I had the pleasure to be part of a year-end interview series on The Next Bull Market Move. Below is a reprint of the interview, and I would highly recommend checking them out for more upcoming interviews!

Hi Justin, welcome back to The Next Bull Market Move. It’s been a while since we last spoke and as it’s nearing the end of the year I thought it would be great to get your thoughts regarding the markets in 2017. Let’s start with Gold. It looks as though we are still consolidating since the run up we had last year and sentiment is looking bearish. How is Gold looking to you?

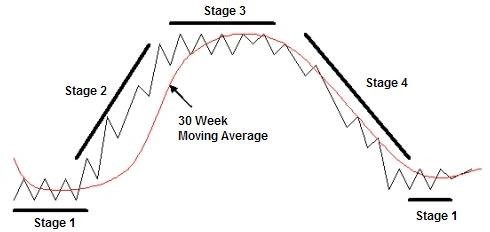

Gold is still moving sideways right on top of its 30-week moving average. The gold stocks are acting slightly weaker than gold if you take a look at GDX or GDXJ. They are both trading more below their 30-week moving average than gold.

Silver is also acting weaker than gold which typically isn’t a good sign. One thing I have noticed is how the volume has collapsed in GDX and GDXJ as this consolidation has dragged on. That can be a bullish sign as volatility and volume often collapse before a market moves higher, especially for a market that has been basing for a while like gold and gold stocks.

I’ve been out of gold and gold stocks all year and I don’t see any reason to be in them until we see them move above the 30-week moving average on increased volume in a new Stage 2 breakout. Until then I’ll keep monitoring the situation. Certainly we could see things change dramatically at any time.

Let’s move on to Uranium. Over the last few weeks it looks as though the sector wants to break out, your thoughts?

After the Cameco production cut announcement we’ve seen almost all the uranium stocks move above the 30-week moving average on increased volume. This includes Uranium Participation Corp. which tracks the price of uranium.

I like how the volume in that fund is actually heavier than it was during the breakout in uranium stocks we saw around the same time last year.

We are at the point now where the rubber needs to meet the road in uranium stocks. We’ve consolidated around the 30-week moving average after the initial breakout. If this is a real breakout it should start to move higher again over the next couple weeks.

If it doesn’t it will be a higher chance that this a fake breakout and the market will consolidate sideways for a while longer. It’s definitely not abnormal to see multiple fake breakouts in a Stage 1 base, that’s what wears people out until the real breakout happens.

What has been the biggest surprise of the year for you? Bitcoin comes to my mind.

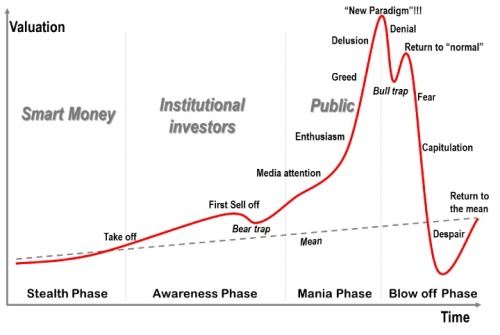

I’m simultaneously surprised and not surprised at all by what has happened to Bitcoin over the past year. I am surprised by the amount of money that has poured into it, I never fathomed over 300 billion dollars would pour into this asset class. It has also been a lesson for me because I made a fundamental judgement on Bitcoin back in 2012 that has kind of kept me out of being interested in trading it. Basically I decided that I didn’t think it had any intrinsic value so it couldn’t be considered a real form of money.

What I should have done was just traded it like any other Stage 2 breakout and I could have captured the biggest winner of 2017. I’ll definitely learn from that for the future. What I find unsurprising is that humans have blown another bubble, we seem to love to blow bubbles periodically and this is yet another example. In my lifetime I’ve already experienced the Internet bubble, the housing bubble, and huge parabolic moves in other assets like oil and uranium. My lesson learned from Bitcoin is to just trade the chart like any other asset class and apply the Stage Analysis system. It would have worked beautifully on this huge move in Bitcoin from 2015 until now.

Which sectors in 2017 have done well for you? And what lessons have you learnt from this?

I took some good profits on uranium stocks at the start of this year when they were exploding higher. But I also let a few winners turn into losers, I used that as another learning experience. Besides that I’ve done very well in tech stocks over the last three months of this year. I’ve been discussing real trades I’m taking on my website since September and you can see some big winners I identified if you go back and look at some of my posts at www.nextbigtrade.com.

This has proved to me again that I have a system that I can trade any market with, and that’s a big advantage because every market goes in and out of favor. I want to be always focused on the markets that are in favor, and in particular getting in early on new uptrends.

I think it’s interesting that certain elements of the trend analysis you follow are designed to be logical and non-emotional, that it’s based on a few key indicators that provide a guide, but that the market itself is emotional and irrational. Do humans generally get in the way of winning trades and investments?

Humans are wired to sell their winners short and let their losers run. This is the exact opposite of winning trading. This happens because most people have no system to trade the markets so they become a slave to their emotions or whatever biases they have, or they just follow a guru who has no system either. You have to have a system that lets winners run and cuts losers short to be successful trading the markets, and I’ve found that using simple trend following like Stage Analysis is the easiest.

And as a final question, what are you looking forward to in 2018?

I’m looking forward to applying the Stage Analysis system to the markets again next year and seeing what markets that takes me into. Or if we get a bear market next year I should be in cash and preserving my capital. Either way I will be trading what the market gives me. One other thing I continue to focus on is position sizing since I think that is another great way to manage risk besides having a stop loss signal.

Checkout my new Stage Analysis Screening Tool at: http://screener.nextbigtrade.com

Checkout my trading videos on Youtube

Twitter: @nextbigtrade

The original article and much more can be found at: https://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.