Checklist for refining the buying process for using the Stage Analysis system. To use the system properly only stocks that meet this criteria would be considered buy candidates.

The Stage Analysis Screener can be used to go through this checklist to find ideal buy candidates.

- What is the trend of the overall market? This heavily influences all stocks, so if it is not a tailwind probability of success is low.

- Is the stock in a leading sector?

- Are Stage 2 breakouts occurring in individual stocks in the sector before the sector as a whole has broken out? What is the quality of these Stage 2 breakouts (check the Stage Analysis page for analyzing the quality of a breakout)

- Are the stocks in the sector outperforming the major indexes?

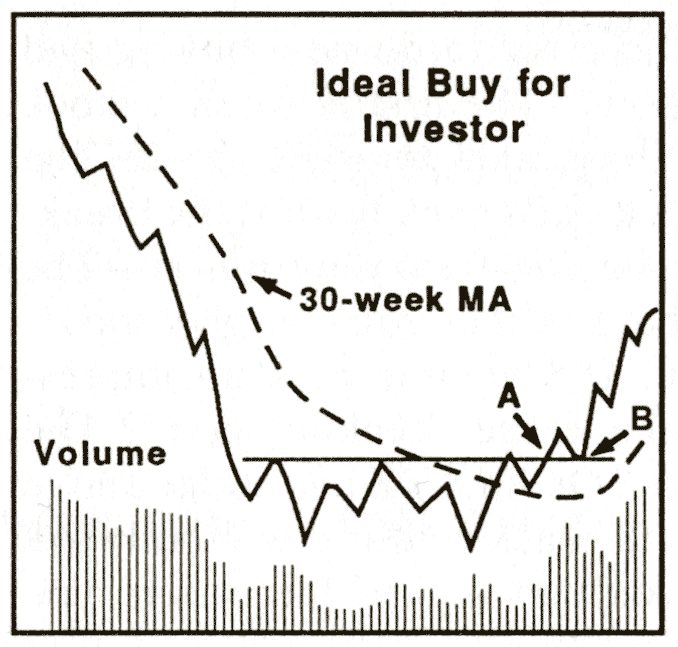

- Is the stock above its 30 week moving average (MA)?

- Is the 30 week MA in an uptrend?

- Is the stock at an ideal buy point?

- Ideal buy point A: The stock breaks above horizontal resistance and the 30 week MA on a big increase in volume

- Ideal buy point B: The stock pulls back to the breakout area after the breakout

- Did the breakout occur on at least 2 times average weekly volume or a cluster of high volume weeks leading into and during the breakout?

- Is the stock outperforming the major stock indexes? (has positive relative strength)

- Does the stock have minimal or no overhead resistance?