Back in January of 2018 I went to cash and sidestepped the first part of this sideways bear market that we’ve been in since then. Bear markets are just a natural part of market cycles, and they can take the form of a Stage 4 decline or sideways price action that frustrates longs. This paves the way for a new bull market to emerge.

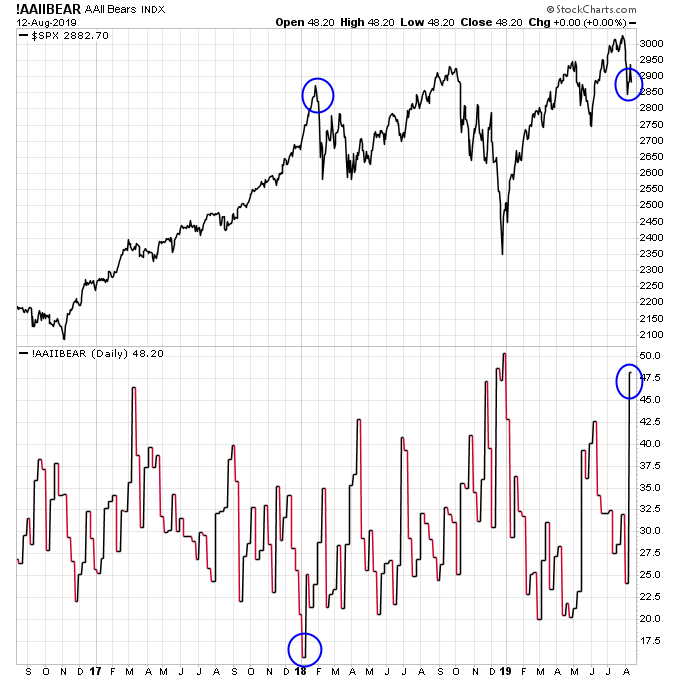

As you can see from the charts below the S&P 500 is at the same price level essentially that it was in January 2018, yet sentiment is much worse 20 months later than it was back then. If you remember back to January 2018 no one was asking for rate cuts from the Fed, but at the same price level now the market is demanding a rate cut. This is just one of many examples of how this market has grown fearful by going nowhere over the last 20 months.

The percentage of AAII Bears below is over 47% and at the same price level in January 2018 there was less than 20% bears.

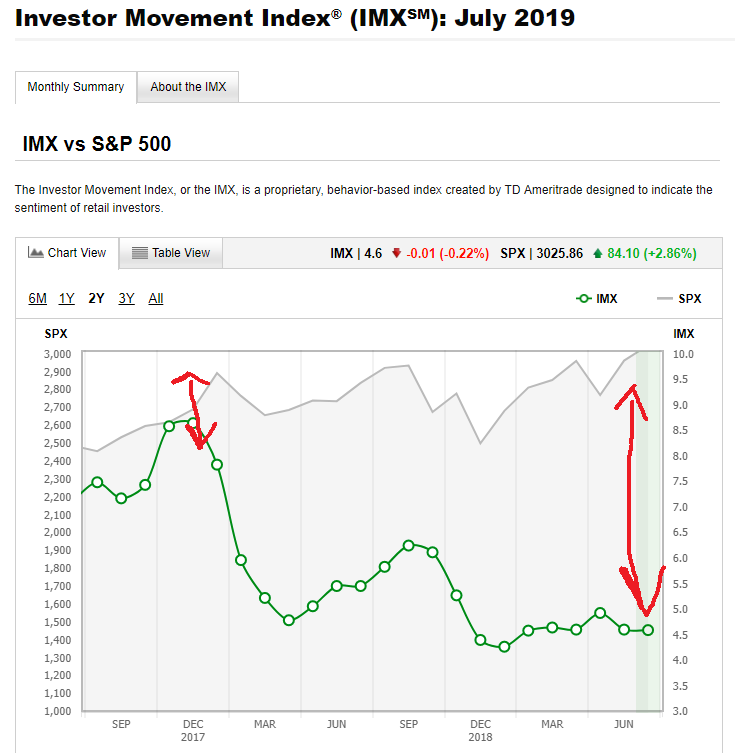

The Ameritrade IMX is another example of how investors have become less interested in this market over time with the market going nowhere with a few major dips. Notice how the IMX has declined with the S&P 500 at the same price level.

Checkout my new Stage Analysis Screening Tool at: http://screener.nextbigtrade.com

Checkout my trading videos on Youtube

Twitter: @nextbigtrade

The original article and much more can be found at: https://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.