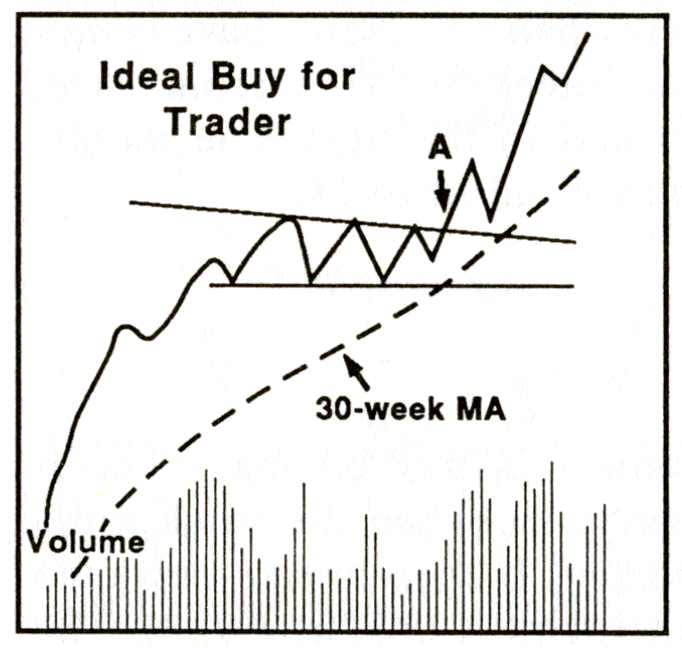

Gold and silver have been in a sideways correction since the start of September, consolidating after the Stage 2 breakout a few months earlier. Some gold and silver miners however have started to build the right side of their bases and move higher on volume after earnings. These higher quality gold and silver miners are clearly benefiting from higher metal prices, which is showing up in their price action on the charts.

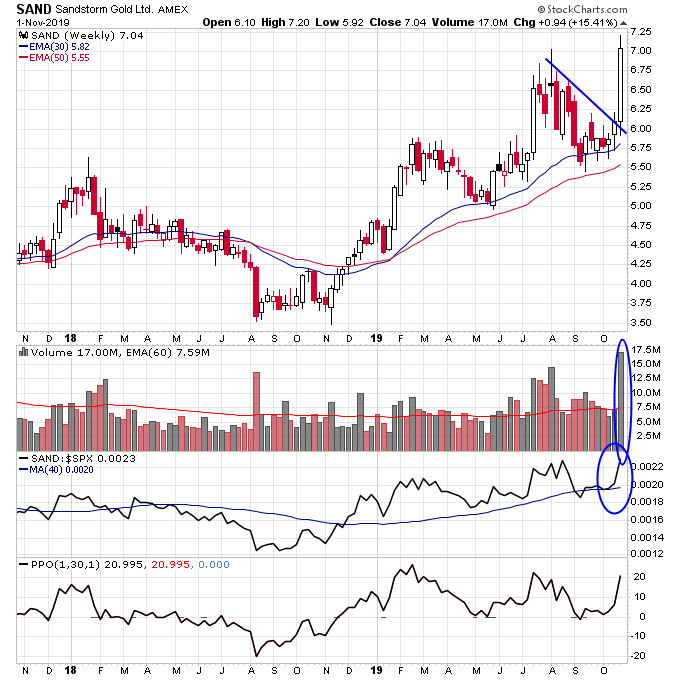

One gold stock so far has had an exceptional reaction after earnings and that is Sandstorm Gold. After reporting earnings SAND had its largest daily upside volume ever in the stock and finished the week with 2x average weekly volume. This results in a Stage 2 continuation breakout for SAND.

One other thing to note is that any gold and silver miner that has a negative reaction to earnings in this environment is probably not worth owning. In Stage Analysis you want to own the leaders of a sector, not the laggards.

Disclosure: I am long SAND.

Checkout my new Stage Analysis Screening Tool at: http://screener.nextbigtrade.com

Checkout my trading videos on Youtube

Twitter: @nextbigtrade

The original article and much more can be found at: https://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.