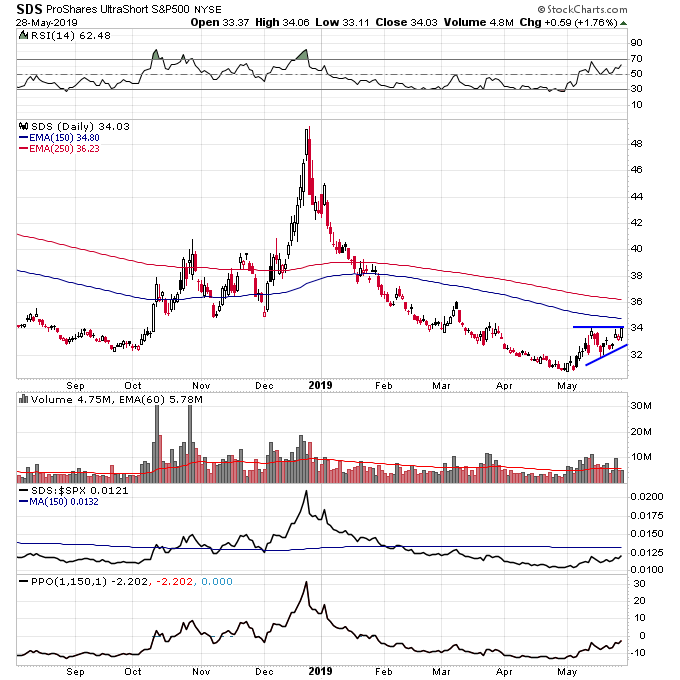

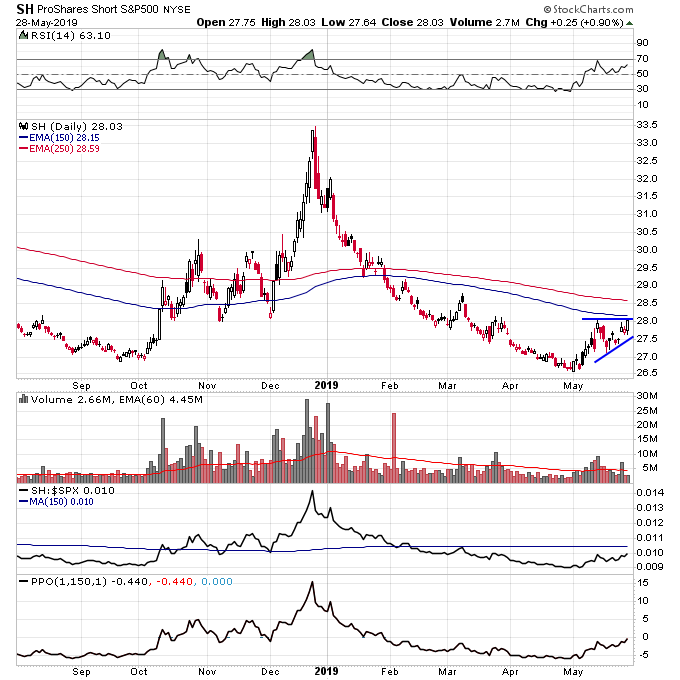

We should get a technical breakout in many inverse ETFs tomorrow. A big volume increase on the breakout will be good for the bears. A low volume breakout and a failure to close at the highs of the day will be good for the bulls. So far the volume in these ETFs has been weak compared to last fall which I recently wrote about.

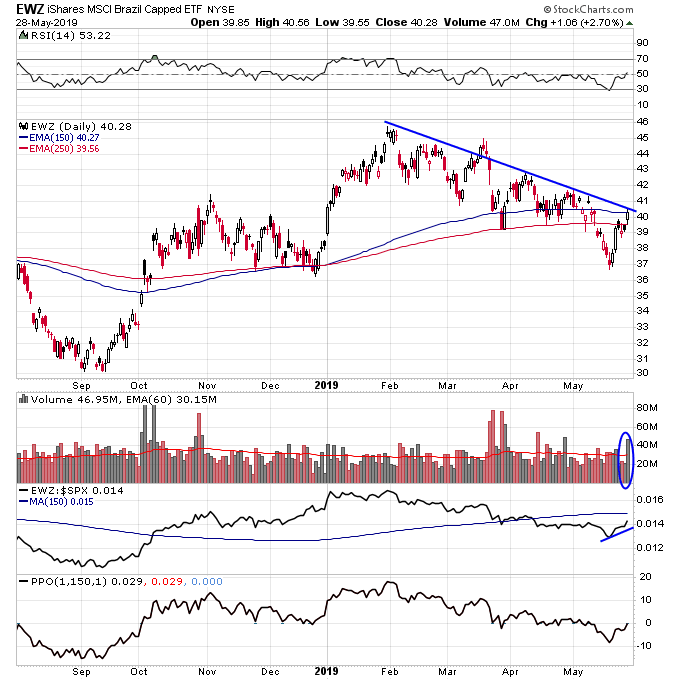

Emerging market ETFs EWZ and EEM are actually starting to outperform the S&P 500 over the previous few trading sessions. This is something to pay attention and could indicate a market that is getting close to putting in a bottom.

I continue to see a lot of strength in leading stocks even though generally the market remains weak. If we were really headed for a bear market I’d be seeing more leading stocks breaking down. Instead they look like they are consolidating and waiting for the market to put in a bottom so they can resume their uptrend.

Check out my Stage Analysis Screening Tool at: http://screener.nextbigtrade.com

Check out my trading videos on Youtube

Twitter: @nextbigtrade

The original article and much more can be found at: https://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.