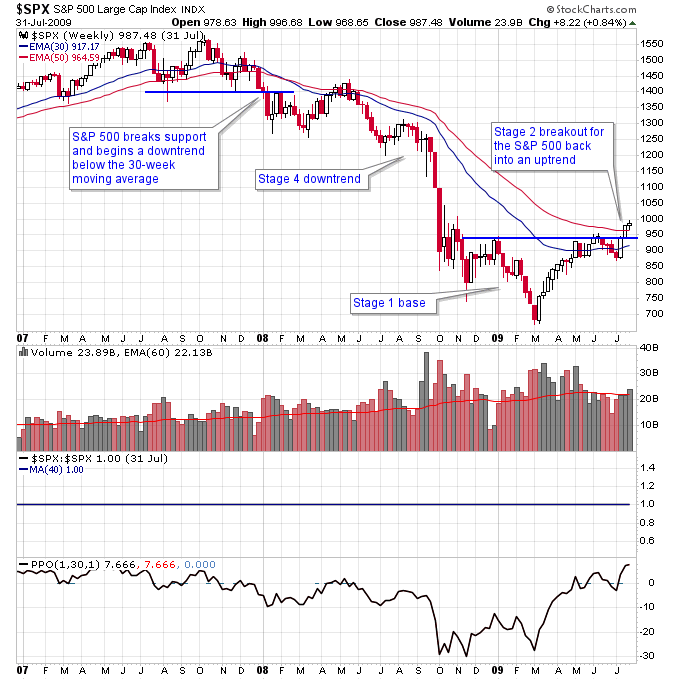

Stan Weinstein says that if you only do one thing from reading his book, which is refuse to buy or hold stocks that are in a Stage 4 downtrend, your results will improve dramatically. If you look at the 2008 bear market in the S&P 500, using Stage Analysis the exit signal was around 1400 in early 2008 well before the fall of 2008 where the rout began and the S&P 500 got crushed. After the breakdown in early 2008 the 30-week moving average became resistance which is what happens in a down-trending market and it was simple to stay out of the market by using the price action below a falling 30-week moving average as your guide to be out of the market.

Of course you’d be down 10% from the top if you waited until 1400 to get out, but that’s a much more recoverable loss than being down 50% at the end of this bear market.

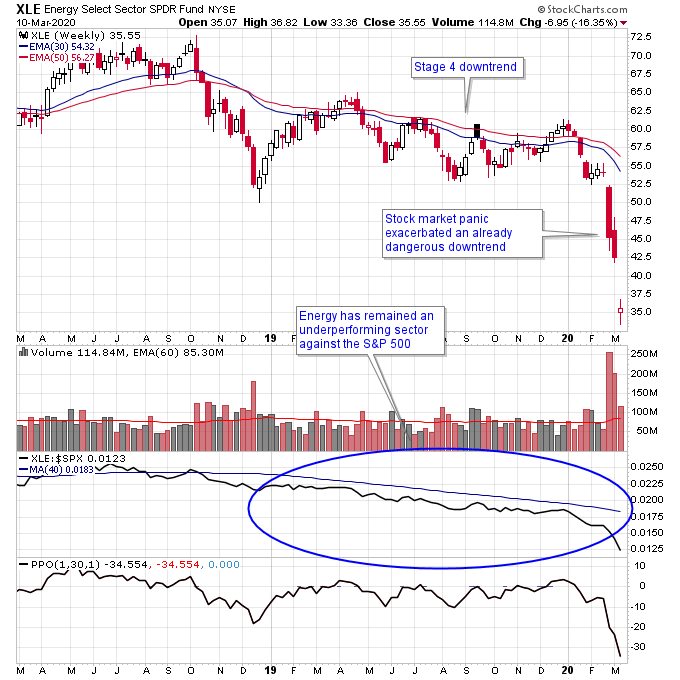

Oil and gas stocks are one of the worst performing sectors so far in 2020 with XLE down over -40%. If you notice what was going on before the recent sharp move downward was a Stage 4 downtrend and under-performance against the S&P 500. This bad situation was exacerbated by the recent stock market panic and also a price war on the price of oil.

Even though energy stocks may have appeared to be a bargain heading into 2020 we can see that with Stage 4 downtrends the eventual bottom can occur much further down than one can imagine.

Get more info on Stage Analysis or Stan Weinstein’s book

Check out my trading videos on Youtube

Check out my Stage Analysis Screening Tool at: http://screener.nextbigtrade.com

Twitter: @nextbigtrade

The original article and much more can be found at: https://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.