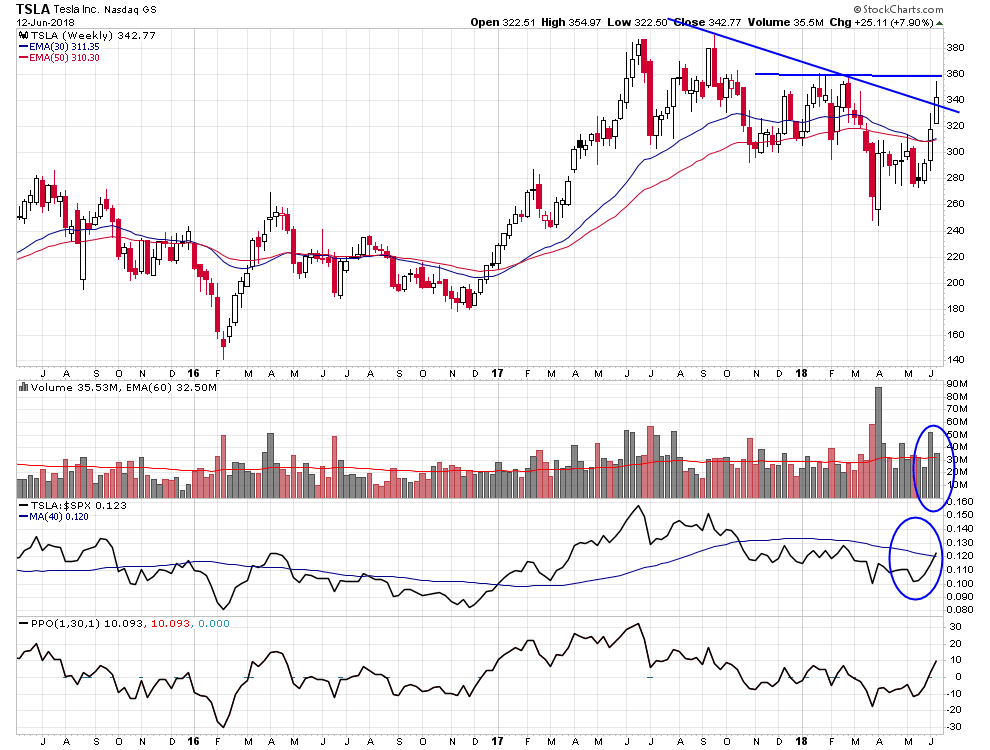

With the S&P 500 starting to move into a new Stage 2 uptrend after a near 6-month consolidation, many stocks across different sectors are moving higher in sympathy. Tech stocks, and notably the software sector have been a big focus of mine and have been leading the market higher this year. One tech stock that has been consolidating sideways for almost a year now and primed to break into a new Stage 2 uptrend is Tesla. TSLA has surged higher the past 2 weeks and during this current week is trading on very heavy volume, already surpassing average volume for the week on Tuesday.

We know from Stage Analysis that heavy volume on the break above the 30-week moving average is what we are looking for to indicate massive accumulation by institutions. A new uptrend in TSLA combined with a very large short position with over 30% of the float shorted could lead to an explosive rally in this stock. I’ll be looking for a continued increase in volume combined with a break above 360 to confirm the break out into Stage 2.

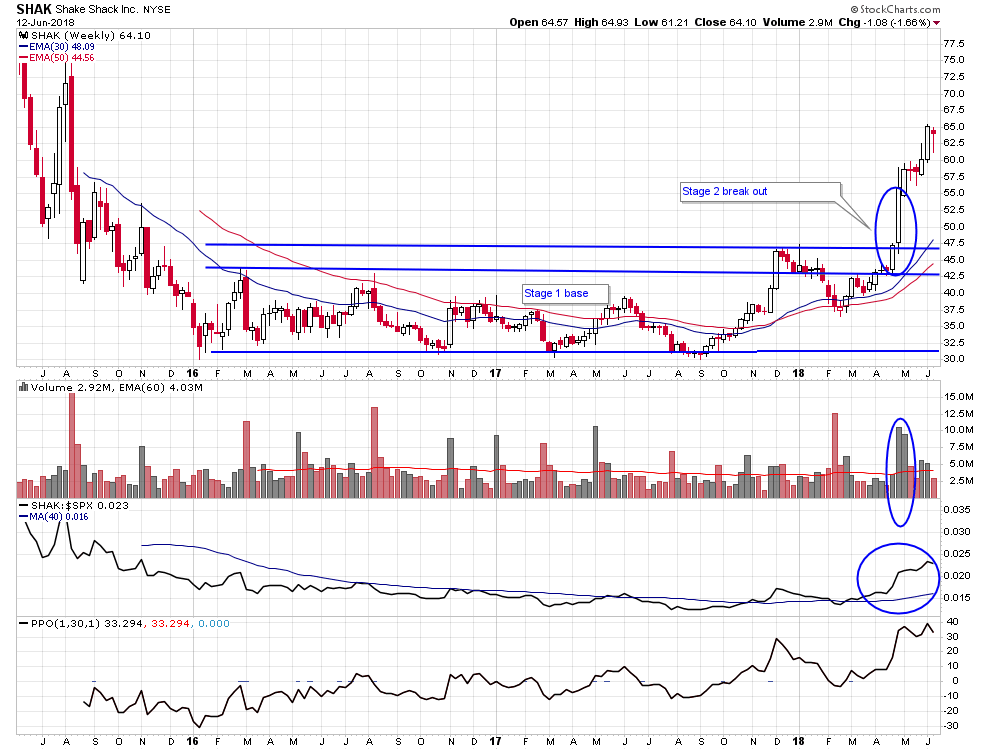

Shake Shack has already broken out into a new Stage 2 uptrend but is still early in the uptrend, with the Stage Analysis Screener showing the rally at only 15 weeks old. SHAK is even more heavily shorted than TSLA with more than 35% of the float sold short. While heavy short positions is not something I specifically look for in a new Stage 2 uptrend, they are nice to have as a tailwind as they provide pent up demand.

Disclosure: I am long TSLA and SHAK.

Check out my Stage Analysis Screening Tool at: http://screener.nextbigtrade.com

Check out my trading videos on Youtube

Twitter: @nextbigtrade

The original article and much more can be found at: https://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.