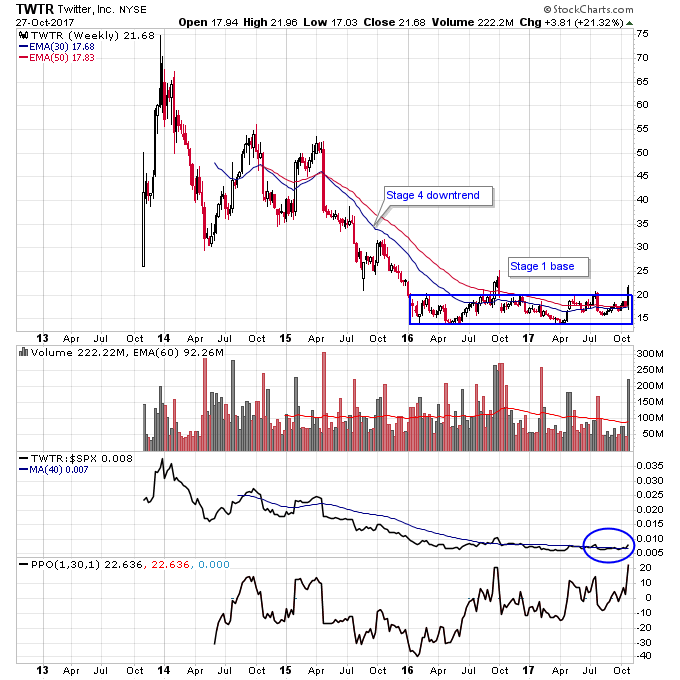

TWTR shares exploded higher last Thursday on a big increase in volume after their earnings report. TWTR has been an abysmal stock since its IPO in 2013. It had erratic price action after the IPO, which is often a sign of topping action, and then a Stage 4 downtrend in 2015 leading into 2016. It has since been in a Stage 1 base in 2016 and 2017 with a few false breakout attempts, which is the frustrating part of Stage 1 basing action. For example we’ve seen a lot of frustration in the commodities sector over the last year as those markets continue to grind sideways and produce fake breakouts.

TWTR did 222 million shares of volume last week which is over 2x average weekly volume. That’s the kind of volume to look for in a new Stage 2 breakout. If TWTR does another week of over 2x average volume over the next week that’s an even better sign. TWTR is also finally starting to outperform the S&P 500 which is what you want to see in potential big winning stocks.

Risk-reward wise I don’t want to see TWTR fall back below 20 since that zone has been resistance during the Stage 1 base. The overhead resistance created from the Stage 4 downtrend in 2015 should be minimized now that the basing action has gone on for so long as weak hands sell to stronger hands.

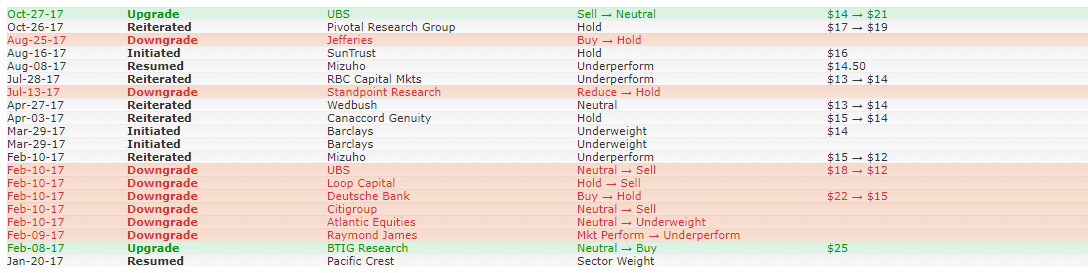

Wall Street hates TWTR as evidenced by the ratings on the stock shown below. This also means if TWTR does start trending higher a lot of money is on the sidelines missing out, which could turn into new buying pressure. TWTR also has an 8% short interest against the stock. Not surprising to see so much angst against a stock at the bottom of a bear market.

Source: Finviz.com

TWTR is new edition to the Real Trading Report series that I launched in September. The first stock I mentioned in that report was DAIO which exploded higher on Friday after earnings. I’ll do a follow up on that stock (which I increased my position in after earnings) this week.

Checkout my new Stage Analysis Screening Tool at: http://screener.nextbigtrade.com

Checkout my trading videos on Youtube

Twitter: @nextbigtrade

The original article and much more can be found at: https://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.