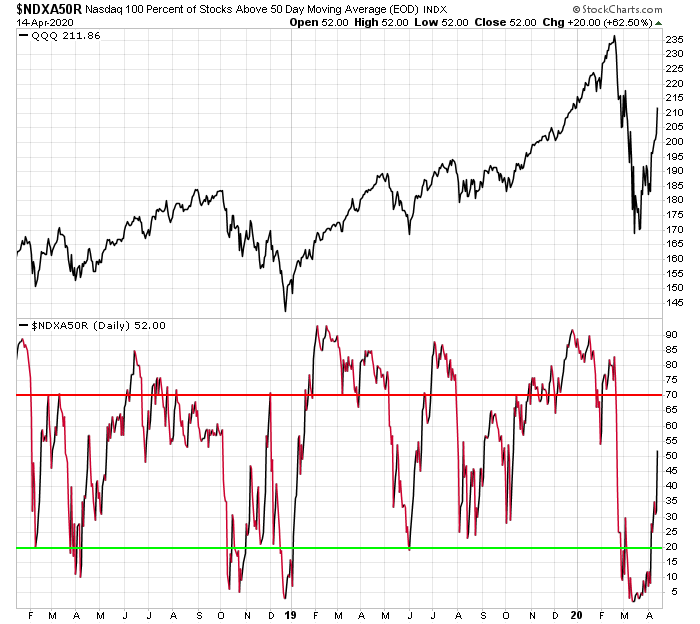

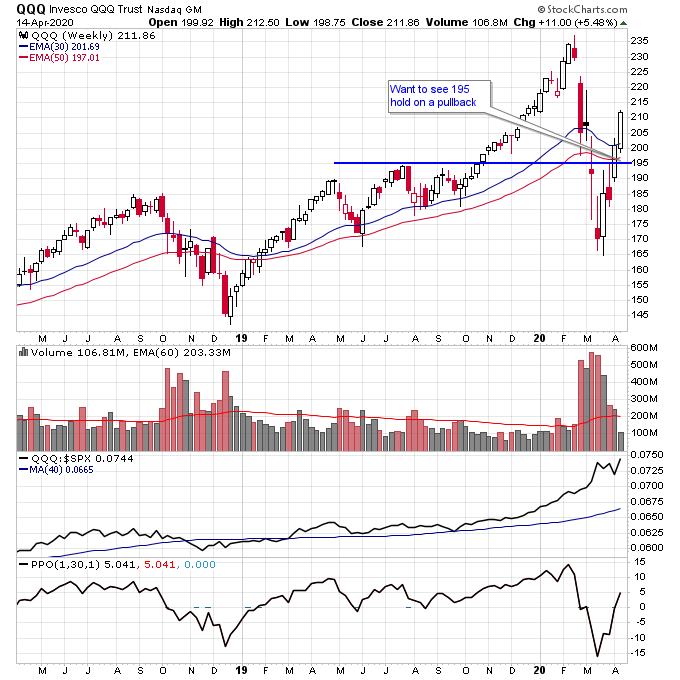

The Nasdaq 100 ETF QQQ has now broken back above the 30-week moving average after an impressive thrust off the bear market lows in mid-March. The percentage of stocks above the 50-day moving average has surged to over 50 percent in the Nasdaq 100 which is something I discussed back in March as the market worked off its oversold condition.

I will be watching this index closely for how it reacts to the next pullback. If it can hold above 195 which is a resistance zone from 2019 that is bullish for the stock market. Or even more bullish would be if it holds the 30-week moving average on a pullback. If it fails at 195 then the bear case would be in play and the rally off the March lows could possibly have been a bear market rally.

Along with QQQ I’ll be watching to see how SPY acts as it approaches the 30-week moving average. As I’ve discussed in previous videos the best place to enter short positions is above the 30-week moving average in a bear market, but it’s also important to be open-minded and flexible in case the bear market is over and the market merely consolidates on the next pullback.

Get more info on Stage Analysis or Stan Weinstein’s book

Check out my trading videos on Youtube

Check out my Stage Analysis Screening Tool at: http://screener.nextbigtrade.com

Twitter: @nextbigtrade

The original article and much more can be found at: https://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.