Even though there is a lot of doom and gloom in the markets currently when I go over my list of leading stocks I still see a ton of stocks rising above a rising 30-week moving average. These stocks are simply still just correcting down to this moving average currently. Until they break the moving average this is just a normal correction within a Stage 2 uptrend.

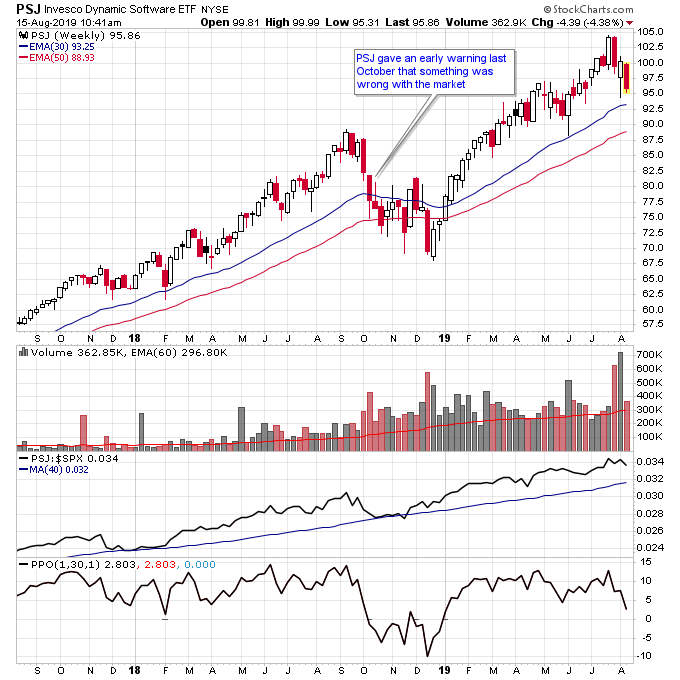

The software ETF PSJ which is a leading sector of the market gave an early warning signal last October that something was wrong by breaking the 30-week MA and trading below it. Right now it is still respecting this moving average.

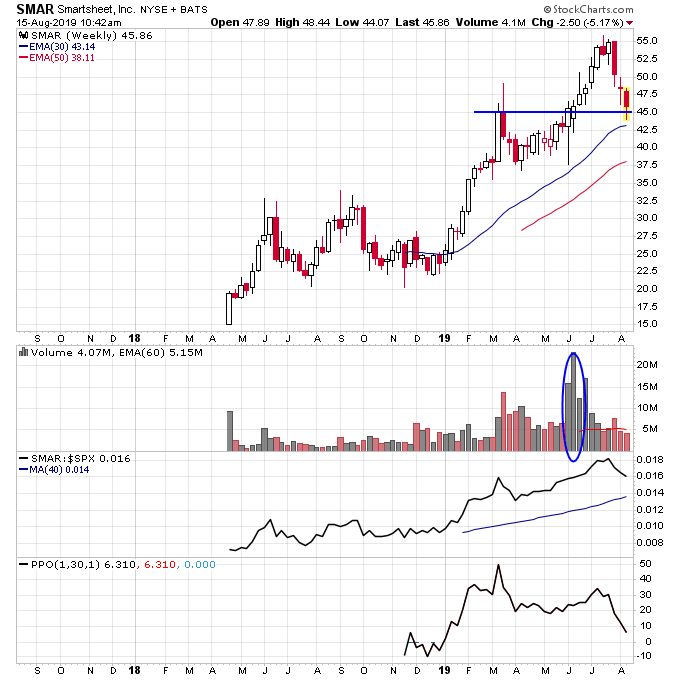

Similarly leading stock SMAR is now retesting its breakout around the 45 level.

If these moving averages hold we are just witnessing a normal pullback in the market. If they don’t hold then something is wrong with the market and the appropriate action would be to raise cash and get more defensive.

Disclosure: I am long PSJ and SMAR.

Checkout my new Stage Analysis Screening Tool at: http://screener.nextbigtrade.com

Checkout my trading videos on Youtube

Twitter: @nextbigtrade

The original article and much more can be found at: https://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.