While volume isn’t a silver bullet when it comes to analyzing the market (there is no silver bullet), big moves in stocks are very often preceded by big volume. Institutions can try and hide their moves as much as possible but if they are piling into something then it will show up in the trading volume.

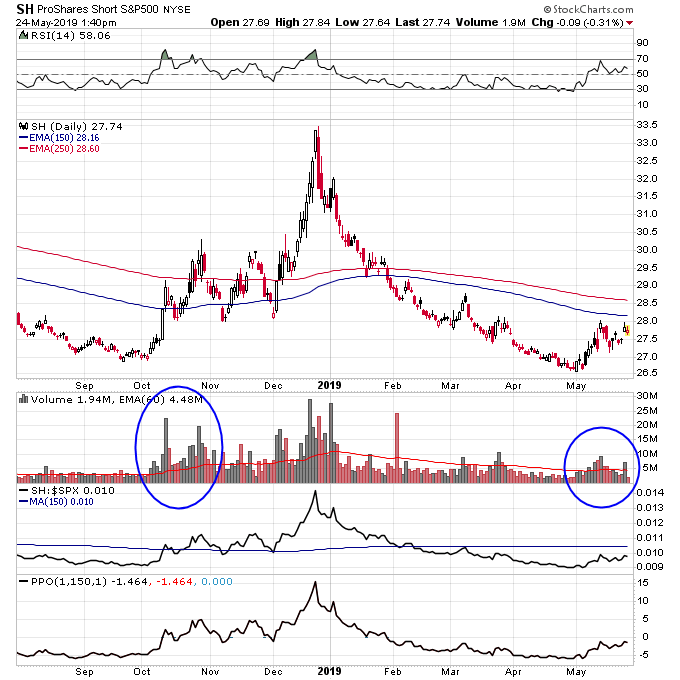

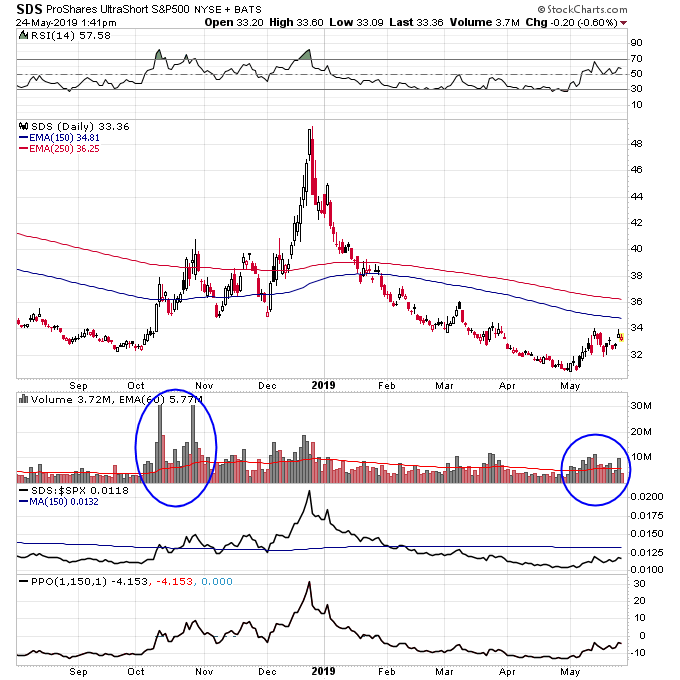

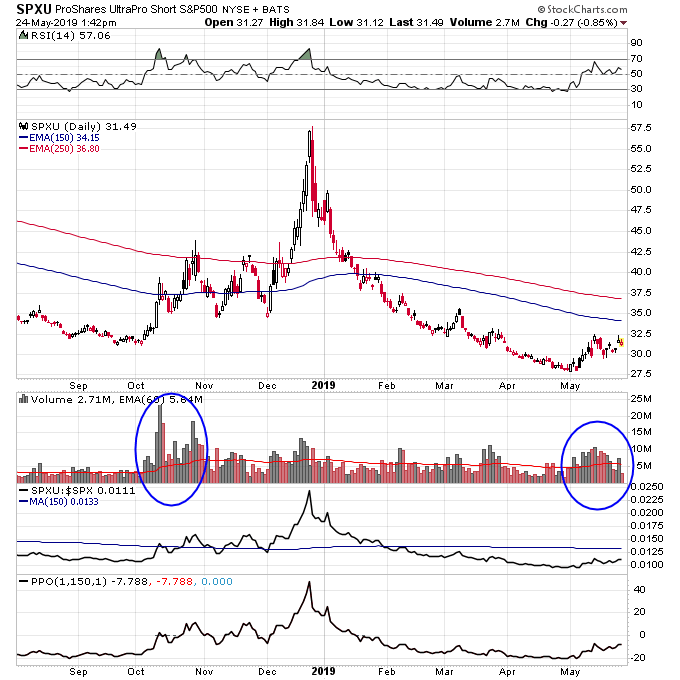

One thing I like to keep track of during market corrections is the volume in the largest inverse ETFs. When volume spikes in these trading instruments it is often a good sign a big selloff is coming. This is what occurred last fall when stocks started weakening and then a selloff accelerated into a mini-meltdown in December.

So far during this pullback in May, the volume coming into inverse ETFs is not showing near the spike that happened last fall. That’s a good sign that we are not headed for a repeat of what happened last fall, but as always we will take it a day at a time as we survey the markets.

Check out my Stage Analysis Screening Tool at: http://screener.nextbigtrade.com

Check out my trading videos on Youtube

Twitter: @nextbigtrade

The original article and much more can be found at: https://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.