Most of the people who write about trading on the Internet do one or more or all of the following 4 things:

- Never talk about losing trades.

- Don’t have a real system for trading the markets.

- Believe that they are smart enough to predict the future.

- Are biased to their favorite asset class.

I define a real system as a system that clearly defines entry and exit criteria for winning and losing trades. Something that you can write down and explain to someone else. The system makes no attempts to predict the future. The rules of the system have to be followed. Many smart traders are aware of different systems and may say that they use them, but when push comes to shove they are NOT really following the rules.

Bias to their favorite asset class means they constantly look for bullish theories for assets they are bullish on, and vice versa for assets they are bearish on. Whether they are willing to admit it or not, they start with their bullish or bearish outlook first and then try to build a theory behind that outlook to justify their opinion.

I’ve been guilty of all 4 of these things earlier in my trading career. Until I adopted Stage Analysis I had no real system, but even after I studied Stage Analysis initially I still wasn’t following the rules. Mostly because I had some inherent biases to different asset classes, notably commodity related assets. And a lot of those biases came from listening to people who just predict the future and are guilty of the other 3 things above.

In this new series of content on my site at www.nextbigtrade.com I’m going to do the opposite of the 4 things above since I believe that is the real way to trade the markets: 1) talk about winning AND losing trades 2) use a REAL system to trade the markets and follow the rules 3) no predictions and 4) no biases.

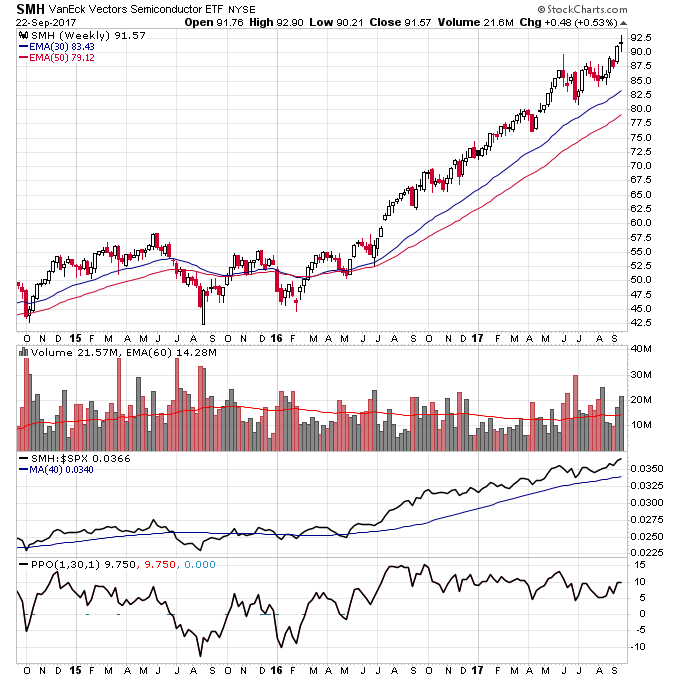

For the first report I’m going to take a look at the semiconductors sector and 2 semiconductor stocks that I have positions in. I like the semiconductors sector because it is clearly in a Stage 2 advance and a number of stocks in that sector are at or near all time highs. Looking at the chart of SMH below over the last 6 weeks it has started to breakout to the upside after consolidating for a few months over the summer. SMH has been outperforming the S&P 500 since it broke out in mid-2016 and hasn’t gotten overextended from the 30-week moving average yet (as shown by looking at the PPO below). According to Stage Analysis when the market is bullish, you want to be in sectors that are outperforming the overall market and in the best stocks in those sectors.

I’ve been tweeting about semiconductor stocks for the last few weeks since I’ve been observing the price action in many names starting to act well.

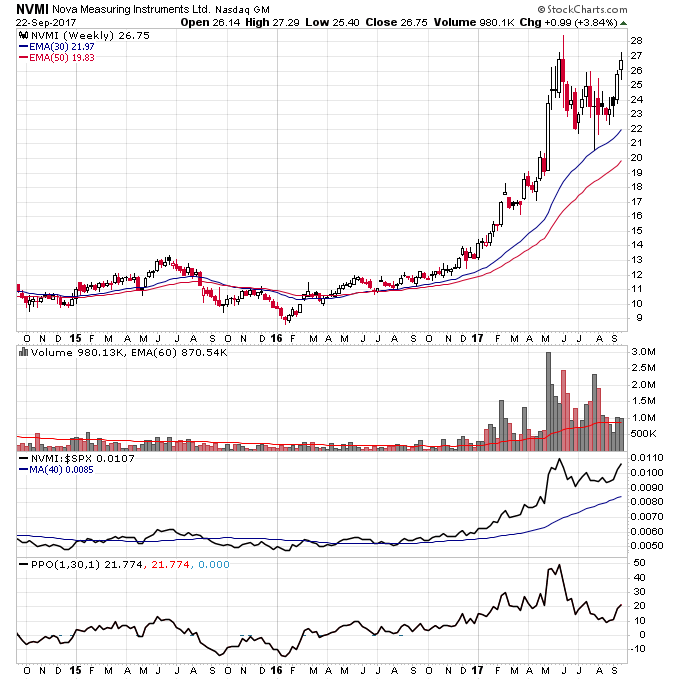

I made my first entry in NVMI in mid-August and have added some more shares since. I use the 30-week moving average as a line to measure risk against. The further I buy above this moving average the more risk I’m taking since the stop loss is right below this line, so this impacts my position sizing. The closer I buy to the moving average the bigger the position size I can take. The ideal time to buy is either the breakout above the moving average or a pullback to it during a consolidation.

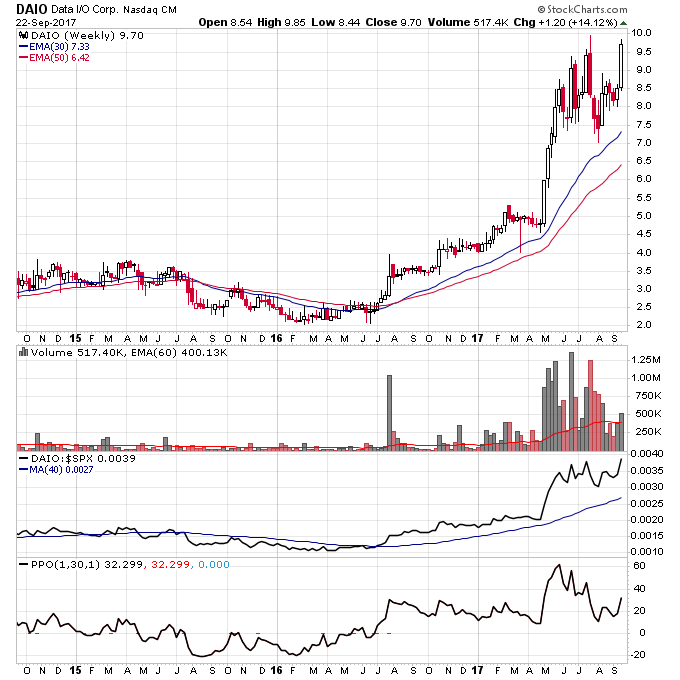

DAIO looks like a lot of other semiconductor related stocks. Broke out of a base on explosive volume in mid-2016 then followed it up with another explosive breakout in May of this year. Consolidated for the rest of the summer but recently has been acting well and might be ready to breakout soon.

My goal is to continue this series with real trading results and be a different format than the majority of what is out there on the Internet. I will follow up with what happens with these 2 trades and have future trades to discuss as the series progresses.

Checkout my new Stage Analysis Screening Tool at: http://screener.nextbigtrade.com

Twitter: @nextbigtrade

The original article and much more can be found at: https://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.