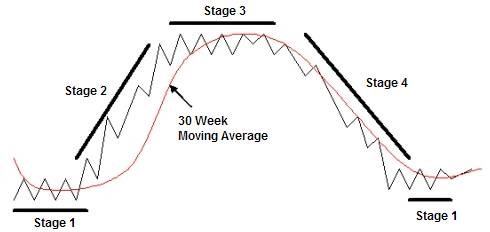

Most cannabis stocks moved into Stage 4 during the May-July timeframe and have been a catastrophic downtrend ever since. Anyone following the rules of Stage Analysis would have exited these stocks during the May-July timeframe and would not have thought about trading them from the long side since because they have remained in Stage 4 the entire time. The #1 rule of Stage Analysis is to get out of any stock that moves into Stage 4 because you never know how low it will go, it could have a shallow pullback or it could go to zero.

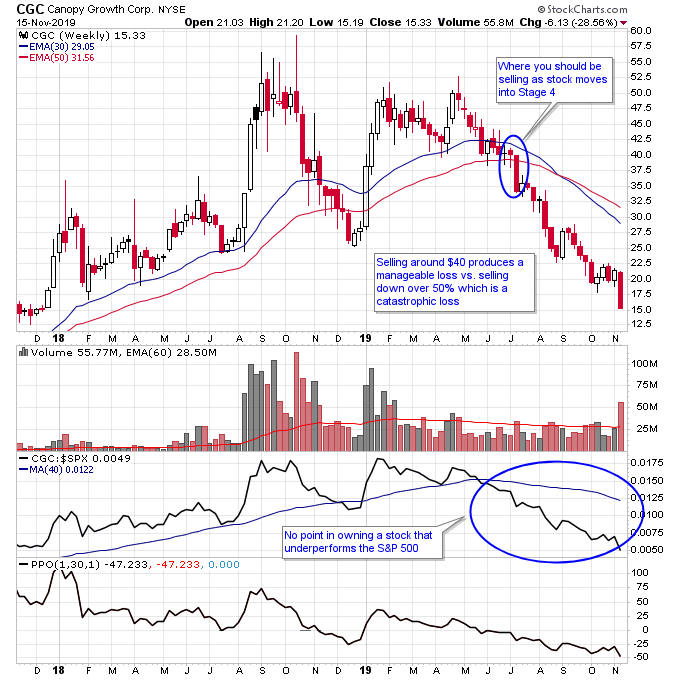

If you look at CGC for example below let’s say a long trade was put on when CGC tried to break above $50 in late April (which turned about to be a bad time to buy as the breakout failed). If the rules of Stage Analysis were followed and the stock was exited as it broke $40 then a loss of around 20% would have been taken on the position. This is much more manageable than losing 60%+ where the stock trades today since it has continued its Stage 4 downtrend with no indication of a bottom yet.

Mathematically the only way to be a profitable trader or investor is to minimize big losses, and the way Stage Analysis accomplishes that is exiting any stock that moves into Stage 4. This frees up capital to either re-deploy into stocks that are moving into Stage 2 or remain in cash if the overall market is in Stage 4 or there are few opportunities in the market.

Checkout my new Stage Analysis Screening Tool at: http://screener.nextbigtrade.com

Checkout my trading videos on Youtube

Twitter: @nextbigtrade

The original article and much more can be found at: https://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.