Profitable trading is about taking good risk/reward trades, and letting winners run and cutting losers short. In Stage Analysis we take good risk/reward trades by either buying a Stage 2 breakout from a Stage 1 base or a Stage 2 continuation breakout which is a breakout from a consolidation within an existing uptrend. Both of these buy points attempt to get in early in the uptrend, not at the exact bottom but at the point where it becomes apparent institutions are getting into the stock aggressively (because of the big increase in volume this becomes apparent).

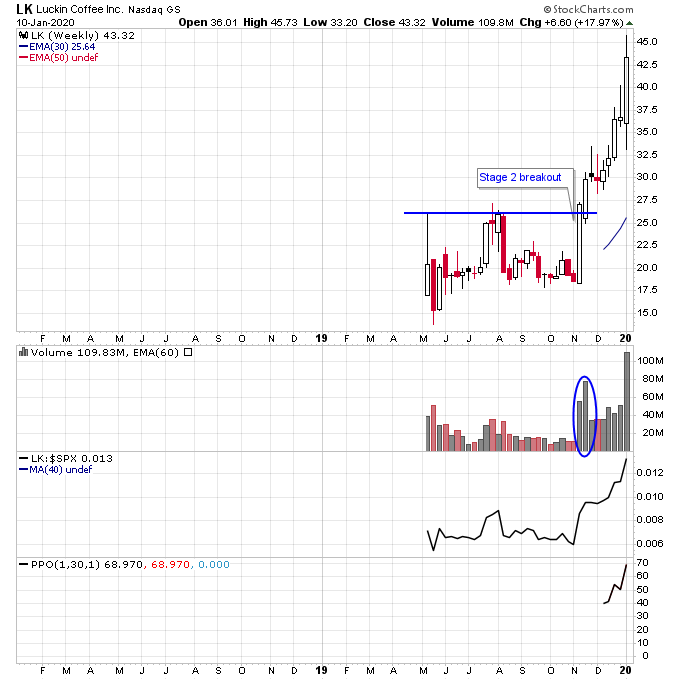

LK broke out of a Stage 1 base in November on a huge increase in volume and is up over 60% since then. This is one of the best Stage 2 breakouts I’ve seen over the past few months as it had all the right conditions including a massive volume increase and no overhead resistance.

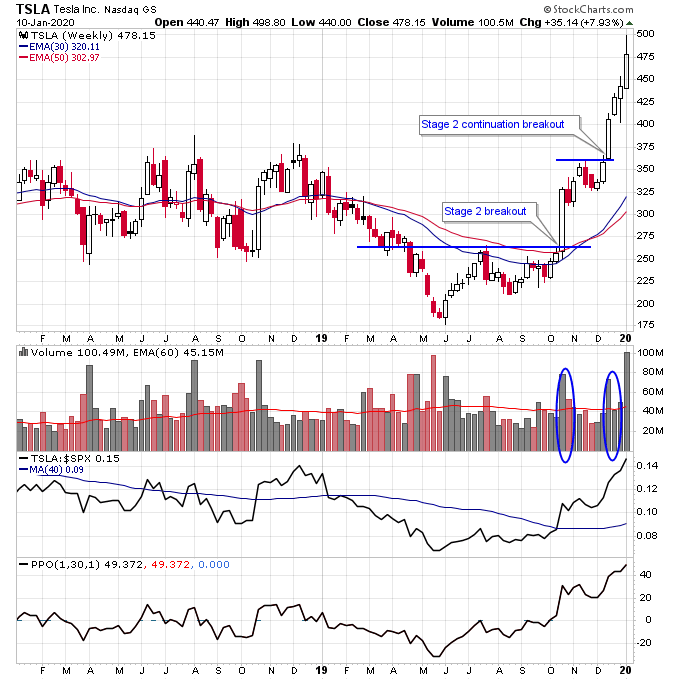

TSLA broke out in October on a big increase in volume after earnings and is up over 50% since then.

TSLA took a little while longer than LK to get going, perhaps because of some overhead resistance remaining after the Stage 2 breakout. Stan Weinstein says to be patient after the Stage 2 breakout because stocks can pullback after this initial move and take a little while longer to really get going. The last thing you want to do is give up your good risk/reward entry because of impatience especially if the stock has held above the breakout point.

TSLA and LK are now beyond good risk/reward ratio buy points. But you will find that more people are interested in trading them now because of how well they have recently performed. Fear of missing out (otherwise known as greed) is a powerful emotion.

Of course TSLA and LK could keep running here, but the longer the rally goes the more likely the stocks will enter a consolidation period next (often kicked off by a sharp pullback) and that’s where these stocks would setup again for the next quality risk/reward entry point.

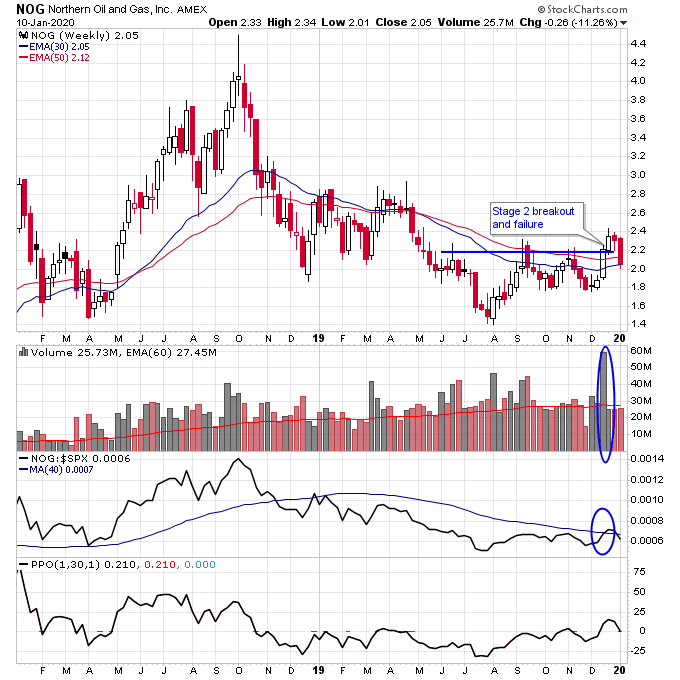

NOG is an example of a Stage 2 breakout that failed and went back below the buy point. The correct action there would be to cut the position which is what I did. Looking back at NOG there are multiple problems here, the stock had overhead resistance and the sector as a whole is still not breaking out yet. Perhaps oil and gas stocks need more time to base in Stage 1 before the sector gets going.

By cutting a position that isn’t acting properly short, you free up capital to deploy into other good risk/reward setups (Stage 2 breakouts and Stage 2 continuation breakouts).

The great thing about the stock market is new opportunities will always be around the corner, you just have to be patient and wait for them. Waiting for the next great Stage 2 entry is key, and not chasing existing Stage 2 winners or holding Stage 2 breakouts that failed and rolled over back into Stage 1, or especially into a dangerous Stage 4 downtrend.

Disclosure: I am long LK and TSLA.

Get more info on Stage Analysis or Stan Weinstein’s book

Check out my trading videos on Youtube

Check out my Stage Analysis Screening Tool at: http://screener.nextbigtrade.com

Twitter: @nextbigtrade

The original article and much more can be found at: https://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.