Corrections and bear markets produce huge opportunities. Obviously we’ve recently seen that with the October-December 2018 correction. Off the lows on December 24th we’ve seen huge moves in cannabis stocks, enterprise software, medical devices, and semiconductors to name a few leading sectors.

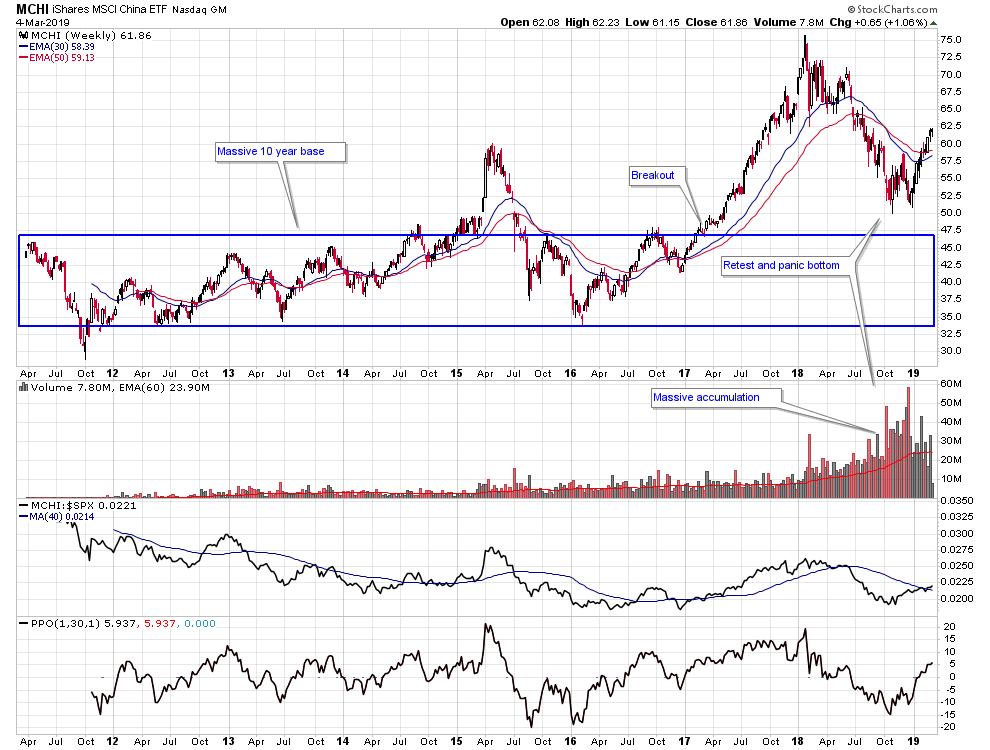

One sector that is flying under the radar from what I’m observing is Chinese stocks. I don’t see anyone pounding the table on Chinese stocks currently, but the setup they have right now is intriguing. Chinese stocks have under-performed U.S. stocks for at least 10 years. You have to go back to the 2000-2008 time frame to see almost any foreign stock market outperform the U.S for more than a year.

In 2017 though we saw a massive breakout out of a long term base in some of the largest Chinese ETFs. This was followed by a retest of that breakout in 2018.

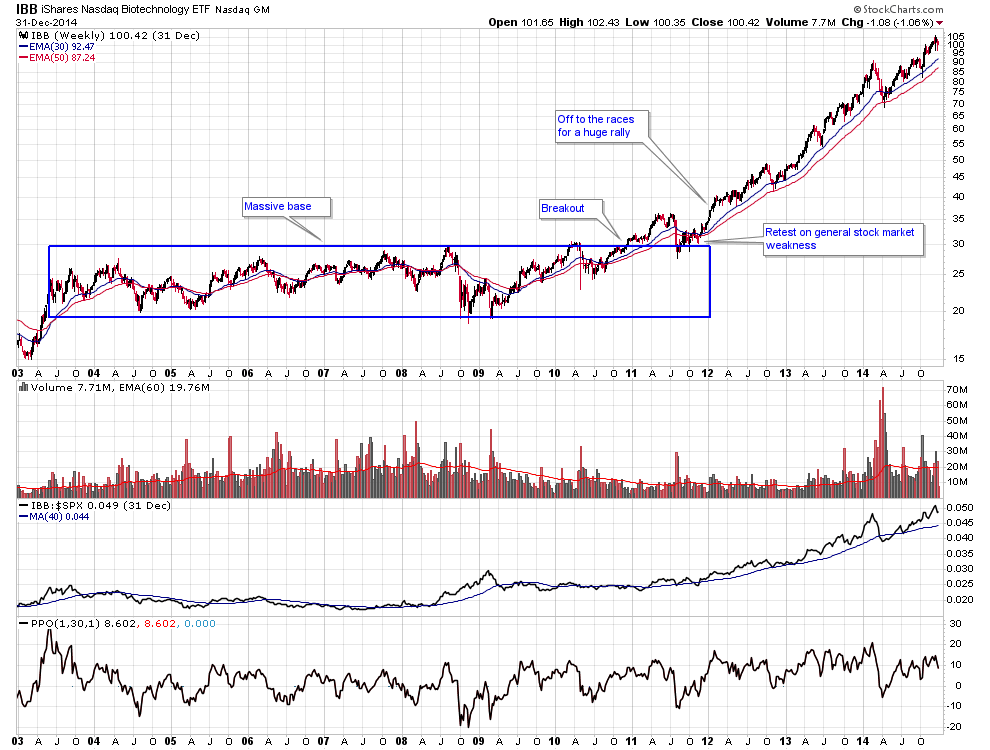

This is very similar action to what happened with biotech stocks in 2011. In 2011 the general stock market was weak and when biotech stocks started a breakout attempt in 2010 it failed initially and biotech stocks retested the breakout area. Once pressure on the general market started lifting in 2012 biotech stocks were off to the races. At the start of 2012 when this breakout was occurring nobody cared about biotech stocks, which is kind of similar to where we are with Chinese stocks today.

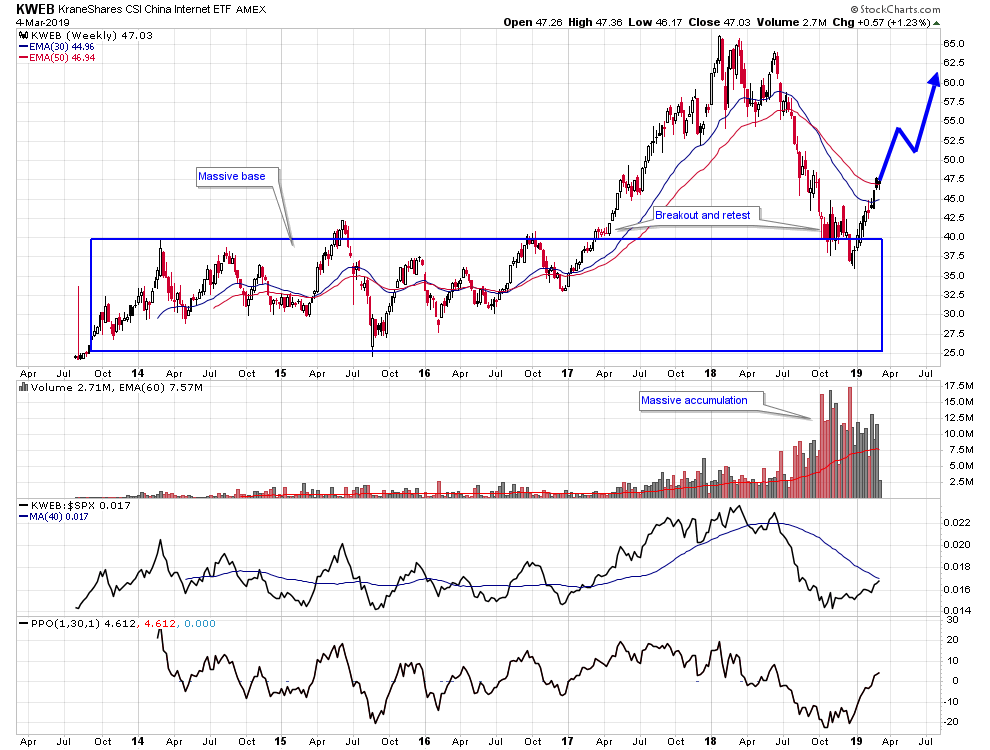

If you look at the Chinese Internet stock ETF KWEB the same thing is happening with MCHI. Many Chinese Internet stocks have IPOed over the last few years, and some sport big short positions and minimal institutional ownership. These are potential catalysts as big moves often occur in disliked and under-owned sectors coming off of big bases, as we know from studying Stage Analysis.

Check out my Stage Analysis Screening Tool at: http://screener.nextbigtrade.com

Check out my trading videos on Youtube

Twitter: @nextbigtrade

The original article and much more can be found at: https://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.