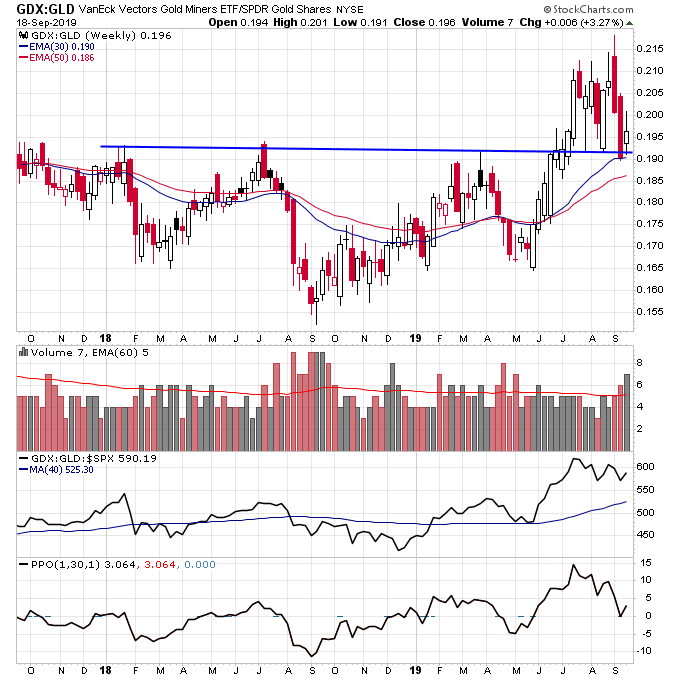

Gold stocks as a group have been underperforming the price of gold since early July besides a brief attempt to break higher in August. This is setting up a retest of the Stage 2 breakout level of the GDX:GLD ratio. This ratio is important because the only time you want to hold gold and silver mining stocks is when they are outperforming gold.

Gold is still well above the 30-week MA in a Stage 2 uptrend, but I would take a breakdown of this ratio below this support level as a sign something is wrong with the gold sector. So we need to see this important level hold for the Stage 2 uptrend in gold stocks to continue.

Checkout my new Stage Analysis Screening Tool at: http://screener.nextbigtrade.com

Checkout my trading videos on Youtube

Twitter: @nextbigtrade

The original article and much more can be found at: https://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.