When trading IPOs using Stage Analysis I like to look for a basing formation and breakout on volume to signal a potential new uptrend. This is exactly what has happened with Luckin Coffee (LK) recently which I’ve highlighted in recent articles. Obviously with IPOs the critical 30-week moving average doesn’t come into play until 30 weeks after the IPO so we have to wait to factor that into the analysis of the stock.

The problem with IPOs when they debut is that insiders are often cashing out on the stock when lockups expire after the stock starts trading on an exchange. At the same time institutions are slowly building positions and potentially waiting for the first few earnings releases to evaluate the stock. This results in a lot of thrashing in the stock price of IPOs for up to a year or more after the IPO until the selling pressure from insiders alleviates and buying pressure from institutions produces a Stage 2 breakout at some point and a new uptrend.

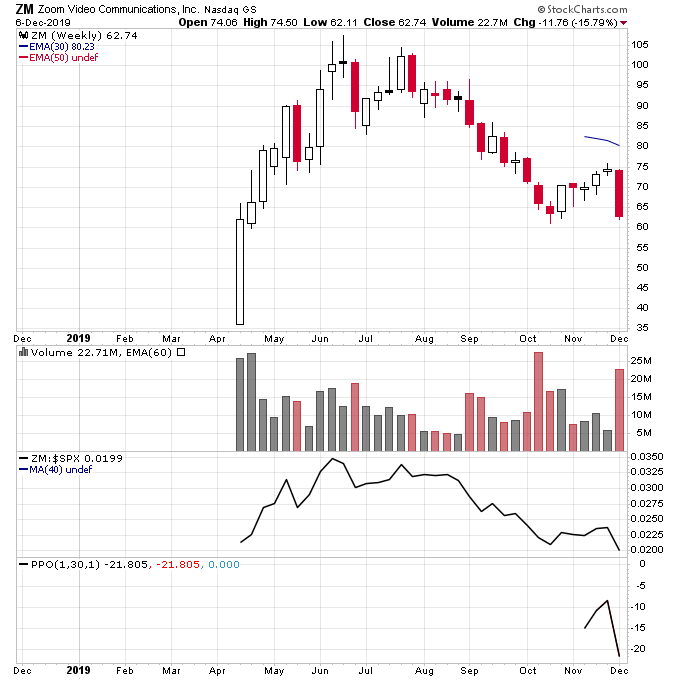

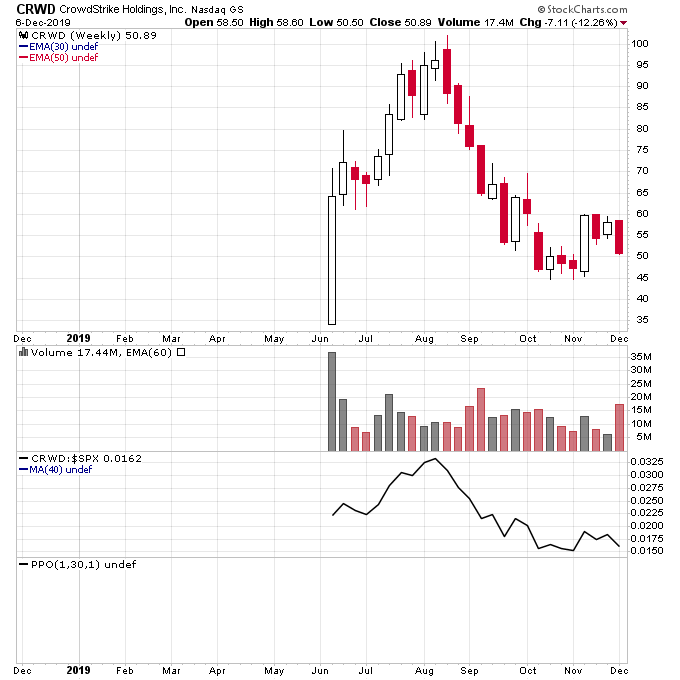

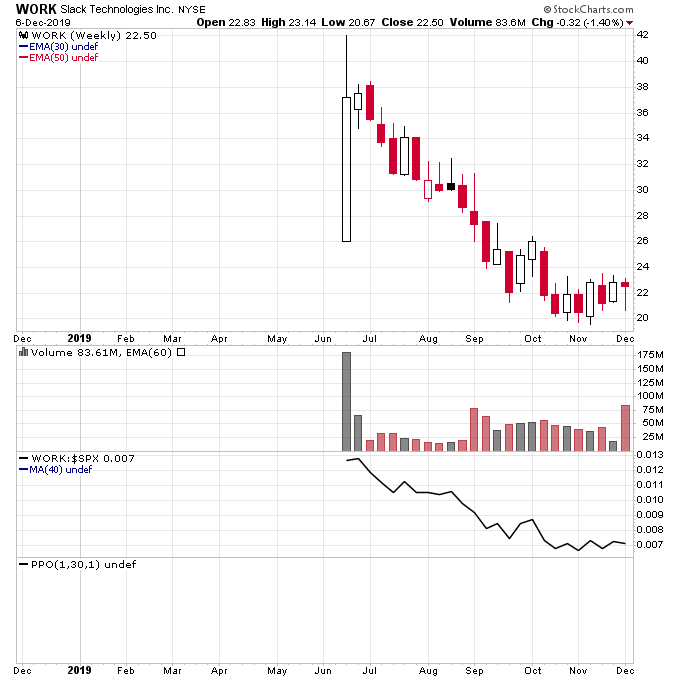

ZM, CRWD, and WORK all came out of the gates with huge buying pressure on their IPO date and this resulted in multi-week moves higher. The problem with buying IPOs right out of the gate though is you don’t know the volume was higher than normal because there is no established trading history. Therefore the initial move higher for an IPO if it happens is really not tradeable from a Stage Analysis perspective. And more often than not these initial moves are sold into by insiders which creates the first IPO base in the stock.

With ZM, CRWD, and WORK all three of these stocks corrected in the fall and came under more selling pressure after earnings last week. More than likely each of these stocks will continue to build their IPO bases and trade sideways and there is no Stage 2 breakout signal yet in any of these stocks.

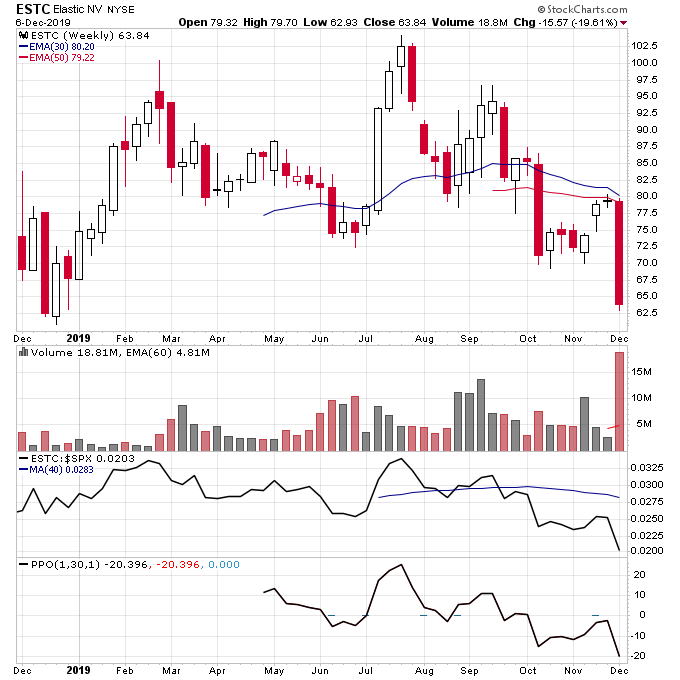

ESTC is different from the previous 3 stocks, it IPOed in 2018 and tried to establish an uptrend in September of this year after trading 3 consecutive weeks on above average volume. Ultimately the breakout above resistance failed though and the stock moved back below the 30-week moving average. After earnings last week it gapped lower on big volume and is actually now in a Stage 4 downtrend and should be avoided.

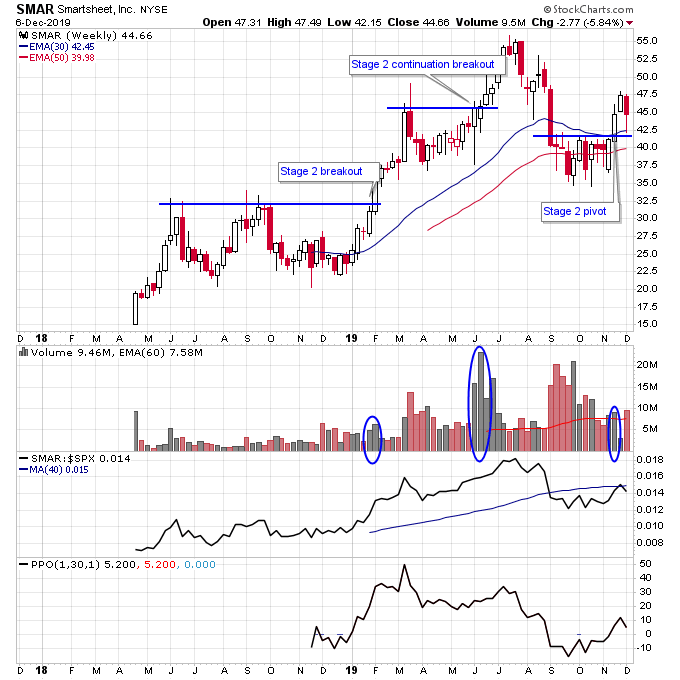

SMAR was a stock that looked promising earlier this year that I traded after it made a Stage 2 continuation breakout back in June. That move higher ultimately topped out like a lot of other tech stocks and broke down below the 30-week moving average in September where it consolidated just below. Then we got a pivot higher on above average volume a couple weeks ago and the reaction after earnings for SMAR was pretty muted with the stock holding above the 30-week moving average. SMAR might just need more time to build a base here before resuming its Stage 2 uptrend.

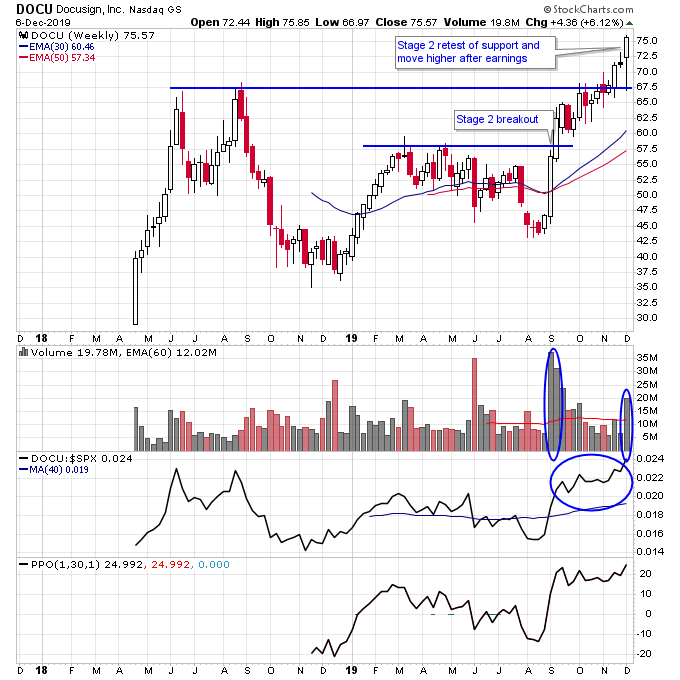

Which brings us to the far and away best looking stock of the group which is DOCU. DOCU completed a Stage 2 breakout on huge volume back in September which is notable because the stock market was weak during that period. The stock continued to grind higher after that breakout and encountered resistance around 65 from the previous high after the IPO. After earnings last week DOCU retested that level after moving through it over the past few weeks and closed near the high for the week. DOCU now has no overhead resistance and is set to continue its Stage 2 uptrend.

So in conclusion from a Stage Analysis perspective only one of these stocks is meeting the criteria of a leading stock and that is DOCU. The other stocks either need more time to complete their bases or in the case of ESTC is now in a downtrend.

Checkout my new Stage Analysis Screening Tool at: http://screener.nextbigtrade.com

Checkout my trading videos on Youtube

Twitter: @nextbigtrade

The original article and much more can be found at: https://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.