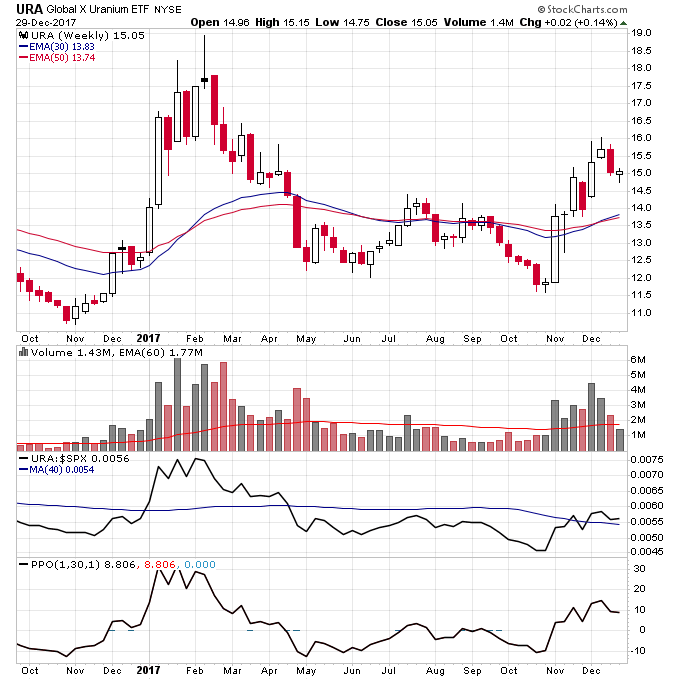

I ended 2016 and started 2017 with a big focus on uranium stocks. This was because they were ripping out of a Stage 1 base on huge volume towards the end of 2016. Uranium stocks had been destroyed for the last 5 years so this had the potential to be a monster trade.

The stocks did well for a few months and by taking some partial profits I made money on some of my uranium positions. But I also held onto a few uranium miners too long as the rally started to fizzle out in March and gave back some profits. I ended up moving on to other sectors as the uranium miners eventually broke down and went back into a Stage 1 base until the end of the year.

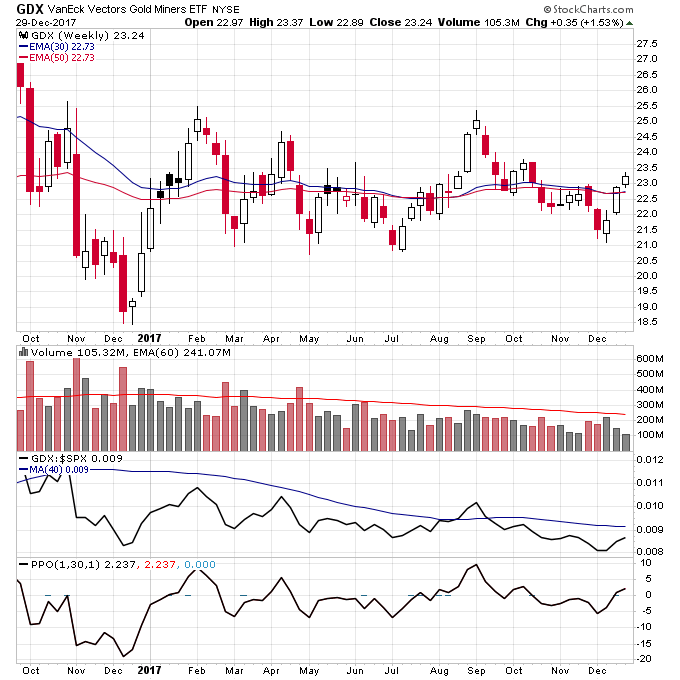

I made huge profits in gold miners in 2016 which enabled it to be my best year performance-wise since I’ve been trading. But fortunately using my Stage Analysis system I avoided gold miners for the most part in 2017 as they were simply drifting sideways in a consolidation the entire year. Even when many were turning bullish on gold in September I looked at the charts of many gold and silver miners and saw no volume increase that almost always accompanies a new rally. You can see that in the chart below of GDX where even though it started rallying back then volume was still well below average. By avoiding gold miners I was able to trade other sectors that were in strong uptrends in 2017.

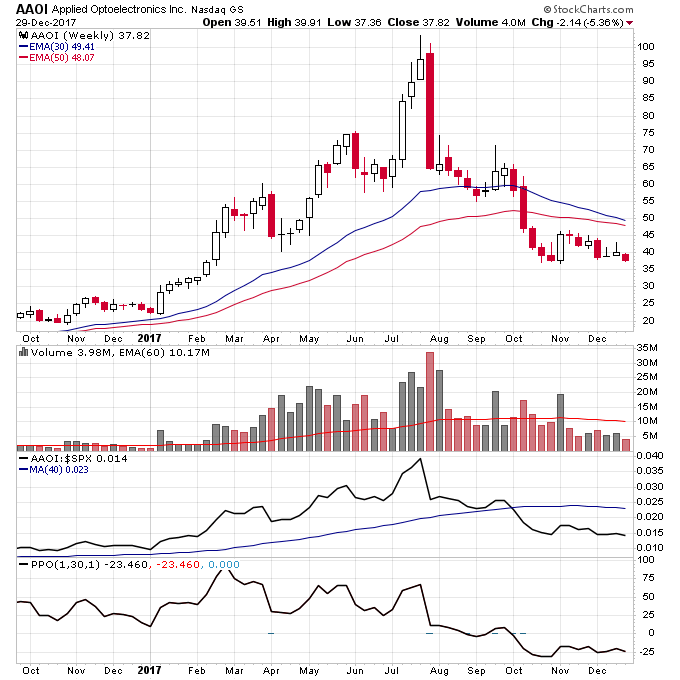

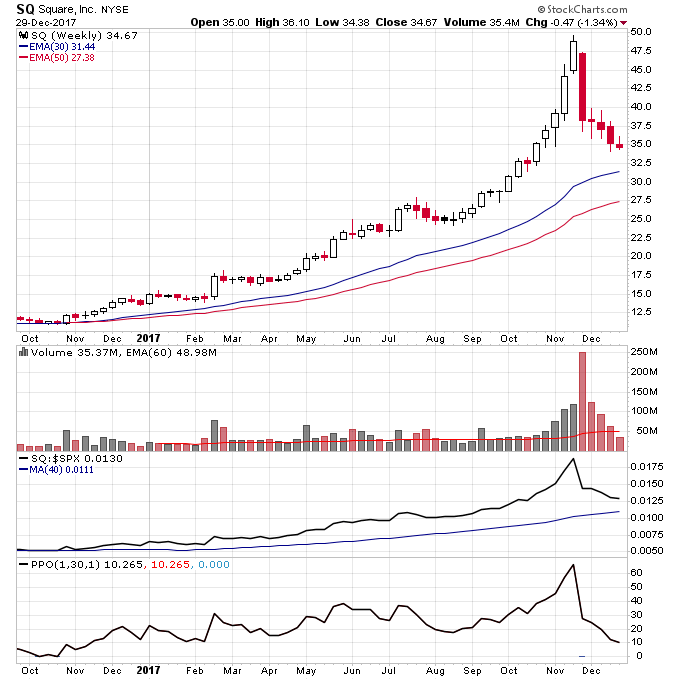

One of the other mistakes I made early in 2017 was being a little too focused on uranium. This made me miss some awesome Stage 2 breakouts early in the year in stocks like AAOI and SQ (shown below). If I would have diversified and taken trades in those stocks when they broke out, I could have added to those positions at the same time I cut back my uranium positions. This was a good lesson to learn in that if you see multiple sectors breaking out then there’s no reason not to take trades in each of them, since it’s impossible to know which rally will be stronger.

I applied this lesson for the rest of 2017 and it worked well for the last 4 months of the year since there were so many sectors breaking out such as tech stocks, bitcoin-related stocks, cannabis stocks, and some commodities producing stocks towards the end of the year.

DAIO was my biggest winner for the year and a stock I detailed in the Real Trading Report. I made money in every stock I discussed on the Real Trading Report in 2017 except for INTT. This included the tech stocks TEAM, TWTR, COHU, and NVMI. Many of these stocks have pulled back since November but by selling and taking partial profits on the way up I was able to capture gains in these stocks. For example for DAIO I sold shares in the 13s, 14s, 15s, and 16s on the way up and now it has pulled back to the 12s, but it is still above the 30-week MA. If I had not taken profits on the way up then I would have left a good portion of my gains on the table.

Bitcoin was another lesson learned for me in 2017 because I totally avoided it. I did make some money on some bitcoin related stocks but even then I let a little bias against Bitcoin derail me from staying in longer on some of the trades. The lesson I’m taking away from Bitcoin: just trade the charts, fundamental opinions on any market are totally worthless. It’s amazing how many Bitcoin experts there are now compared to 12 months ago when no one cared about Bitcoin, and the only reason for this is because of what has happened on the chart. If you apply Stage Analysis properly you can get in early and profitably trade any market, including a totally new asset class like Bitcoin.

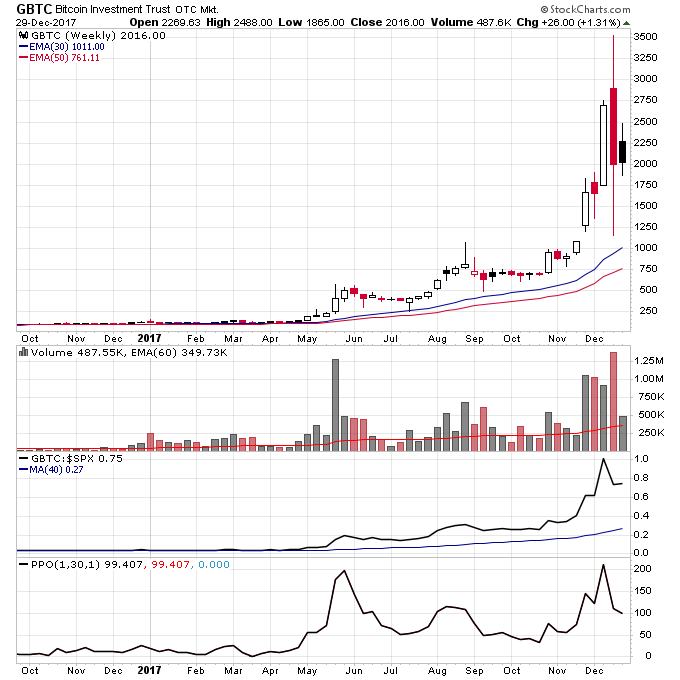

For example if you look at the chart of GBTC below it broke out of a beautiful Stage 1 base in May, then consolidated and broke out again multiple times. Even as late as early November it had another nice consolidation from which it broke out from and more than tripled, and that was after Bitcoin had made some monster gains for the year.

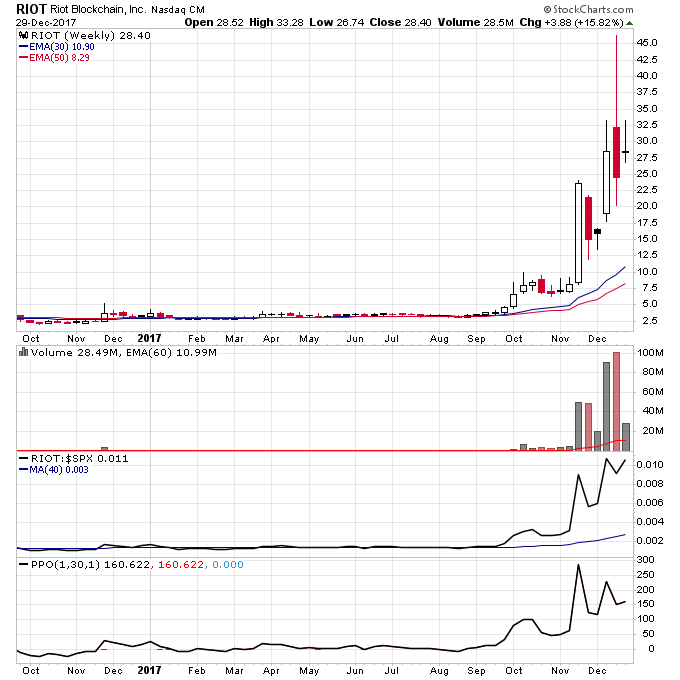

Even some of the “Bitcoin” stocks which many could be nothing more than scams could have been traded easily with a system like Stage Analysis. If you look at RIOT below it broke out of a beautiful Stage 1 base in late September. Then consolidated for a few weeks and had another monster run after breaking out above the 8-9 area.

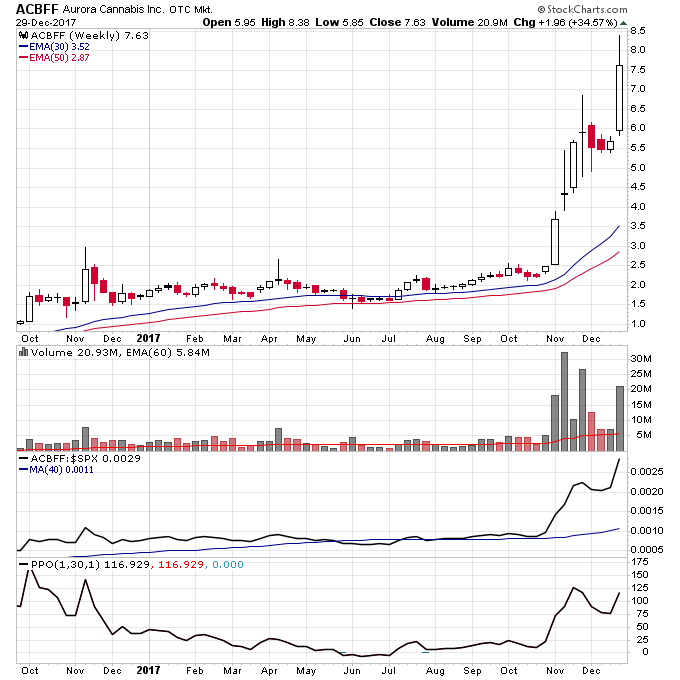

The last two months of 2017 the biggest winning sector besides Bitcoin has to be cannabis related stocks, and fortunately I’ve been all over this sector. I highlighted ACBFF in a post in November and this stock has blasted off along with stocks like TWMJF and APHQF, all three of which I traded.

This sector has been a great example of how stocks in a hot sector break out at different times, I’ve traded probably at least 10 other cannabis related stocks over the past two months since so many of them have broken out of bases but not at the same time. When I’m scanning and evaluating stocks in a sector I’m always on the look out for stocks that haven’t broken out yet if they are in a strong sector where most of the other stocks have already moved. A strong sector can lift all boats including stocks that lag, and sometimes the lagging stocks can turn out to be just as big if not bigger winners than the initial stocks that start breaking out first.

I recorded a cumulative 50.4% gain for my trading in 2017 which was 31% higher than the S&P 500 at 19.4%. The most important lessons I’m taking away from 2017 are:

- Taking partial profits on winning trades is an absolute necessity

- If multiple sectors are breaking out of Stage 1 bases diversify across them. It’s possible some won’t work out while others will, but impossible to predict

- Just trade the charts and the Stage Analysis system, they can be applied to any market and have no bias

- Opinions, fundamental analysis, and predictions are not useful and should be ignored

I have no predictions for 2018 and I would highly encourage anyone reading this to ignore every single prediction they read anywhere since none of them are necessary or helpful. For example no one predicted what happened to Bitcoin this year but that wasn’t at all necessary to make money on Bitcoin.

Checkout my new Stage Analysis Screening Tool at: http://screener.nextbigtrade.com

Checkout my trading videos on Youtube

Twitter: @nextbigtrade

The original article and much more can be found at: https://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.