After a huge move off of the coronavirus panic lows in March and April precious metals have spent a couple months consolidating while leading growth stocks made big moves higher. Then in early June the S&P 500 started a consolidation and gold has broken to new highs. Leading growth stocks are also finally coming under pressure after a big four month run.

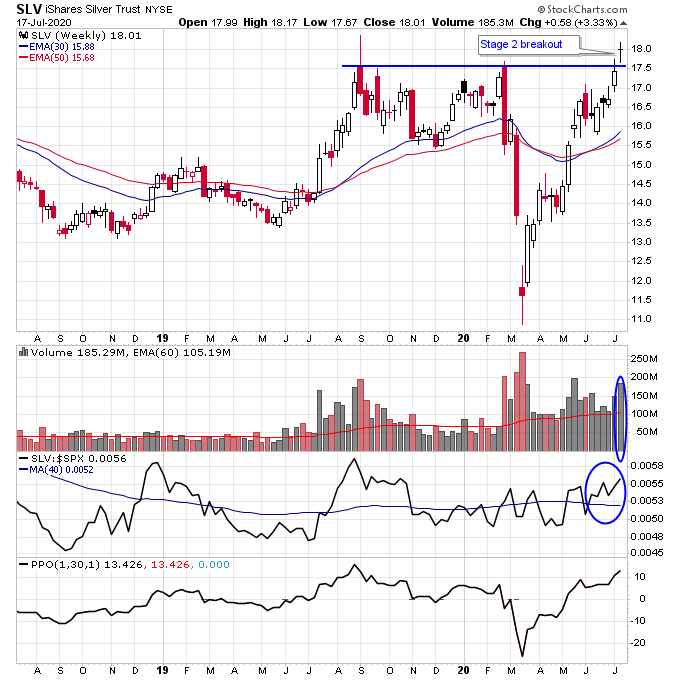

While leading growth stocks may need more time to digest their big gains, silver completed a Stage 2 breakout last week on the second largest weekly upside volume of the year. Silver broke above resistance from the top of the 2019 Stage 2 move and where silver made a panic plunge during the coronavirus meltdown in 2020 ($17.50 on the chart of SLV below). Clearly this is a significant resistance level.

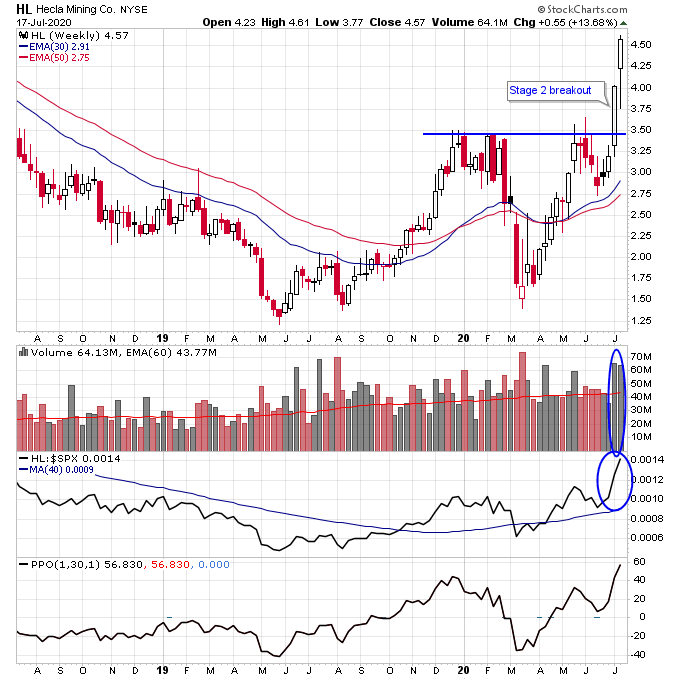

Not surprisingly many silver mining stocks are showing a similar pattern to silver. Hecla Mining completed a Stage 2 breakout two weeks ago and followed up the breakout with another week of big volume last week.

Being able to trade any sector (including cyclical stocks and commodities) is one of my favorite aspects of Stage Analysis and is especially useful here while growth stocks may continue to be under pressure.

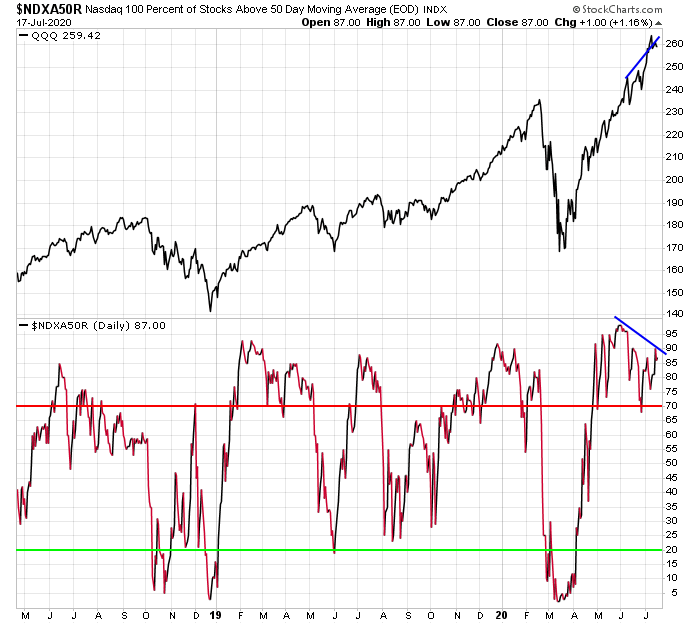

There continues to be a breadth divergence in the Nasdaq 100 and combined with low put/call levels, bullish sentiment, and unfavorable seasonality after a huge four month run odds are increased that the market needs to pullback or consolidate the recent gains.

Disclosure: I am long HL.

Get more info on Stage Analysis or Stan Weinstein’s book

Check out my trading videos on Youtube

Check out my Stage Analysis Screening Tool at: http://screener.nextbigtrade.com

Twitter: @nextbigtrade

The original article and much more can be found at: https://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.