One of the ways you can get a read on a potential correction or end of a correction is studying the way leading stocks behave. When stocks are heading into a correction you tend to see far fewer breakouts happening because the overall market is under pressure. When stocks are wrapping up a correction you tend to see the stocks that held up the best start to breakout on volume and in some cases immediately start making new highs.

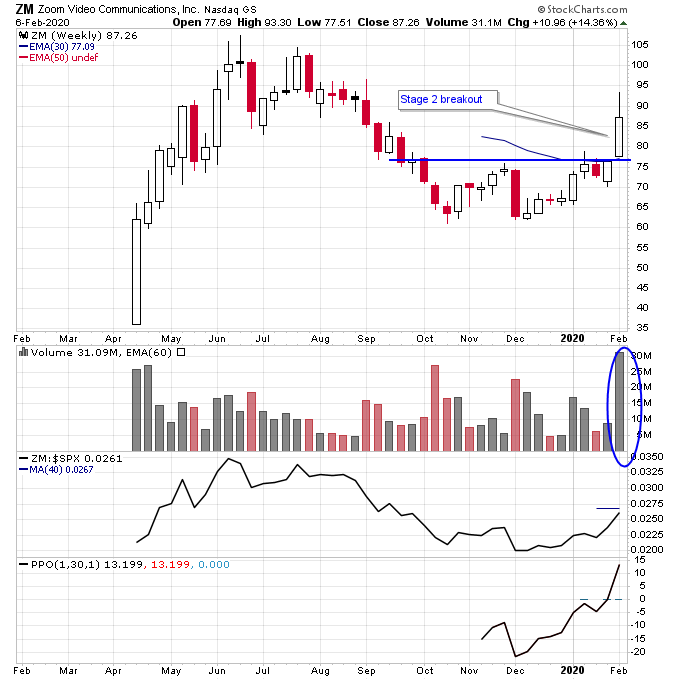

Even though this Coronavirus correction hasn’t lasted very long I’m starting to see evidence of the latter above when studying how stocks are behaving. Two examples of stocks acting well are Zoom Video which completed a Stage 2 breakout this week on heavy volume.

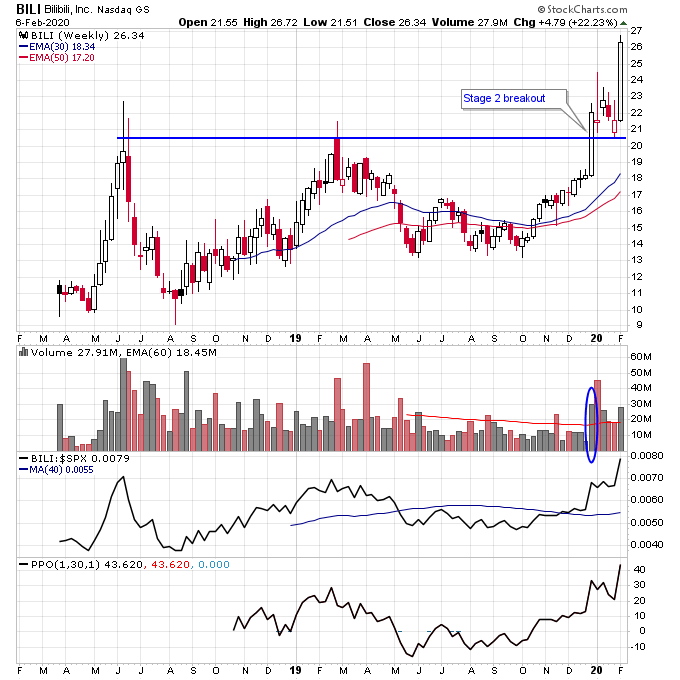

Besides seeing fresh Stage 2 breakouts I’m seeing previous recent Stage 2 breakouts start to follow through on volume. If the market were really in trouble we should be seeing those stocks continue to falter, but that doesn’t seem to be the case. One example of this is BILI which I highlighted in a previous video on my Youtube channel. BILI has followed through this week on huge volume after breaking out into Stage 2 a few weeks ago.

Disclosure: I am long ZM and BILI.

Get more info on Stage Analysis or Stan Weinstein’s book

Check out my trading videos on Youtube

Check out my Stage Analysis Screening Tool at: http://screener.nextbigtrade.com

Twitter: @nextbigtrade

The original article and much more can be found at: https://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.