Stan Weinstein states in his amazing book that choosing the right sector to trade is just as important as trading with the overall market trend at your back. Just in the past year in 2017 we’ve seen this concept front and center with semiconductor stocks, cannabis stocks, and even bitcoin-related stocks all experiencing massive gains as each of those sectors was on fire for a period of time. This is the reason for studying all market sectors at all times because it increases the chances of catching a big trend.

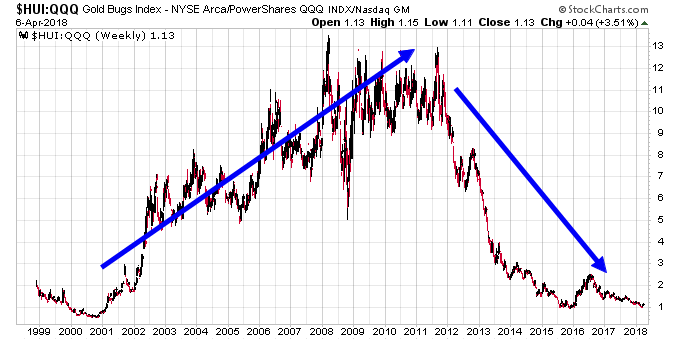

If we go back in time and study the past 20 years it becomes apparent how market outperformance has transitioned between major sectors in the market. From 2001-2011 the leading sectors of the market were anything commodity-related, from gold miners to oil and agriculture producers to uranium and rare earth metals. This is generalized by the chart below which shows how the HUI Gold Bugs Index outperformed the Nasdaq 100 from 2001-2011.

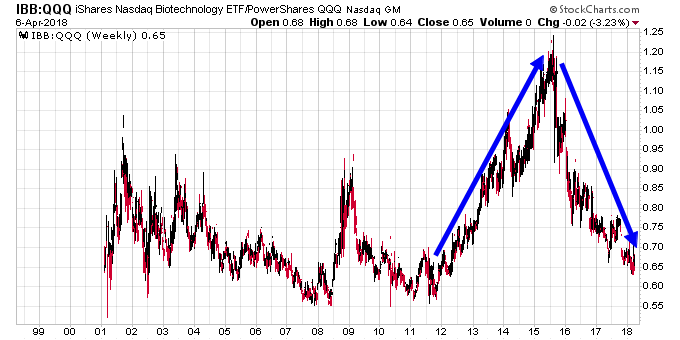

Next from 2011-2015 biotech and healthcare-related stocks were the leading sector in the markets as evidenced by the chart below showing the ratio between the IBB Biotechnology ETF and the Nasdaq 100.

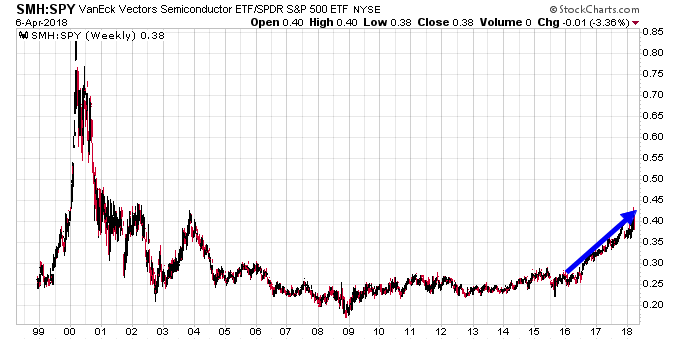

Finally everyone knows that the FAANG stocks have been some of the leading performers over the last few years. But in general it looks like Technology is the new leading sector of the market with semiconductor related stocks leading the S&P 500 higher from the start of 2016.

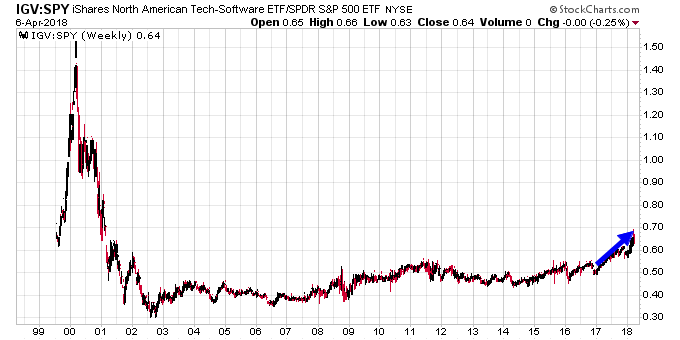

And software stocks have been outperforming the S&P 500 since the start of 2017.

Both of these sectors have put in large bases on their ratio charts with the S&P 500 which suggests that their new trends higher could last a few more years from here.

Check out my Stage Analysis Screening Tool at: http://screener.nextbigtrade.com

Check out my trading videos on Youtube

Twitter: @nextbigtrade

The original article and much more can be found at: https://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.