Sometime over the next few weeks I believe we will have a market pullback, and laid out some thoughts here:

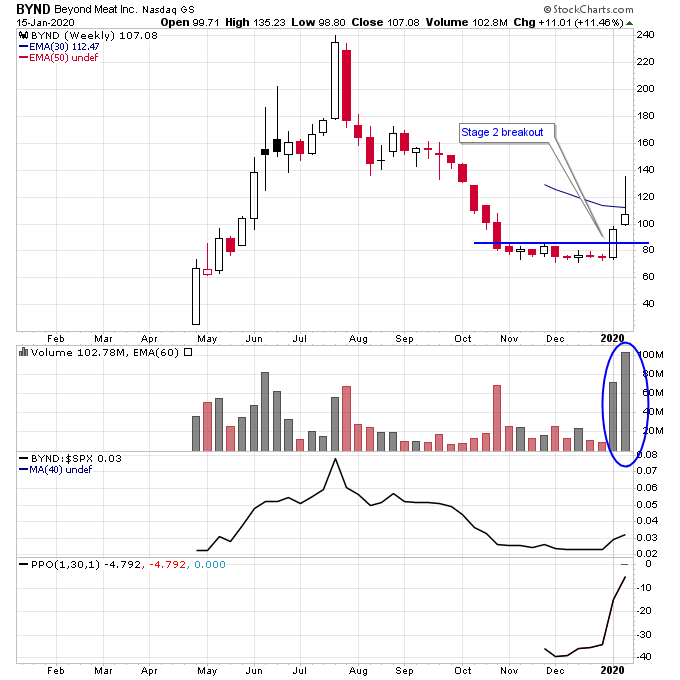

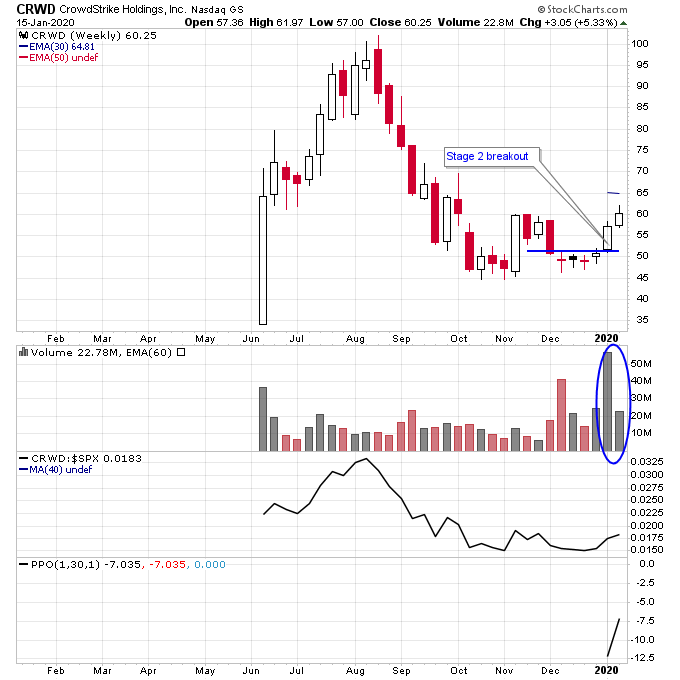

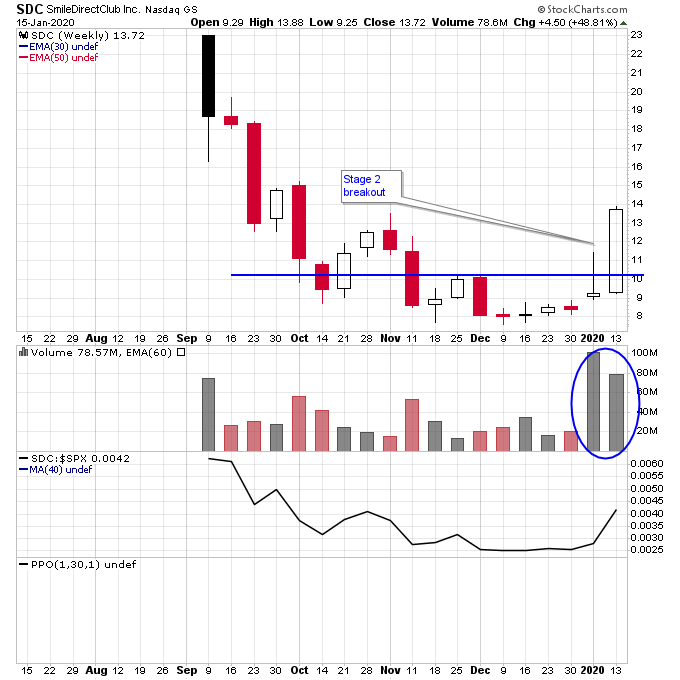

In the meantime though there are still plenty of stocks breaking out on volume. Some IPOs that were beat up last fall have taken enormous volume and have broken out of bases. BYND and SDC I think are interesting in particular because there is a cloud of pessimism around each of them with high short positions, but the accumulation taking place here by institutions is undeniable.

Note above that some of these stocks are breaking out below their 30-week moving average. Since the moving average is still being established due to the stocks being IPOs I think it is more important that they are breaking out of a base on huge volume (indicating transition from Stage 1 to Stage 2). The moving average is less representative of the trend here until more trading history takes place and it becomes more established.

Disclosure: I am long BYND, CRWD, SDC.

Get more info on Stage Analysis or Stan Weinstein’s book

Check out my trading videos on Youtube

Check out my Stage Analysis Screening Tool at: http://screener.nextbigtrade.com

Twitter: @nextbigtrade

The original article and much more can be found at: https://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.