I went back and read a piece I wrote on January 6th on catching the bottom and this paragraph caught my attention:

“Studying leading stocks and leading sectors help to decipher these critical turning points and often help uncover changes in trend before the market indexes which are slower to move. Especially during the early stages of a new uptrend, leading stocks and sectors tend to breakout first.”

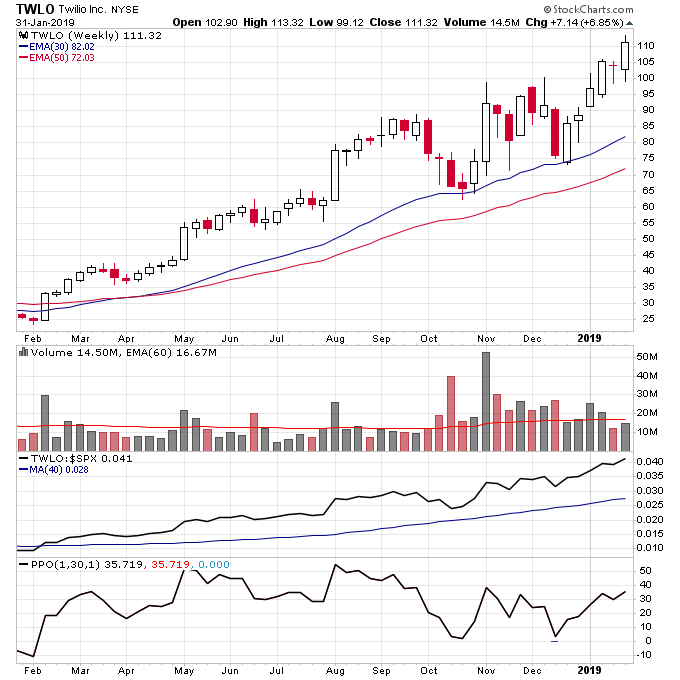

Software stocks have showed great relative strength all during the market correction that began in October 2018. Many actually stayed in Stage 2 even while the S&P 500 moved into a Stage 4 downtrend. A good example is TWLO which pulled back in October and December but maintained its uptrend. This was a good indication TWLO would be ready to break to new highs once the downtrend pressure was off which is exactly what the stock did.

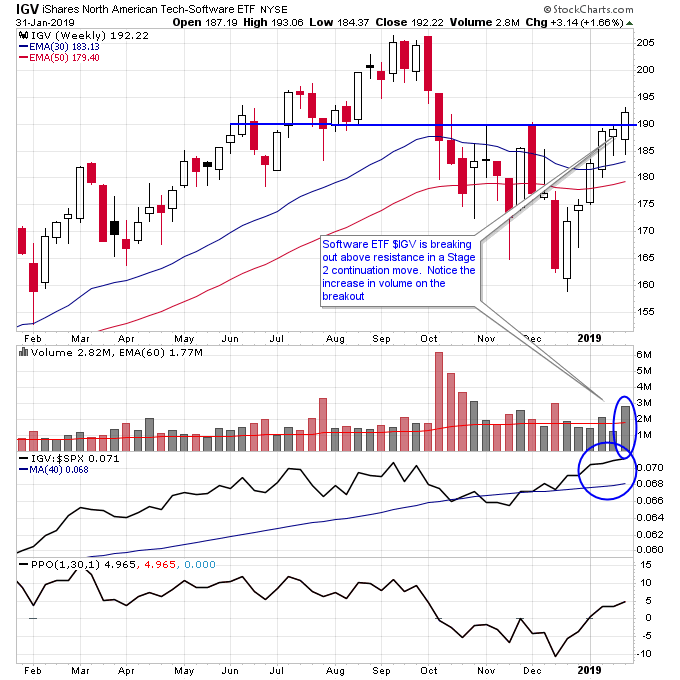

If you look at the software ETF IGV which has been a market leader for a while it is breaking out into a Stage 2 continuation rally this week. This confirms the action in many software stocks which are making new highs this week and breaking out on volume.

I think this display of strength, along with relative strength in other sectors like cannabis and emerging markets, is a sign that the overall market has probably bottomed.

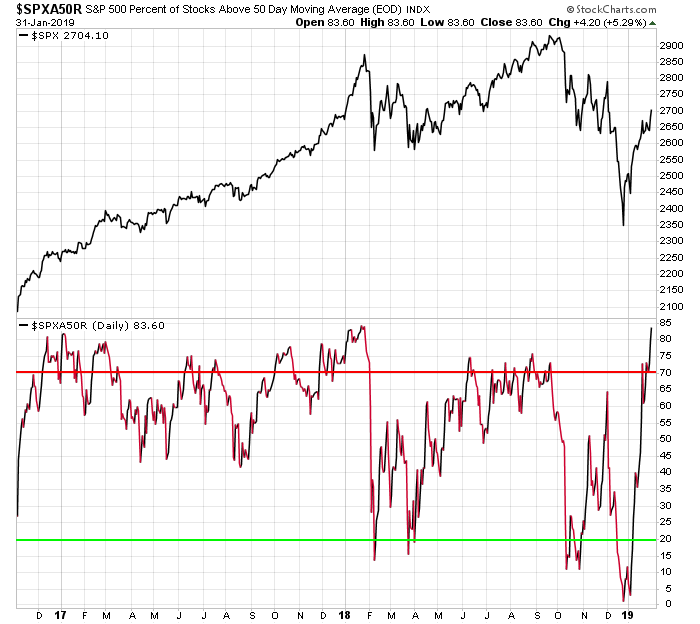

From a short term tactical perspective though the market is now widely overbought and due for a consolidation of recent gains. The percentage of stocks above the 50dma for the S&P 500 is now in an area where pullbacks are more likely.

This is typical of the stock market to not be safe just when it starts to feel more safe. I’ve reduced position sizes to take advantage of a pullback but I’ve also established positions in some leading software stocks which have no overhead resistance. I’ll have more on that in upcoming posts.

Check out my Stage Analysis Screening Tool at: http://screener.nextbigtrade.com

Check out my trading videos on Youtube

Twitter: @nextbigtrade

The original article and much more can be found at: https://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.