I’ve had a lot of questions lately asking “How do I catch the bottom with Stage Analysis?”. The short answer to this question is that you don’t catch the bottom with Stage Analysis. In fact you give it up.

“Catching the bottom” is not the key to trading. The most important aspect of trading is not losing money and cutting losses short. This is because mathematically losses hurt more than gains. The table below shows the percent gains required to get back to break-even from a loss:

| Loss | Gain To Break Even |

| -10% | 11% |

| -20% | 25% |

| -30% | 43% |

| -40% | 67% |

| -50% | 100% |

| -60% | 150% |

| -70% | 233% |

| -80% | 400% |

| -90% | 900% |

You can see from the table that the percent gains required to offset a loss are much bigger. They keep growing dramatically the bigger the loss. This is why investment legend Warren Buffett says that the most important rule to investing is to “not lose money”.

Mark Minervini has two excellent chapters in his book “Trade Like A Stock Market Wizard” where he discusses the concept of risk management in trading. Mark states that “Avoiding large losses is the single most important factor for winning big as a speculator. You can’t control how much a stock rises, but in most cases, whether you take a small loss or a big loss is entirely your choice.”

Turning back to Stage Analysis, it turns out that Stan Weinstein agrees with Mark Minervini and Warren Bufett by stating that the most important rule in Stage Analysis is to stay out of Stage 4 bear markets. The reason is the same as above, staying out of Stage 4 eliminates the possibility of taking a big loss.

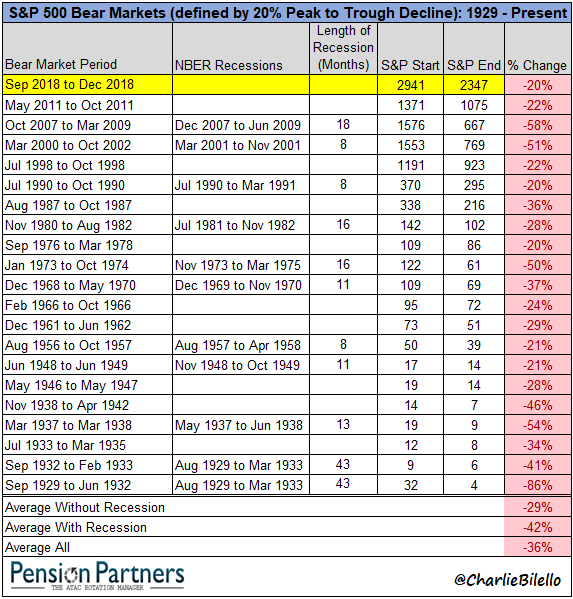

Big losses in the stock market are inevitable and are part of market cycles. The chart below shows that every decade since 1930 has had multiple -20% declines in the stock market. This includes even strong decades such as the current decade or the 1990s.

The problem with bear markets is not just the declines in the market indexes but the damage done to individual stocks. Individual stocks often take damage that they never recover from, or if they do recover it takes 5-10 years in some cases. The stock market indexes hide this carnage by kicking out stocks that perform badly, but accounts can be devastated by holding these Stage 4 disasters and taking big losses.

Investors have two choices when dealing with market bottoms that are mutually exclusive. They can either try and fish for the market bottom and take a small loss if they are too early, or stay out of the market longer and give up the first 10-15% of a new uptrend.

The latter approach has the following two advantages:

- Losses on individual stocks are magnified during a Stage 4 decline

- Losses on a portfolio hurt more than gains help as demonstrated above

However many people crave market action and have a hard time staying out of the markets even when they are under pressure. Mark Minervini calls avoiding this syndrome having “sit out power”.

In Stage Analysis a Stage 2 uptrend won’t occur until first the market bottoms and the Stage 4 decline ends. Then the market creates some type of floor which is called a Stage 1 base. And then eventually the market moves back into a Stage 2 uptrend.

Studying leading stocks and leading sectors help to decipher these critical turning points and often help uncover changes in trend before the market indexes which are slower to move. Especially during the early stages of a new uptrend, leading stocks and sectors tend to breakout first.

We’ve discussed how important it is to avoid big losses, but it’s also important to emphasize how large the gains are in Stage 2 uptrends. In every investment cycle there is a Stage 2 sector of the market that is powering higher producing huge gains. “Catching the bottom” is not required to trade these uptrends using Stage Analysis.

Check out my Stage Analysis Screening Tool at: http://screener.nextbigtrade.com

Check out my trading videos on Youtube

Twitter: @nextbigtrade

The original article and much more can be found at: https://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.