Stan Weinstein said this during an interview about the 1987 stock market crash:

“What I learned long ago, when you’re in a crash sequence, you don’t try and guess a bottom.”

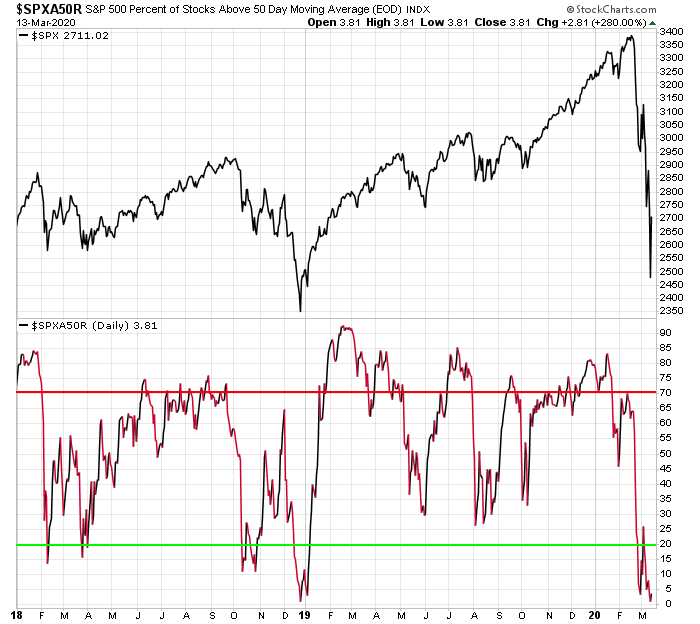

With the remaining leadership sectors in the stock market getting hit hard last week the market now has only the tech sector hanging on by a thread. Essentially what this means is we are now broadly in a downtrend. We are oversold on a short term basis though and the market could easily bounce from here and reset sentiment. The percentage of stocks above the 50-day moving average on the S&P 500 is at a level where the market typically bounces from, but if we are still in a crash sequence this will just remain low until the crash is over.

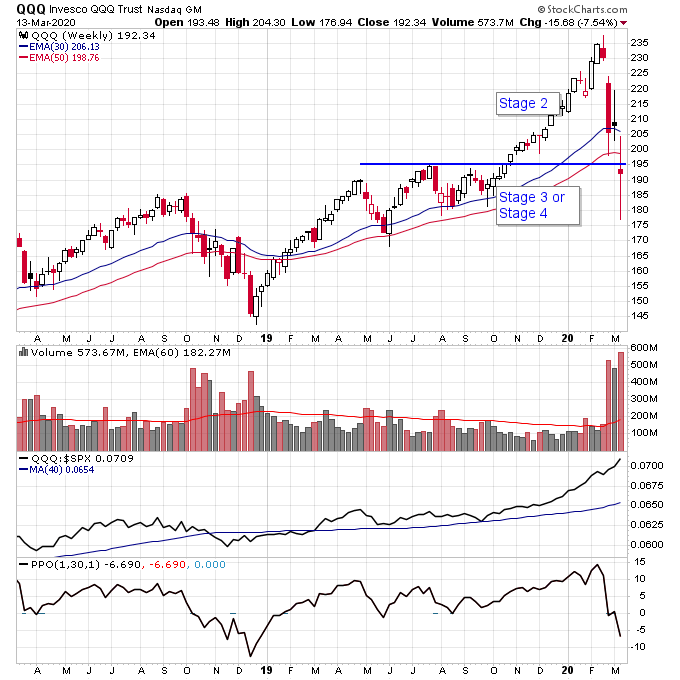

A rollover of the tech sector would be a huge negative for the market given its 20%+ weighting in the S&P 500 and would make the big correction so far in the stock market just the opening act. The QQQ ETF needs to re-take the 195 level to resume a Stage 2 uptrend in technology stocks. If that doesn’t happen then we have to wait for this bear market to play out, which could take weeks to months.

With Stage Analysis we only want to be involved in the market when the S&P 500 is not in a downtrend. Currently that’s not the case so the best place to be is in cash on the sidelines.

At the end of this panic there is going to be tremendous opportunity, we haven’t seen a Stage 4 bear market this significant in the S&P 500 since 2008 and it produced awesome opportunities in 2009 and 2010. The key is going to be patience though, this market might just continue crashing or perhaps it puts in a low, rallies up to the 30-week moving average, then rolls over again. Whatever the case until volatility decreases and we see leadership stocks start to reject the lows in the S&P 500 we’ll have to wait for this to play out.

Get more info on Stage Analysis or Stan Weinstein’s book

Check out my trading videos on Youtube

Check out my Stage Analysis Screening Tool at: http://screener.nextbigtrade.com

Twitter: @nextbigtrade

The original article and much more can be found at: https://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.