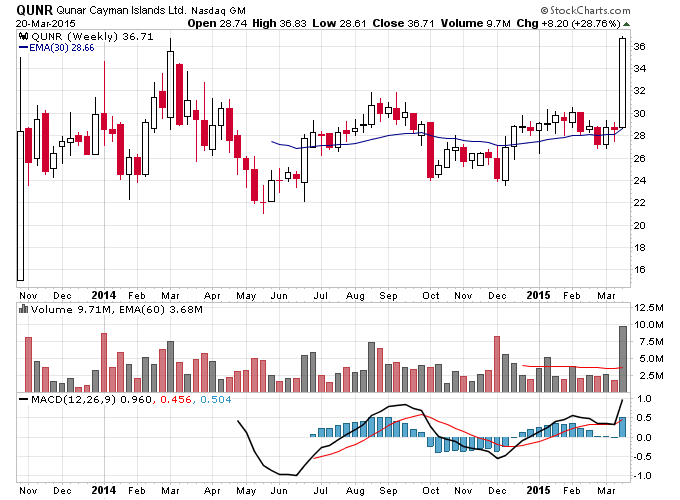

| QUNR | 2 | 11 | D W F Y G |

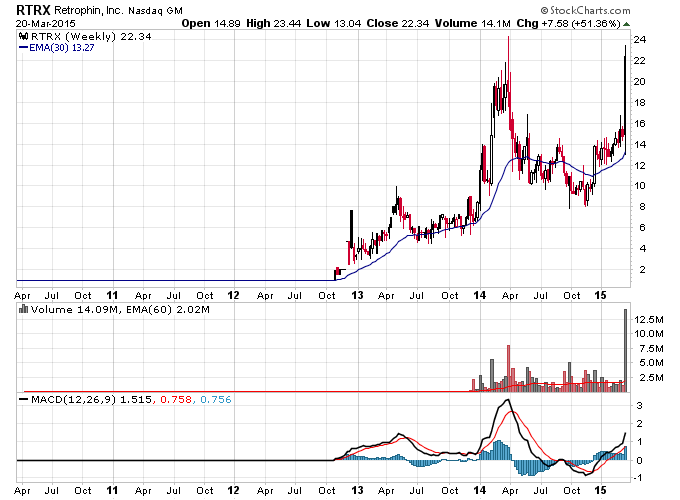

| RTRX | 2 | 11 | D W F Y G |

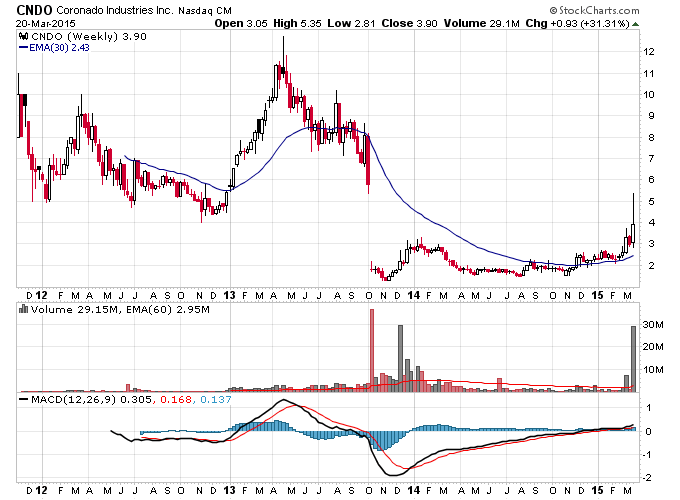

| CNDO | 2 | 12 | D W F Y G |

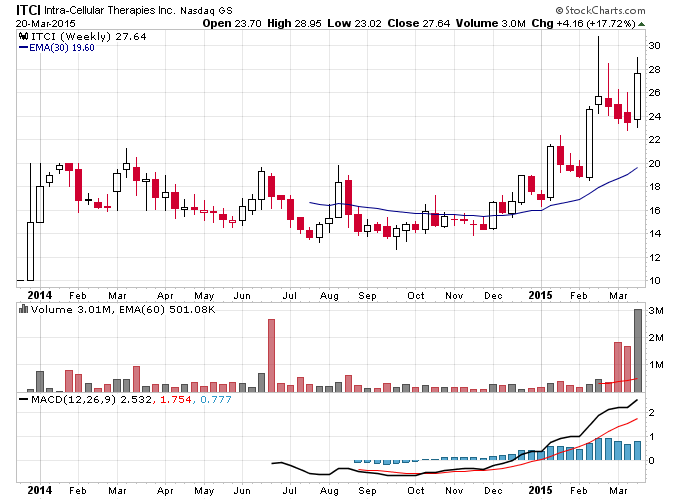

| ITCI | 2 | 12 | D W F Y G |

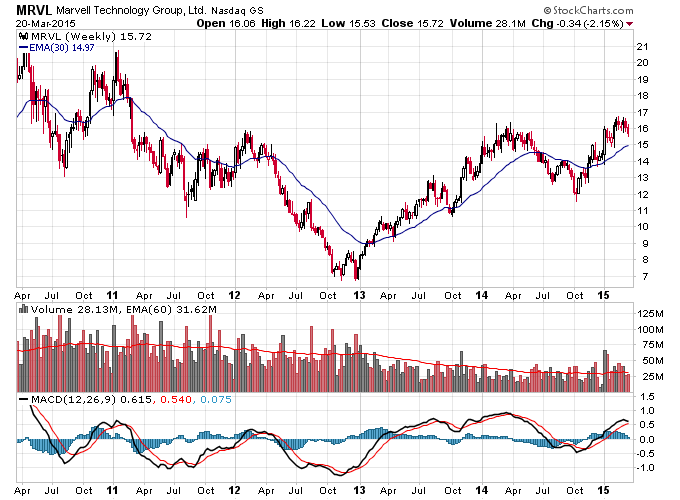

| MRVL | 2 | 13 | D W F Y G |

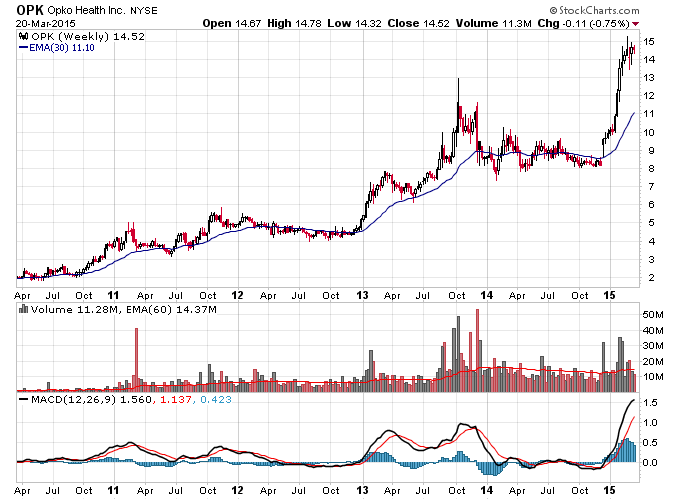

| OPK | 2 | 13 | D W F Y G |

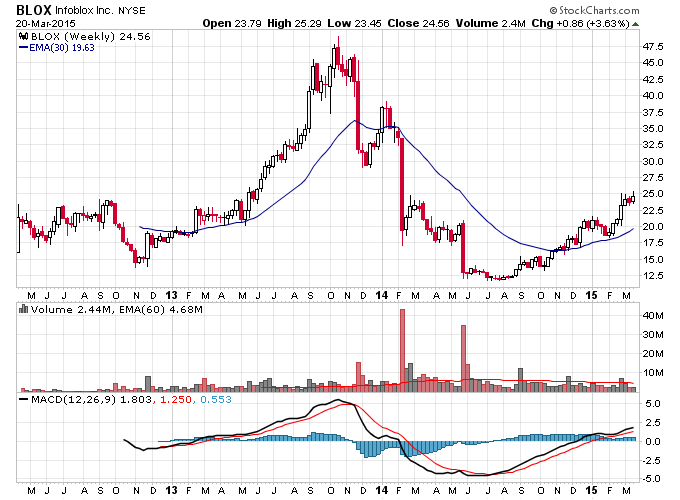

| BLOX | 2 | 13 | D W F Y G |

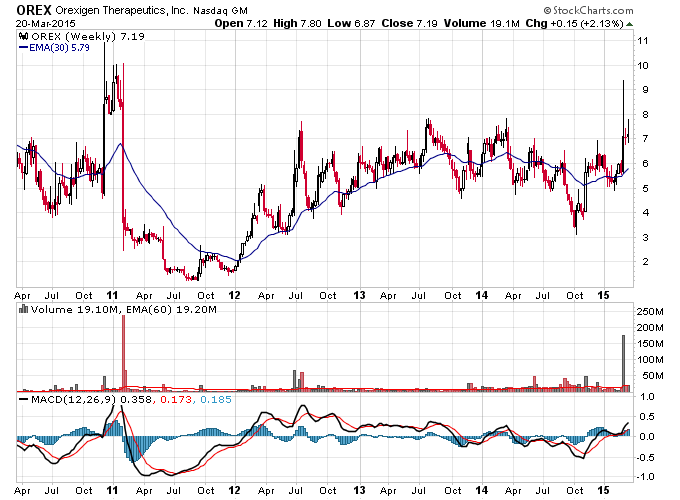

| OREX | 2 | 13 | D W F Y G |

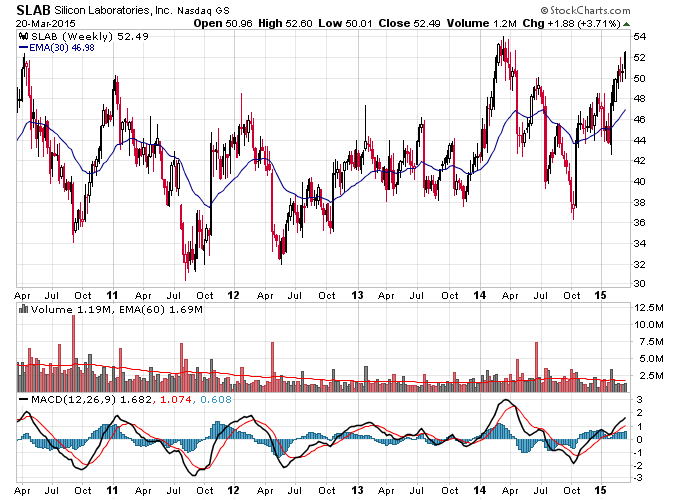

| SLAB | 2 | 14 | D W F Y G |

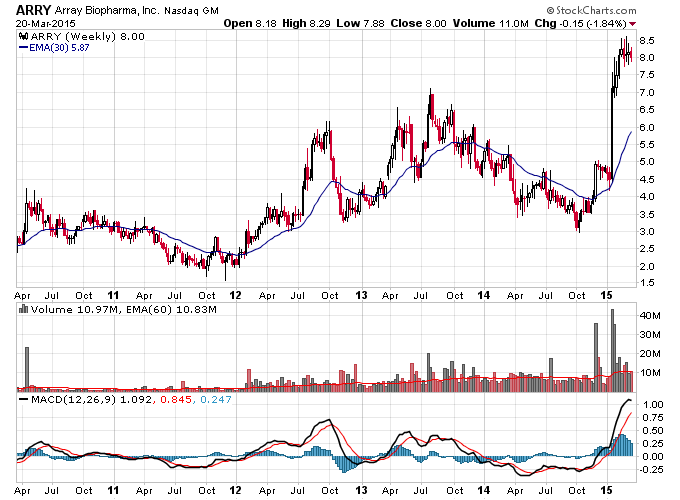

| ARRY | 2 | 14 | D W F Y G |

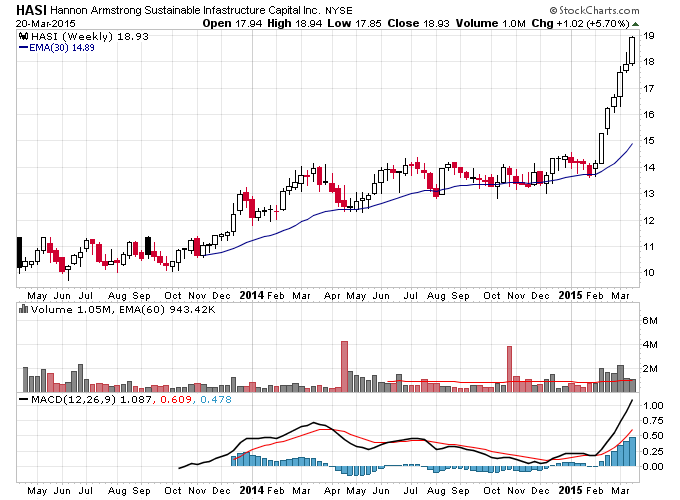

| HASI | 2 | 14 | D W F Y G |

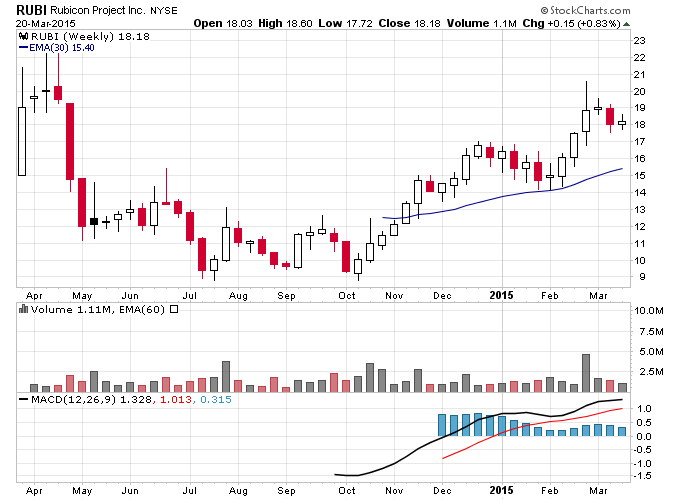

| RUBI | 2 | 14 | D W F Y G |

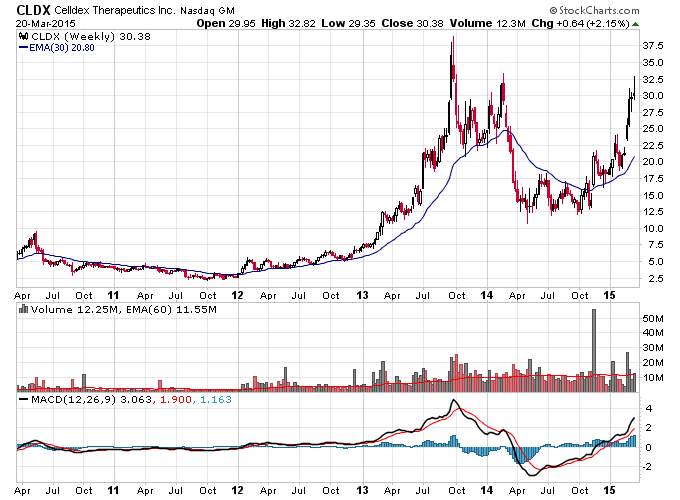

| CLDX | 2 | 15 | D W F Y G |

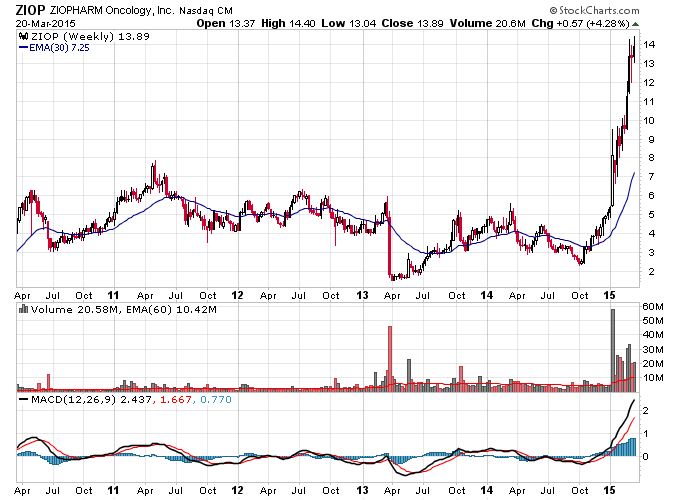

| ZIOP | 2 | 15 | D W F Y G |

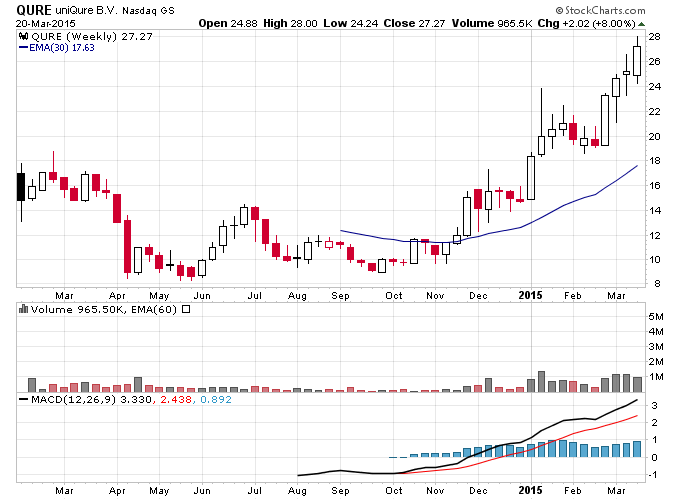

| QURE | 2 | 15 | D W F Y G |

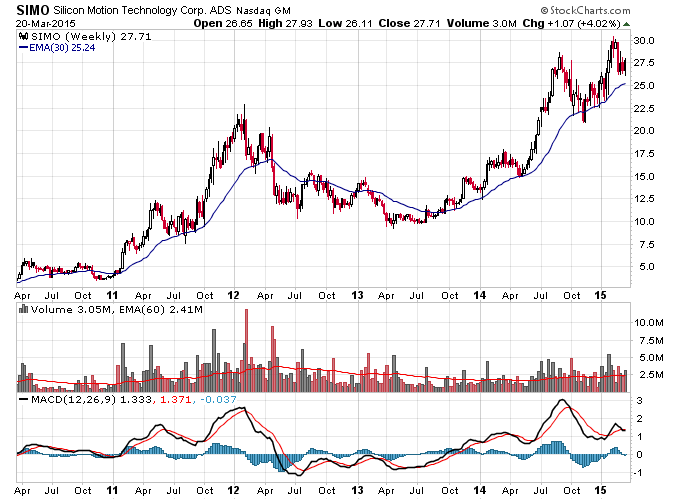

| SIMO | 2 | 16 | D W F Y G |

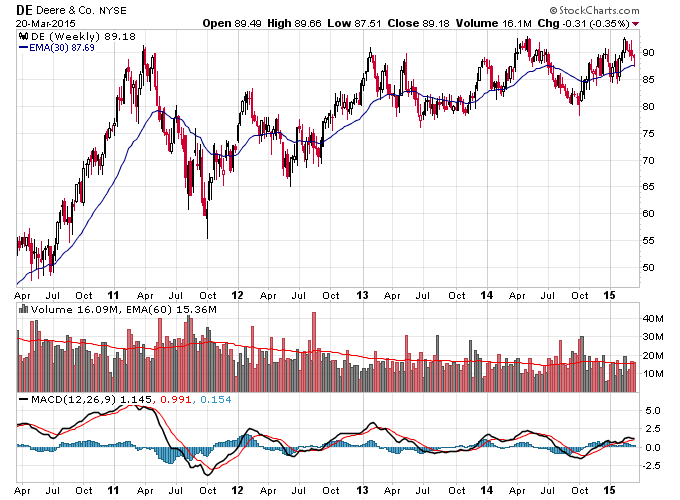

| DE | 2 | 16 | D W F Y G |

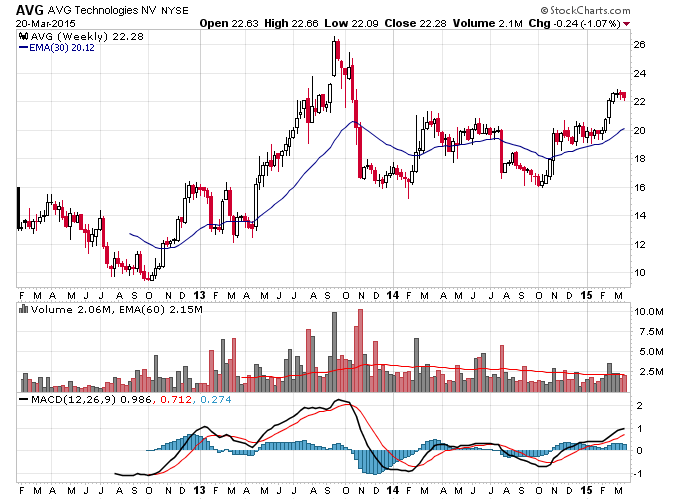

| AVG | 2 | 16 | D W F Y G |

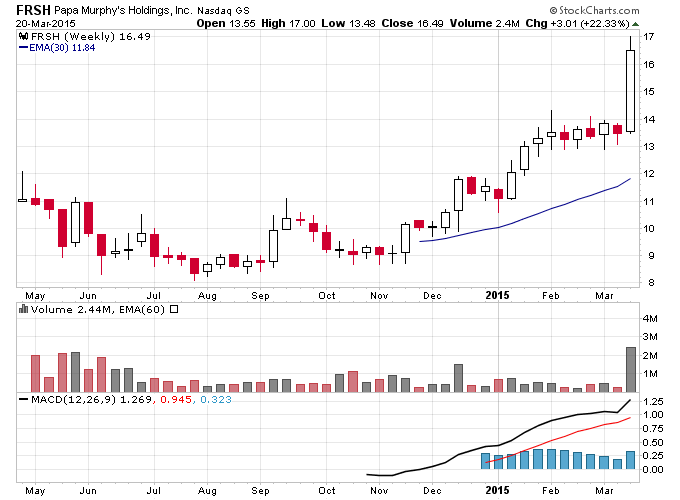

| FRSH | 2 | 16 | D W F Y G |

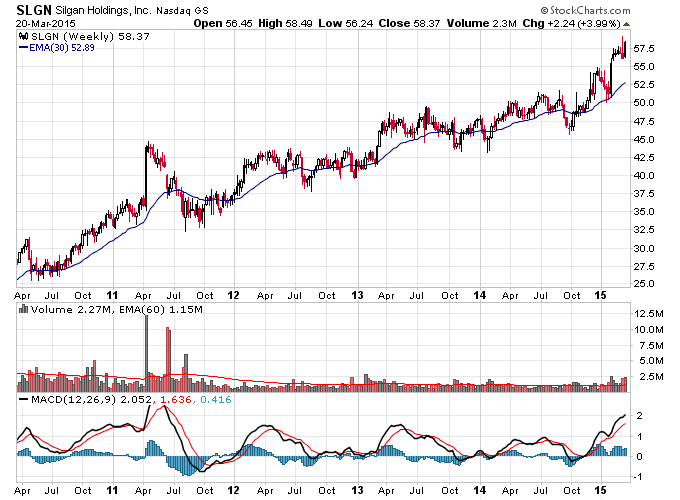

| SLGN | 2 | 18 | D W F Y G |

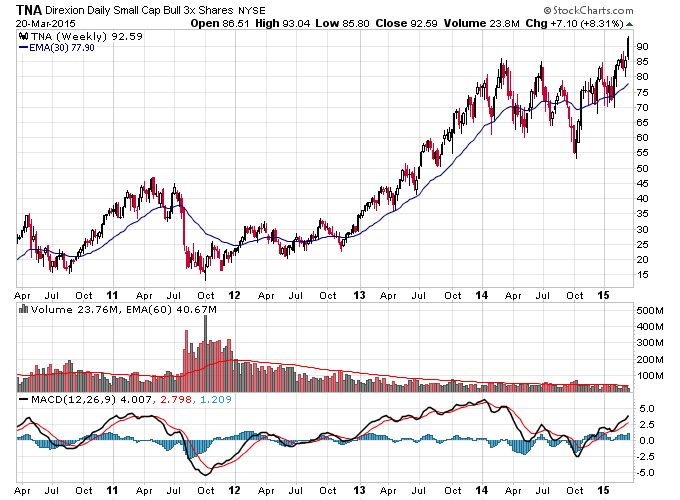

| TNA | 2 | 18 | D W F Y G |

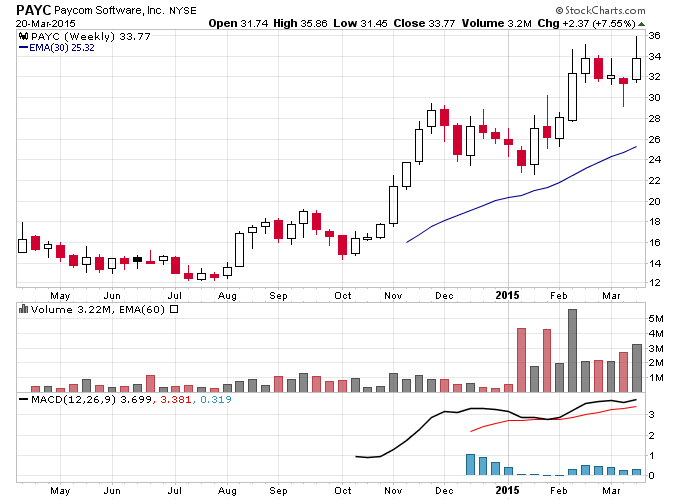

| PAYC | 2 | 18 | D W F Y G |

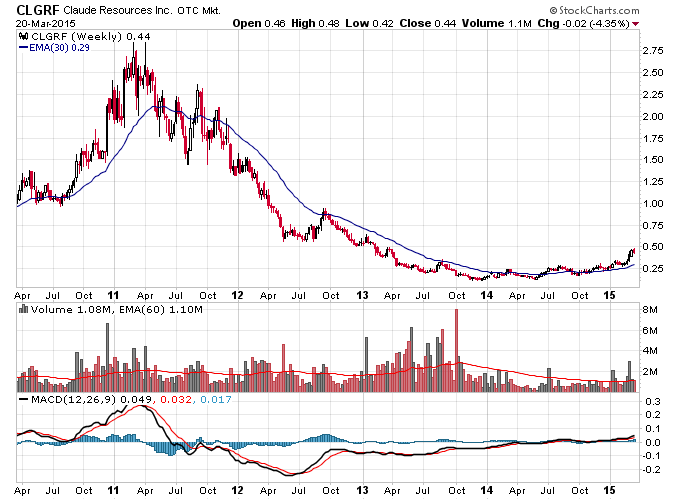

| CLGRF | 2 | 18 | D W F Y G |

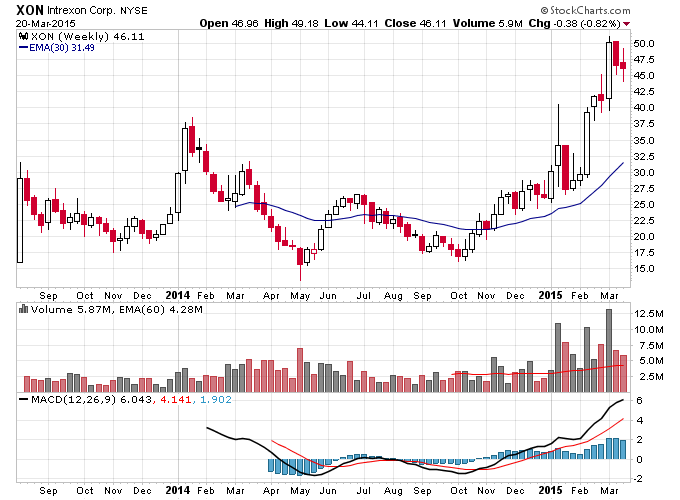

| XON | 2 | 18 | D W F Y G |

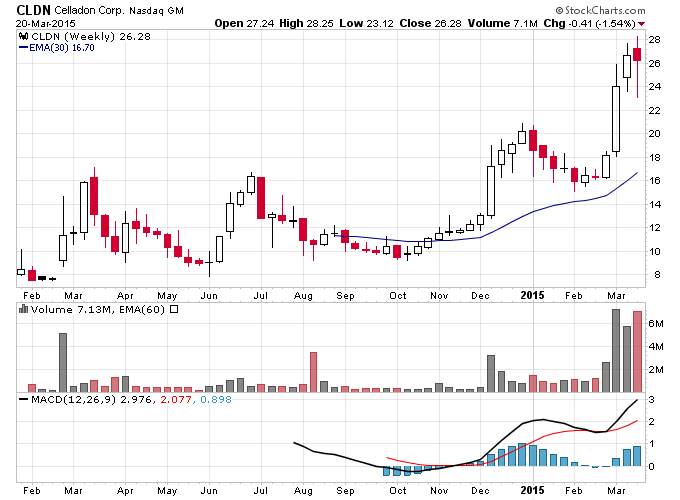

| CLDN | 2 | 18 | D W F Y G |

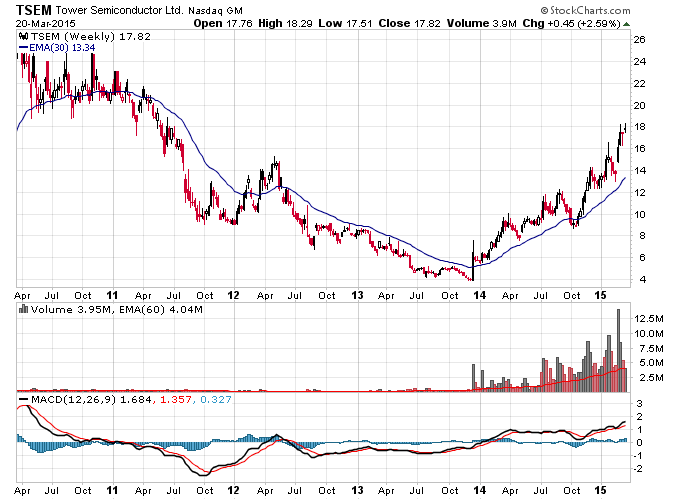

| TSEM | 2 | 19 | D W F Y G |

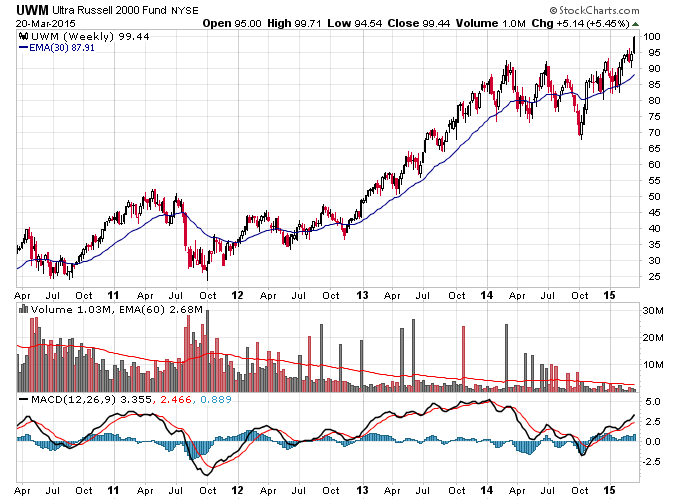

| UWM | 2 | 19 | D W F Y G |

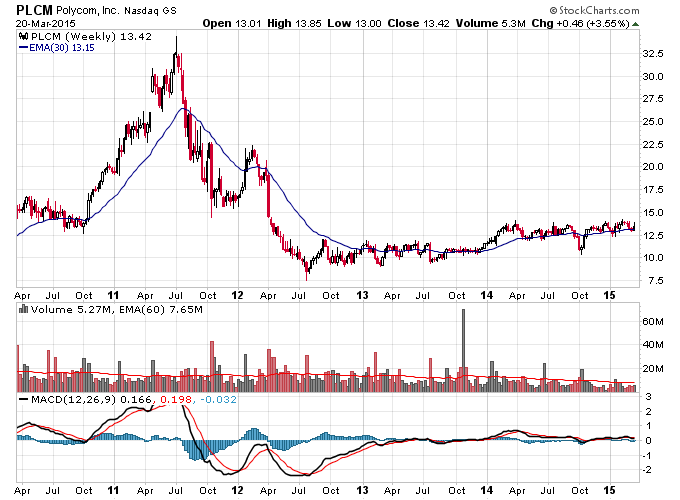

| PLCM | 2 | 19 | D W F Y G |

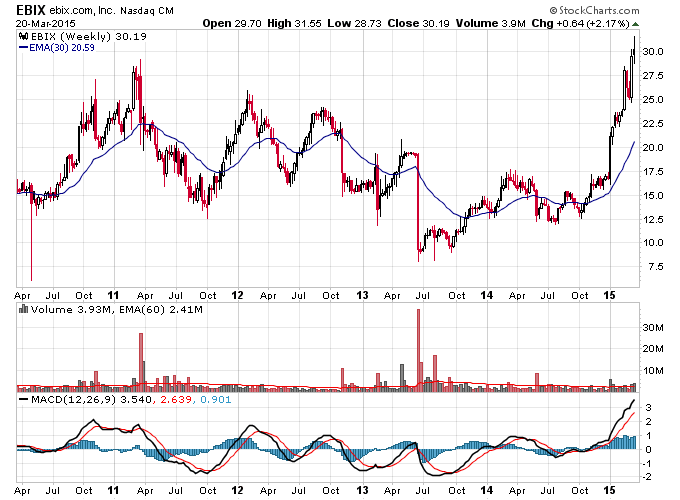

| EBIX | 2 | 19 | D W F Y G |

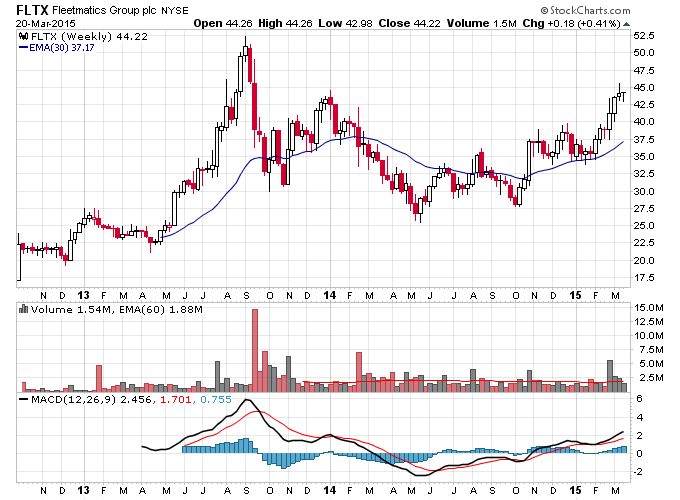

| FLTX | 2 | 19 | D W F Y G |

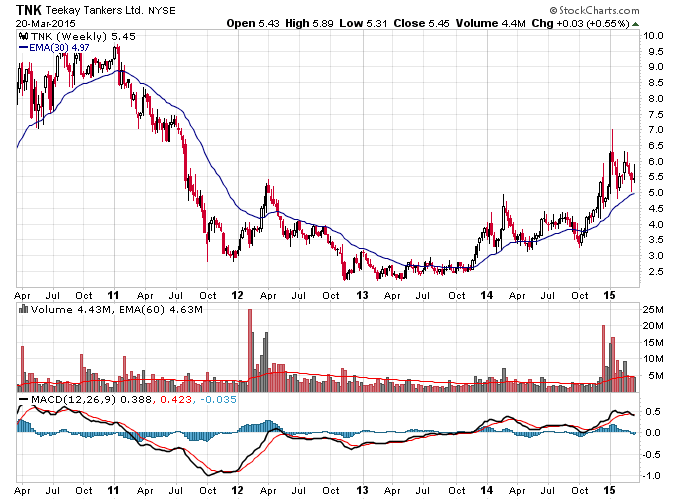

| TNK | 2 | 20 | D W F Y G |

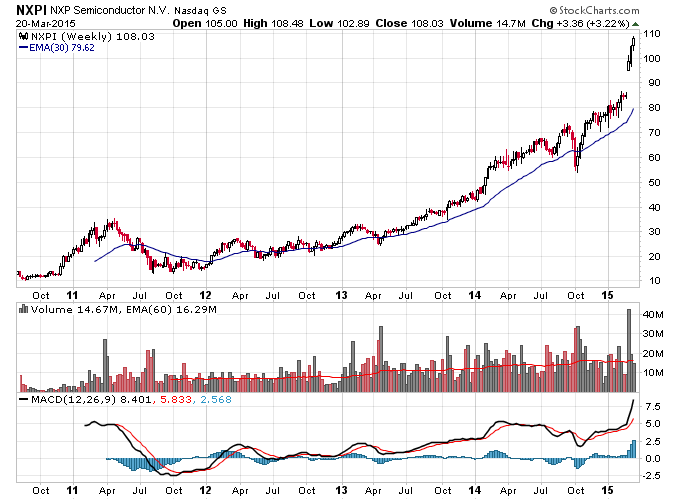

| NXPI | 2 | 21 | D W F Y G |

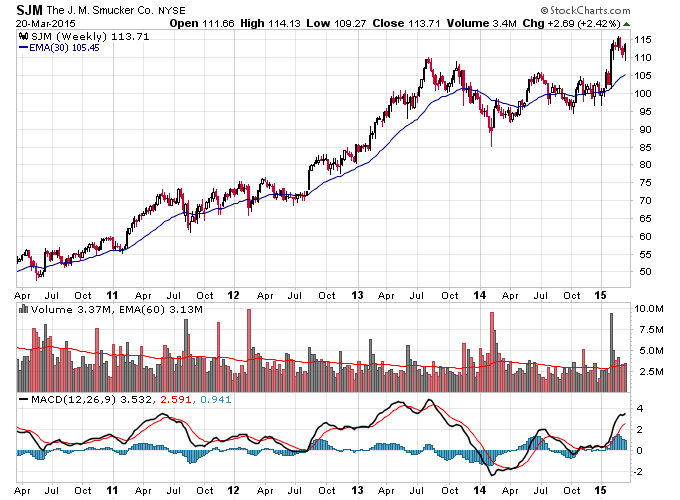

| SJM | 2 | 21 | D W F Y G |

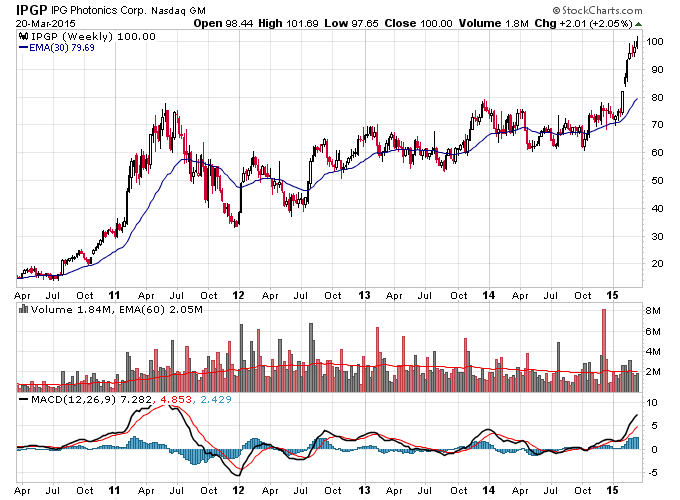

| IPGP | 2 | 21 | D W F Y G |

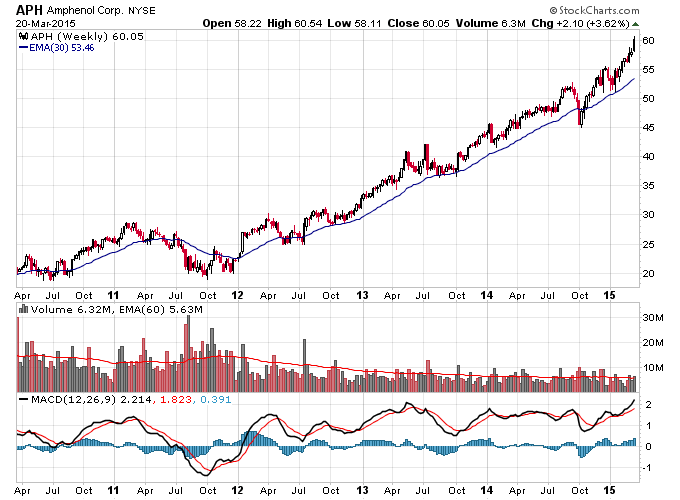

| APH | 2 | 21 | D W F Y G |

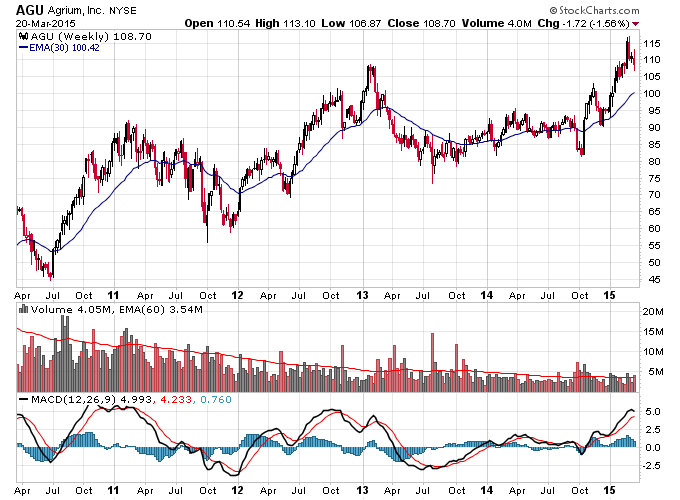

| AGU | 2 | 21 | D W F Y G |

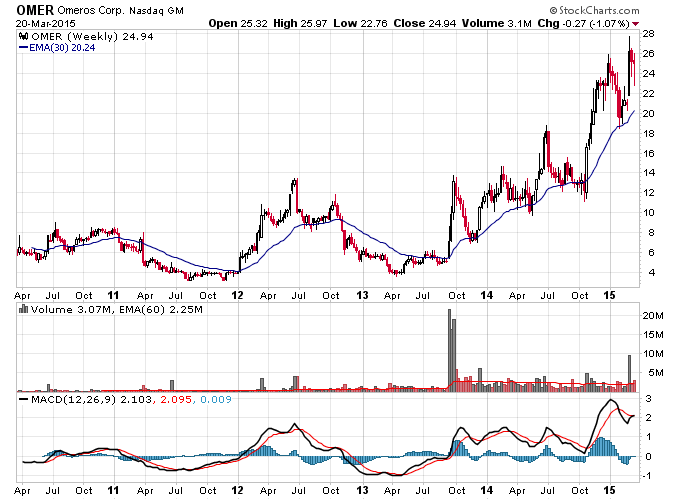

| OMER | 2 | 21 | D W F Y G |

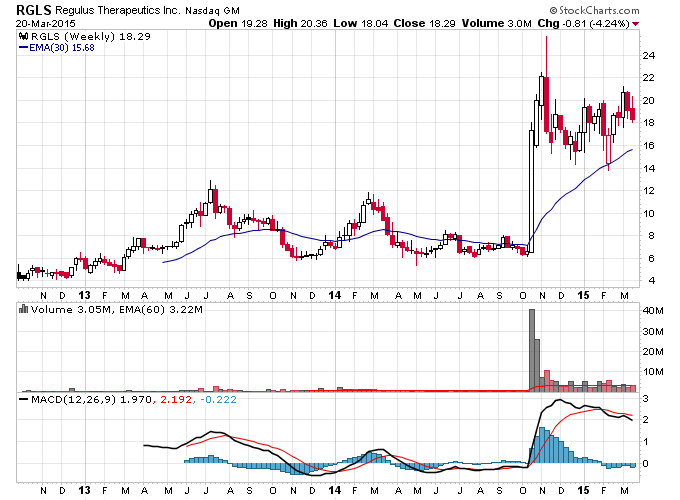

| RGLS | 2 | 22 | D W F Y G |

| CNCE | 2 | 23 | D W F Y G |

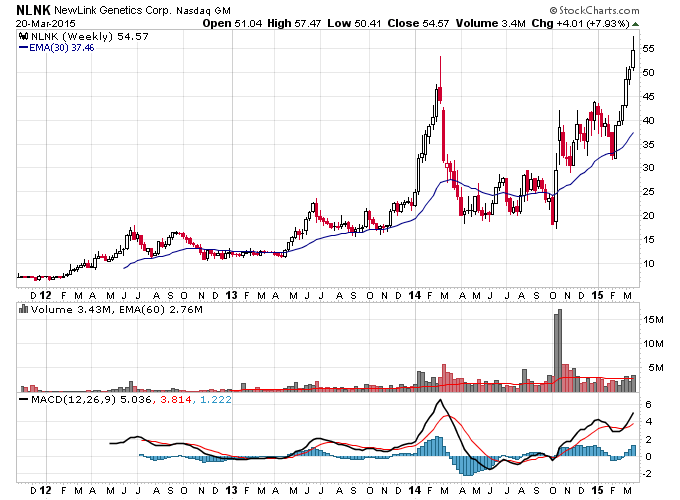

| NLNK | 2 | 23 | D W F Y G |

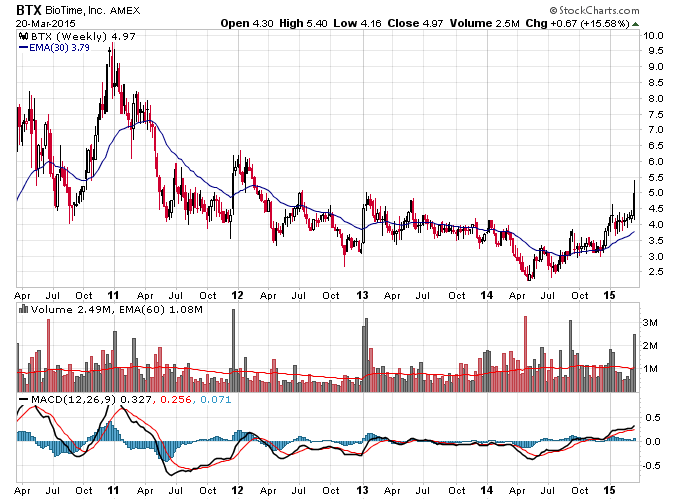

| BTX | 2 | 25 | D W F Y G |

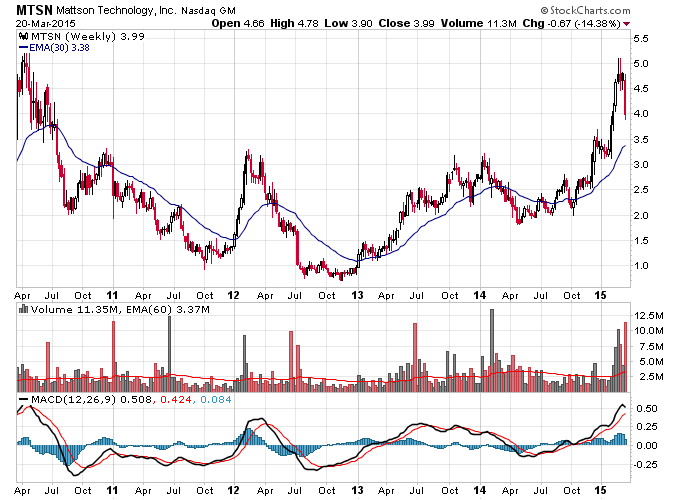

| MTSN | 2 | 27 | D W F Y G |

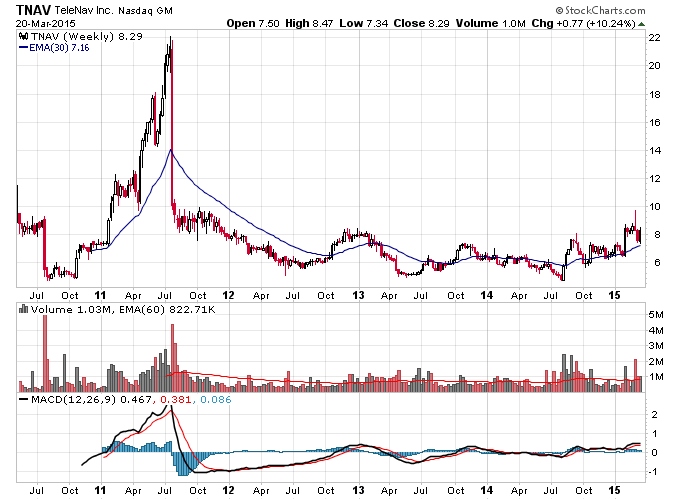

| TNAV | 2 | 29 | D W F Y G |

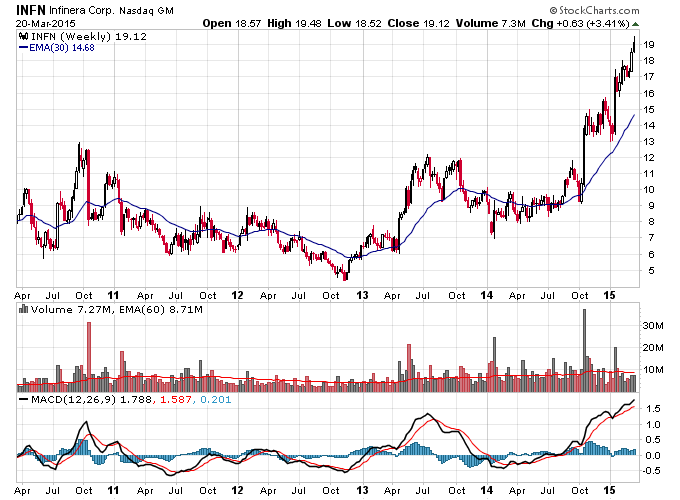

| INFN | 2 | 31 | D W F Y G |

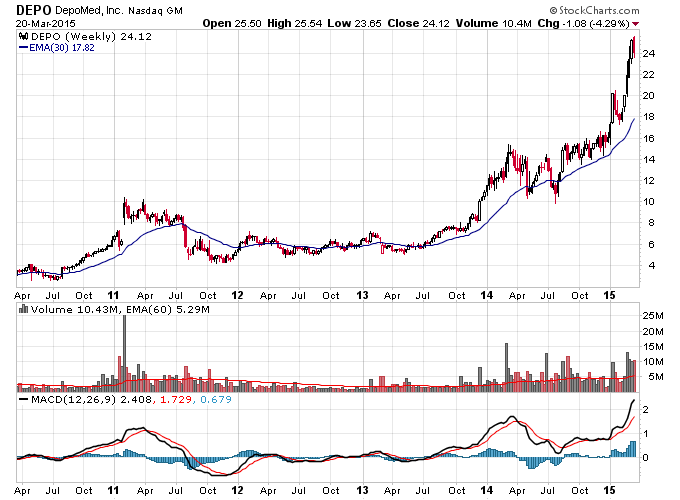

| DEPO | 2 | 31 | D W F Y G |

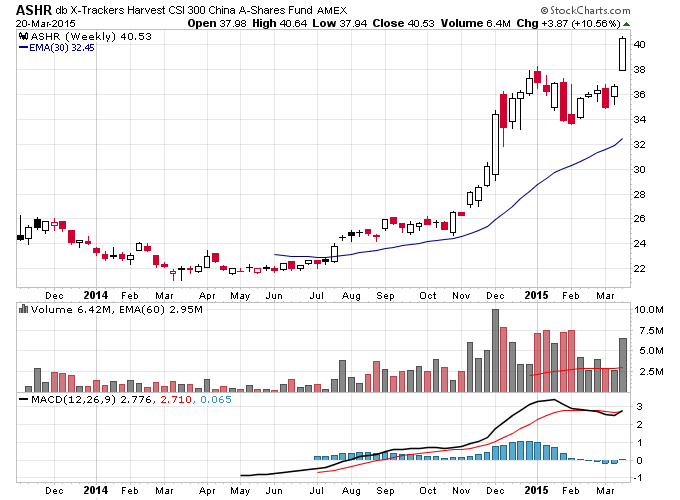

| ASHR | 2 | 31 | D W F Y G |

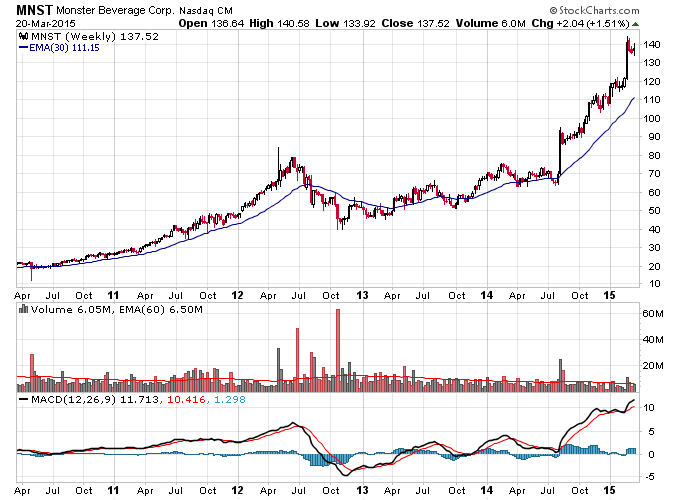

| MNST | 2 | 32 | D W F Y G |

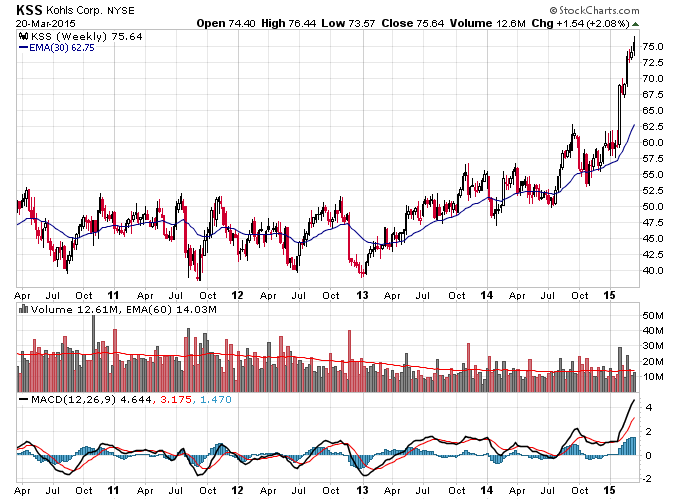

| KSS | 2 | 33 | D W F Y G |

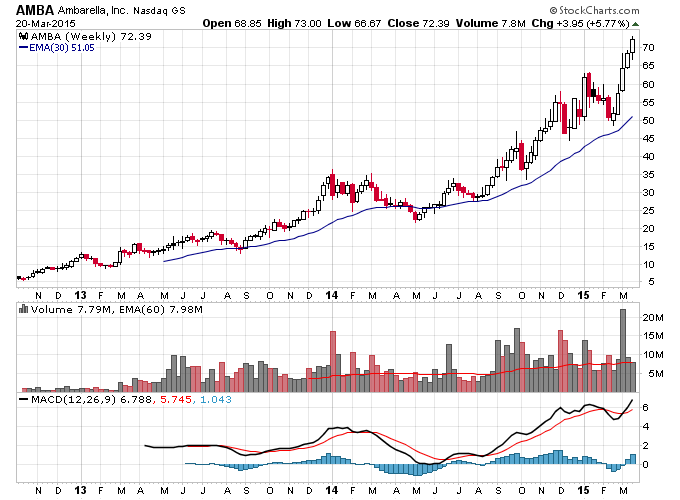

| AMBA | 2 | 40 | D W F Y G |

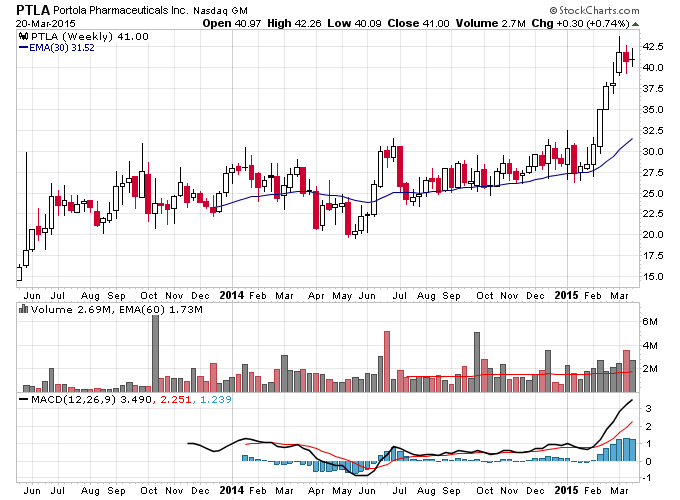

| PTLA | 2 | 40 | D W F Y G |

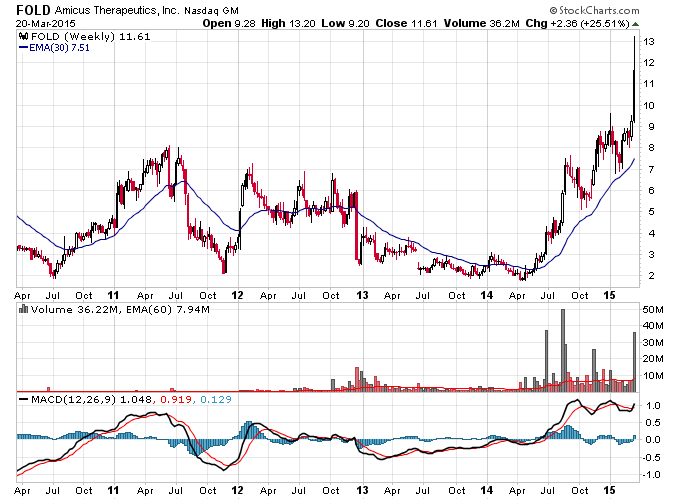

| FOLD | 2 | 40 | D W F Y G |

| Stage 1 | Stage 2 | Stage 3 | Stage 4 |

| 8.8% | 91.3% | 0.0% | 0.0% |

Stage Transitions: Watchlist Report

| Ticker | From | To | Links |

| MBLX | 2 | 1 | D W F Y G |

| SOCL | 4 | 1 | D W F Y G |

| RNF | 1 | 2 | D W F Y G |

| NTDOY | 1 | 2 | D W F Y G |

Volume Analysis: Watchlist Report

| Ticker | Week 0 | Week 1 | Week 2 |

| MBLX | .42 | .72 | 6.09 |

| SOCL | 6.94 | 1.61 | 1.69 |

| ANGI | .69 | .59 | .72 |

| RGR | .60 | .56 | 1.08 |

| URG | .31 | .71 | 2.09 |

| FSLR | .81 | .77 | 1.06 |

| SPWR | .61 | .81 | 1.09 |

| CLRX | .74 | 1.33 | 2.57 |

| ROSG | .77 | .69 | .87 |

| RNF | 1.11 | .65 | .84 |

| NTDOY | 38.85 | .57 | 1.19 |

| PLM | 1.86 | 3.74 | .98 |

| PGTI | .60 | .68 | 1.39 |

| NTRI | 1.23 | 1.22 | 2.27 |

| TWTR | .62 | .60 | .61 |

| BNFT | .71 | 1.28 | 1.60 |

| OHRP | 1.65 | 2.27 | 8.61 |

| TLMR | 6.83 | .76 | .63 |

| CHGG | .98 | 1.16 | 3.04 |

| TILE | .83 | .64 | .96 |

| AMKR | .66 | .92 | .99 |

| CYBX | .81 | 1.44 | 1.49 |

| ATOS | .34 | .38 | 1.96 |

| CYTX | 1.86 | 3.79 | 2.70 |

| ARQL | 2.15 | 2.79 | 1.67 |

| ARUN | 1.12 | 1.86 | 5.39 |

| DGI | .98 | 1.42 | 1.60 |

| BIO | 1.79 | 2.38 | 2.72 |

| OCUL | 2.16 | 3.14 | 2.56 |

| LGND | 1.53 | 1.34 | 1.97 |

| BLRX | 2.31 | 4.95 | 7.65 |

| RNG | .82 | .90 | .95 |

| ANTH | 5.10 | 2.19 | 1.78 |

| FEYE | .65 | .61 | .77 |

| ARIA | .96 | .80 | .99 |

| SPLK | .76 | .77 | 1.08 |

| SYN | 3.01 | 3.51 | 1.52 |

| GENE | .82 | 1.51 | 1.48 |

| SUNE | .64 | .79 | .74 |

| MVNR | 1.87 | 2.99 | 8.84 |

| AMZN | .66 | .70 | .61 |

| PPO | 1.54 | 1.82 | 3.77 |

| MCHP | 1.03 | 1.42 | 1.12 |

| ELOS | 2.02 | 1.52 | 2.06 |

| ELOS | 2.02 | 1.52 | 2.06 |

| DNA.TO | .39 | 1.31 | 1.74 |

| MVIS | 17.90 | 2.78 | 2.02 |

| SCIF | 1.09 | 1.12 | 1.18 |

| CUBI | 2.10 | 1.48 | 1.48 |

| ELX | 1.02 | 1.23 | 1.78 |

| MSO | 4.20 | 1.58 | 1.38 |

| KYTH | 2.48 | 4.44 | 4.80 |

| QUNR | 2.70 | .48 | .72 |

| RTRX | 7.54 | .61 | 1.02 |

| CNDO | 21.59 | .80 | 5.30 |

| ITCI | 8.96 | 4.94 | 5.38 |

| MRVL | .88 | .83 | 1.25 |

| OPK | .78 | .94 | 1.41 |

| BLOX | .56 | .57 | 1.05 |

| OREX | .85 | .96 | 7.85 |

| SLAB | .72 | .69 | .68 |

| ARRY | .90 | .81 | 1.26 |

| HASI | 1.13 | 1.19 | 2.34 |

| RUBI | .68 | .89 | 1.04 |

| CLDX | 1.00 | .69 | 1.27 |

| ZIOP | 1.85 | 1.79 | 2.96 |

| QURE | 2.24 | 2.74 | 2.64 |

| SIMO | 1.16 | .85 | 1.01 |

| DE | .97 | 1.01 | .73 |

| AVG | 1.14 | .90 | 1.28 |

| FRSH | 4.33 | .41 | .85 |

| SLGN | 1.97 | 1.85 | 1.12 |

| TNA | .60 | .80 | .78 |

| PAYC | 2.17 | 1.82 | 1.39 |

| CLGRF | 1.22 | 1.33 | 3.39 |

| XON | 1.31 | 1.48 | 2.94 |

| CLDN | 5.82 | 4.69 | 5.90 |

| TSEM | .72 | .99 | 1.57 |

| UWM | .50 | .57 | .78 |

| PLCM | .79 | .74 | .88 |

| EBIX | 1.94 | 1.61 | .66 |

| FLTX | .84 | 1.30 | 1.54 |

| TNK | .83 | .80 | .79 |

| NXPI | .79 | 1.05 | 2.27 |

| SJM | 1.09 | 1.08 | .95 |

| IPGP | .90 | .80 | .89 |

| APH | 1.08 | .78 | 1.11 |

| AGU | 1.13 | .69 | 1.04 |

| OMER | 1.46 | .97 | 4.48 |

| RGLS | .61 | .44 | .75 |

| CNCE | 4.42 | 1.24 | .53 |

| NLNK | .93 | .60 | .88 |

| BTX | 2.26 | .90 | .49 |

| MTSN | 3.91 | 1.49 | 2.64 |

| TNAV | 1.08 | 1.02 | 2.23 |

| INFN | .72 | .73 | .57 |

| DEPO | 1.76 | 1.72 | 1.79 |

| ASHR | 1.39 | .57 | .64 |

| MNST | 1.01 | .70 | 1.23 |

| KSS | .85 | .72 | .99 |

| AMBA | .76 | .89 | 2.16 |

| PTLA | 1.41 | 1.87 | 1.29 |

| FOLD | 3.62 | .70 | .70 |