Many of the newer generation of traders probably has no idea what happened to silver in 2011 but that was the year of the super spike in silver that took it over $50 an ounce. Later that year gold topped out as well and precious metals have been in a bear market since then, except for the big rally in 2016.

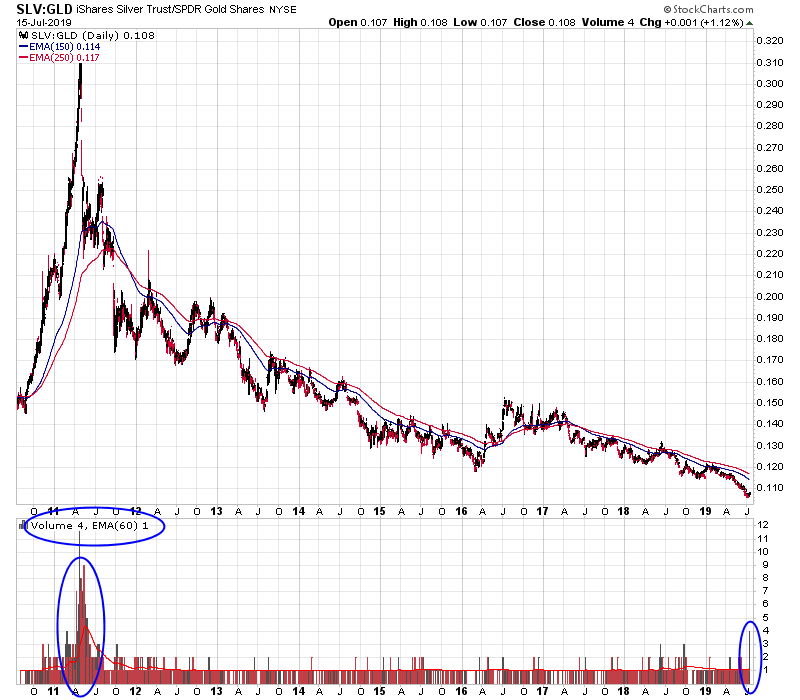

Silver today traded over 4x the daily volume in the SLV ETF than the GLD ETF. That hasn’t happened since 2011. I think this is extremely interesting because as we know from Stage Analysis big volume tends to precede big moves in a market.

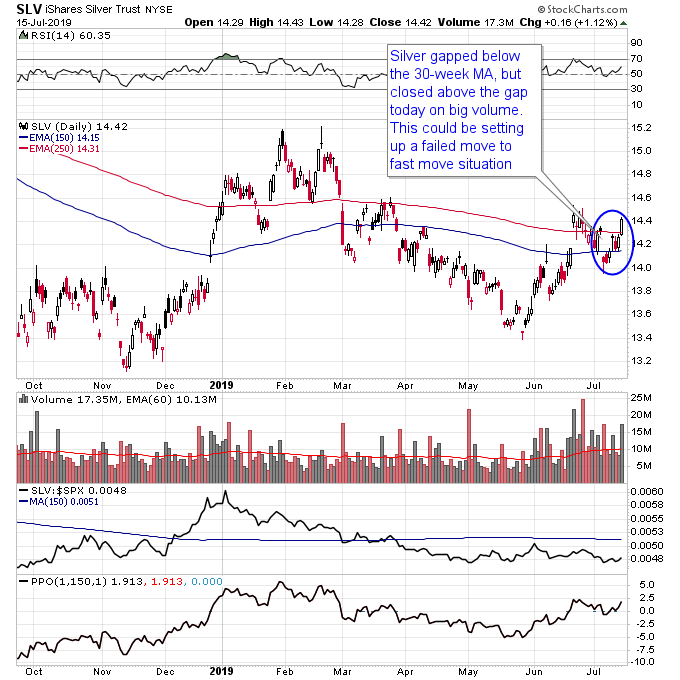

What is also interesting about today’s move in the SLV ETF is that it closed the gap down below the 30-week moving average on the 2nd highest bull volume of 2019. This is setting up a failed move lower to fast move situation.

The precious metals continue to digest their gains in a bullish fashion and I think it’s only a matter of time before things start moving higher aggressively again.

Disclosure: I am long SLV.

Checkout my new Stage Analysis Screening Tool at: http://screener.nextbigtrade.com

Checkout my trading videos on Youtube

Twitter: @nextbigtrade

The original article and much more can be found at: https://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.