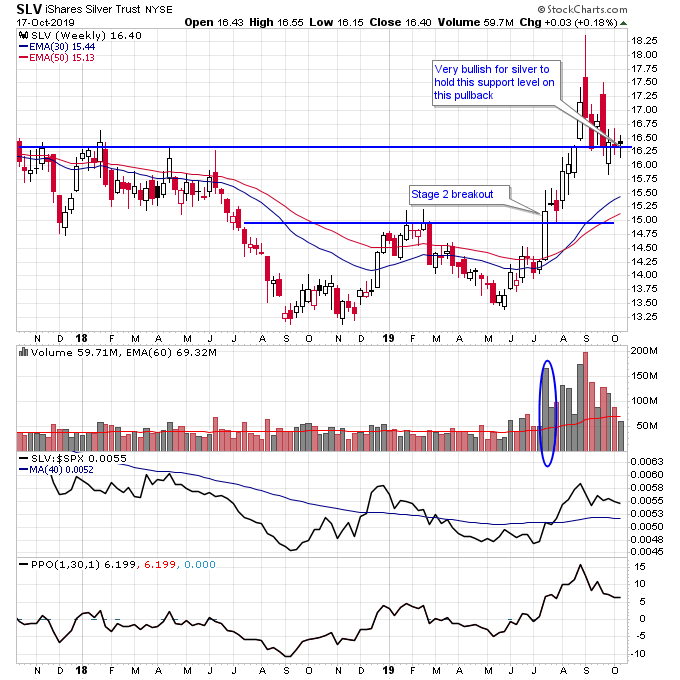

When silver broke out into a Stage 2 uptrend it had an area of resistance below $16.50 that it moved right through over multiple weeks. This area of resistance has now become support after an almost two month pullback in silver. This point is key because once the Stage 2 uptrend resumes in silver it will have no overhead resistance and be in “blue sky breakout” mode where the sky is the limit as to how high it might go.

Some would say that silver has longer term resistance above $16.50, but from a Stage Analysis perspective we are only concerned with resistance that stretches back 2 years. The reason is the longer the time frame the more likely it is that frustrated holders would have “sold out” by now and moved on to something else rather than continuing to hold a losing position in silver.

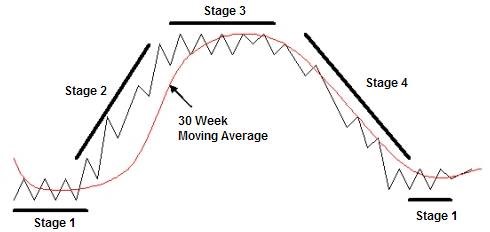

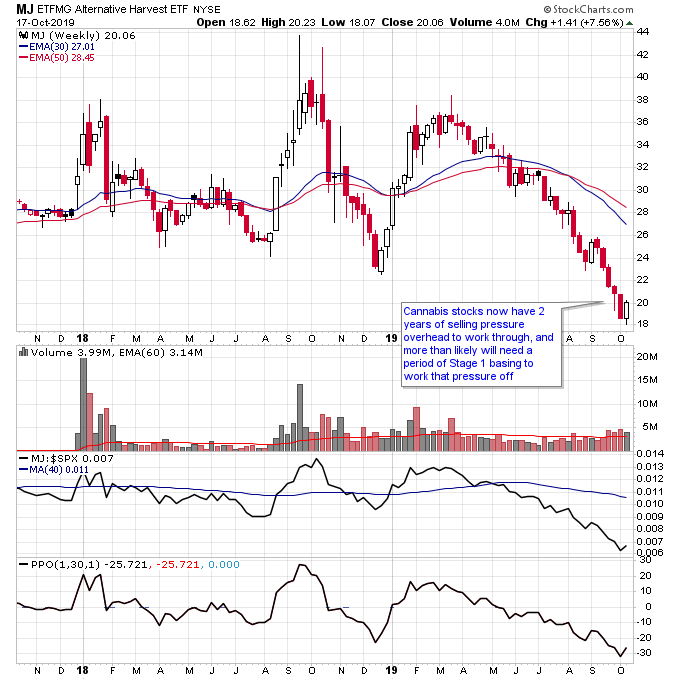

The Stage 1 phase is perhaps the most underappreciated phase by value investors looking to “buy the dip”, such as what is going on with cannabis stocks right now. Immediately after a Stage 4 downtrend ends, there is a wall of bag-holders that represent overhead selling pressure that usually takes many months if not years for the market to work through. This is why attempting to buy the end of a Stage 4 downtrend is a critical mistake because it is less likely that a Stage 2 uptrend will immediately take place afterward.

Gold and silver investors don’t have to worry about this because they’ve already been through a multi-year Stage 1 basing phase which has cleared out the overhead supply that existed after the 2011-2014 Stage 4 downtrend.

Checkout my new Stage Analysis Screening Tool at: http://screener.nextbigtrade.com

Checkout my trading videos on Youtube

Twitter: @nextbigtrade

The original article and much more can be found at: https://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.