The market corrected in May, but many leading stocks simply went sideways and held up while this correction was occurring. Once the pressure alleviated on the market over the last 4 days many leading stocks have exploded higher.

Before this correction ended we talked about a number of reasons why the market was not poised for a meltdown, including lack of volume in inverse ETFs, emerging markets were starting to put in a bottom, and leading stocks were trading sideways and not breaking down.

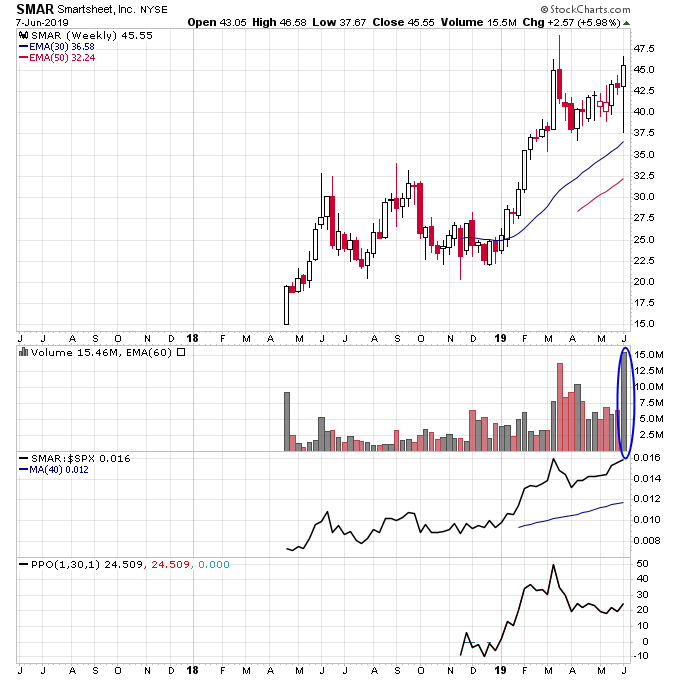

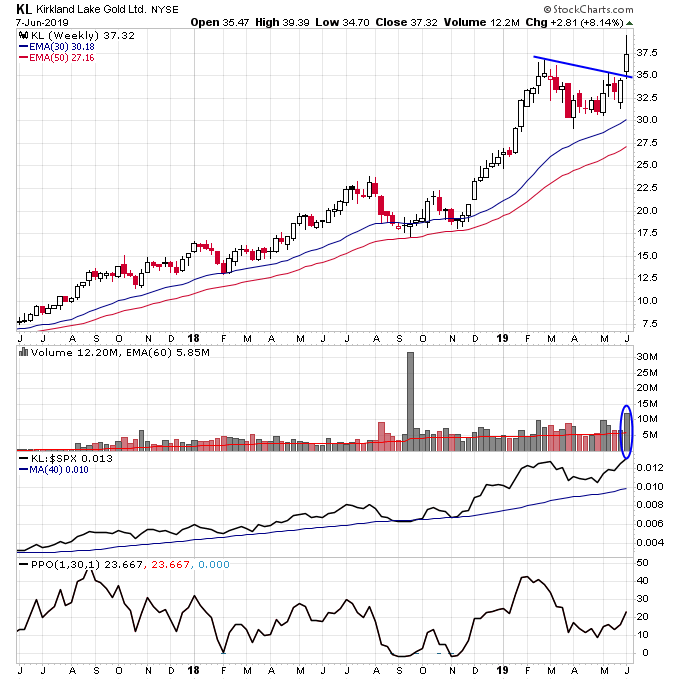

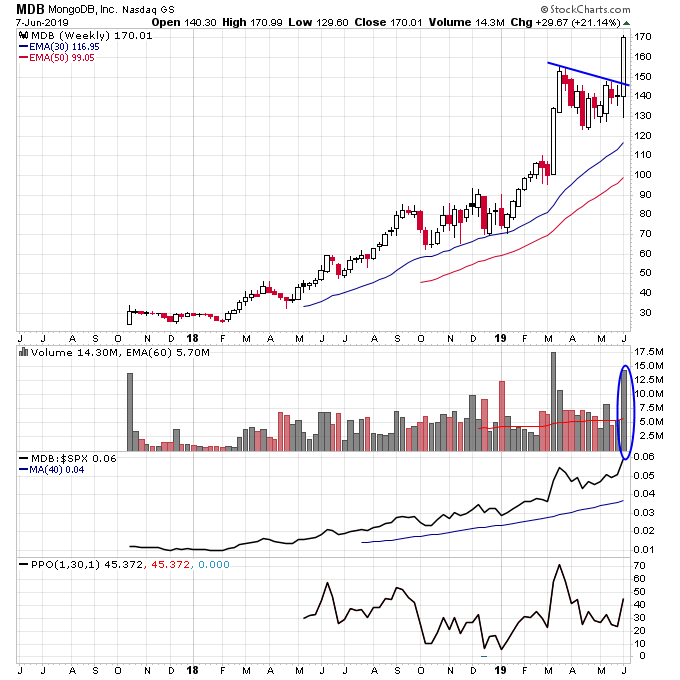

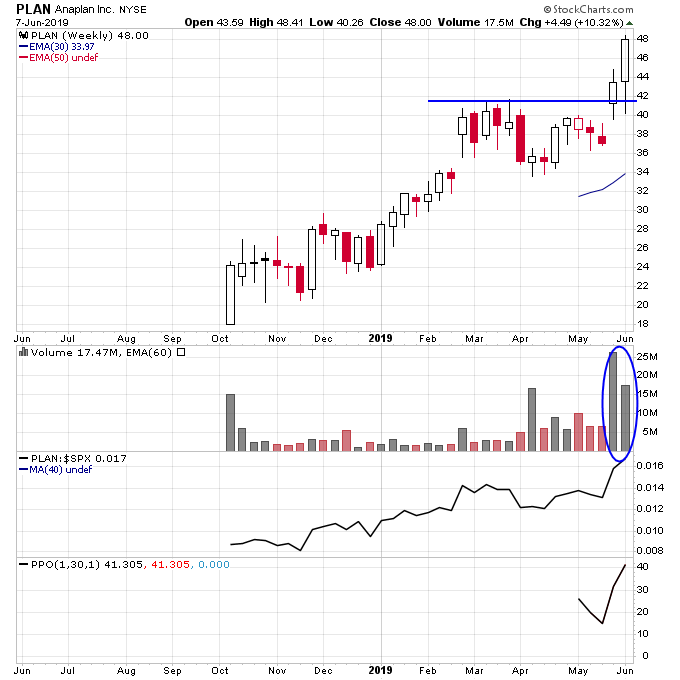

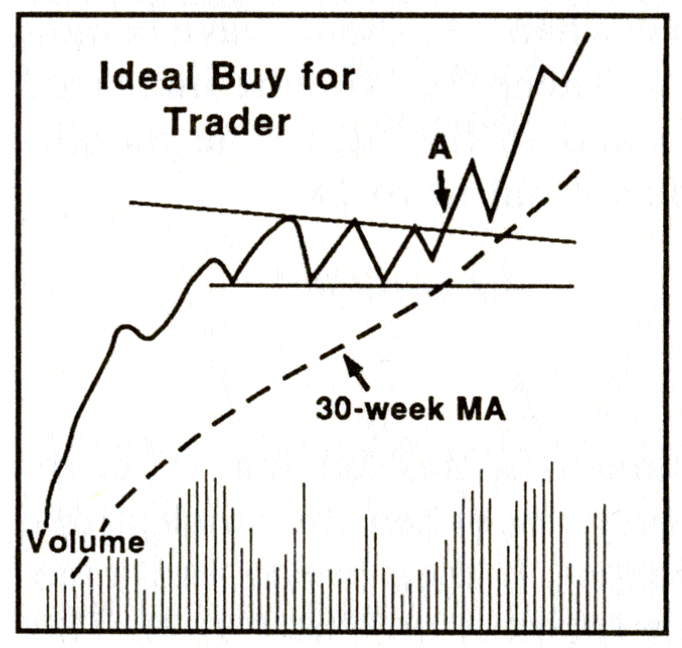

Here’s a sample of some of the Stage 2 continuation breakouts that have occurred over the last few days:

Disclosure: I am long SMAR and KL.

Checkout my new Stage Analysis Screening Tool at: http://screener.nextbigtrade.com

Checkout my trading videos on Youtube

Twitter: @nextbigtrade

The original article and much more can be found at: https://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.